- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: When I try to file it says Nic has duplicate W2's for MN. He worked in both MN and Iowa tried...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I try to file it says Nic has duplicate W2's for MN. He worked in both MN and Iowa tried to fix.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When I try to file it says Nic has duplicate W2's for MN. He worked in both MN and Iowa tried to fix.

Are you trying to enter two separate W-2 Forms or do you have one W-2 form with two different states?

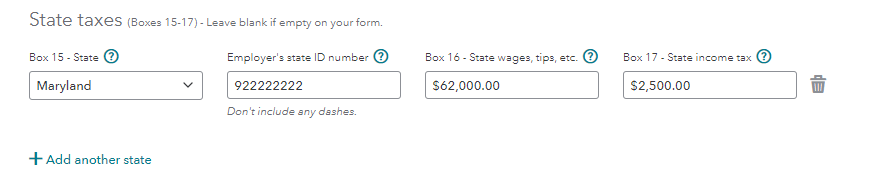

If you have two different states, you can enter both states on the same input screen if it is from the same company with the same Employer Identification Number (EIN).

To enter or edit your W-2 information, go to the Federal section of the program.

- Select Income & Expenses

- Select Job (W-2)

- Click Edit/Add to the right of the Job (W-2)

- Proceed to enter your information as prompted

- When you get to the state input section in boxes 15-17, you will select Add a state

If you determine you have two W-2 forms with different EIN for each employer, you will need to follow the steps above except on #3, you will select Add to the right of the Job (W-2). In the state section, you will select the appropriate state as reported on your W-2 Form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jcrouser

New Member

vicki1955vic

New Member

gerardh

New Member

dennison-jenna

New Member

Katie1996

Level 1