- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Work part time in Delaware while retired resident of PA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work part time in Delaware while retired resident of PA.

I'm over 60 retired living in PA, and work PT in Delaware where state tax is deducted. My only Delaware sourced income is less than $3k from the PT work. All other income from IRA's, Interest, Dividends, and Capital Gains is all non-Delaware sourced. Should all of the non-Delaware sourced income be excluded from the tax calculation as a non-resident?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work part time in Delaware while retired resident of PA.

No. Being over age 60 your retirement income is excluded from DE adjusted gross income, but interest, dividends and capital gains is not.

DE uses all adjusted gross income which is divided by your DE sourced income to arrive at a ratio. That ratio is multiplied by the tax on the total adjusted gross income to arrive at the tax on the DE source income.

You can see the calculations on line 42 which pulls from lines 30a and 30b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work part time in Delaware while retired resident of PA.

Yes, when you are doing your nonresident return for Delaware, only include the Delaware-sourced income from your part-time job.

Your other income, if it is taxable in PA, will be subject to PA taxes and PA taxes only. You will get a credit on your PA tax return for the taxes you pay to Delaware on your earned income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work part time in Delaware while retired resident of PA.

Thanks. I inserted zeros in the column for De sourced income, and the program shows a line for "Pension and Retirement Exclusion", but not interest, dividends, etc. The only item subtracted to calculate the De Taxable income is the "Pension and Retirement" amount.

Is there another adjustment line for the other items?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work part time in Delaware while retired resident of PA.

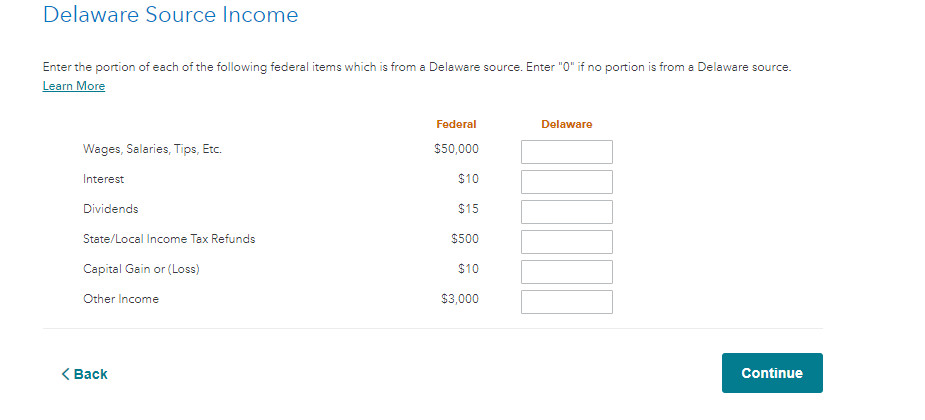

Yes, there is an adjustment for the other sourced income, such as interest and dividends, as a non-resident of Delaware. I have attached a picture below of the screen that should come up as you complete your nonresident Delaware return.

The first thing you want to do is make sure you've filled out the Personal Info section correctly:

- With your return open, select My Info in the left-hand menu.

- Then, on the Personal info summary screen, scroll down to Other State Income, and select Edit.

- At the Did you make money in any other states? question, answer Yes and make sure that Delaware is selected from the drop-down.

- Select Continue to return to your Personal info summary.

Then, please complete the steps below to complete your Delaware nonresident return:

- Click on State.

- Click Continue next to your Delaware nonresident return.

- Follow the onscreen instructions.

- Ensure that you chose Full-year nonresident on the page Delaware Nonresident Options.

- Enter your sourced income on the page Delaware source income (as shown in the screenshot above).

- Follow the on-screen instructions.

To ensure accurate calculations, always complete your non-resident return first because your resident state of Pennsylvania will give you a credit for any taxes paid in Delaware.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work part time in Delaware while retired resident of PA.

Thanks for responding. I went through the program again. Using your example of Delaware Sourced Income, I would insert $3K in the Delaware column for Wages with zeros on the remaining lines. So I'm thinking the only income I should be taxed on as a Delaware non-resident is $3K.......correct?

My retirement income from pension and IRA's is inserted on PIT-NON line 23 (pension/retirement exclusions) so that is subtracted from my federal gross income. When the program calculates my Delaware Adjusted Gross Income (and De taxable income) it still includes any interest, dividends, and capital gains. That amount is much higher than the $3K of Delaware sourced income.

Should the interest, dividends, and capital gains be added to line 23?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work part time in Delaware while retired resident of PA.

No. Being over age 60 your retirement income is excluded from DE adjusted gross income, but interest, dividends and capital gains is not.

DE uses all adjusted gross income which is divided by your DE sourced income to arrive at a ratio. That ratio is multiplied by the tax on the total adjusted gross income to arrive at the tax on the DE source income.

You can see the calculations on line 42 which pulls from lines 30a and 30b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AliStraz

New Member

user17591658047

Returning Member

Kh52

Level 2

rdemick54

New Member

InTheRuff

Returning Member