- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

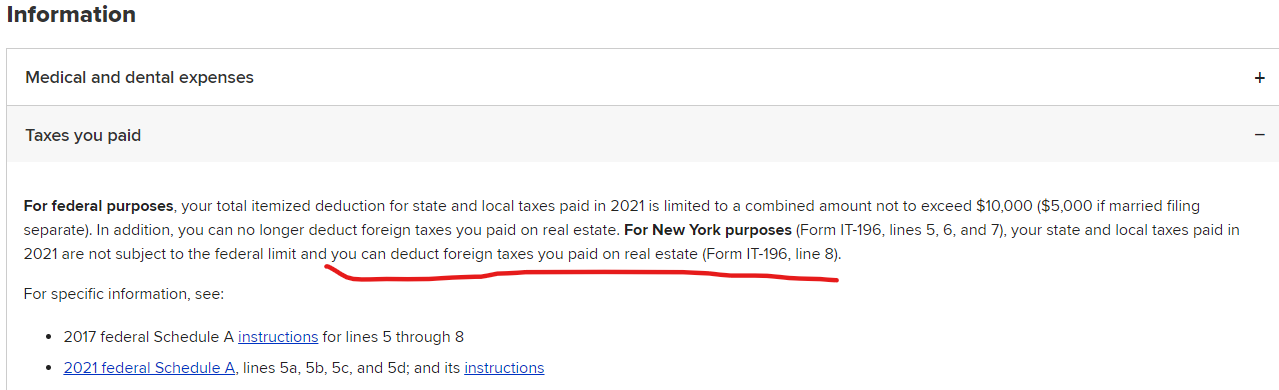

Foreign property (real estate) taxes aren't deductible in tax year 2018 through 2025 due to the Tax Cuts and Jobs Act. In 2017 and prior years, foreign property taxes could be deducted.

But for NYS income tax purposes, you can deduct foreign taxes you paid on real estate (IT-196, line 8), if you itemize the deductions.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 10, 2022

2:14 PM

1,114 Views