- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: W2 from 2 states lists same wage earned for both.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 from 2 states lists same wage earned for both.

My W2 for MA and NY lists the same amount of earned income for both states. The amount earned on my W2 for worked completed in NY was for all my NY income. The MA W2 which is my state I live in lists the same state wage even though the income was not earned in that state.

When I input my w2 info it ends up showing 30k higher income than I actually earned total for the year and is saying I owe taxes on the MA portion even though I paid NY tax already on that income. Not sure what it's showing 30k higher total income.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 from 2 states lists same wage earned for both.

Both NY and MA are states that require that box 16 of your W-2 reflect all of the income that your employer paid you during the year, even if you didn't earn all of that income within the state. To avoid including that income twice on our MA return, you'll need to tell TurboTax to only transfer the amount from the MA line on your W-2.

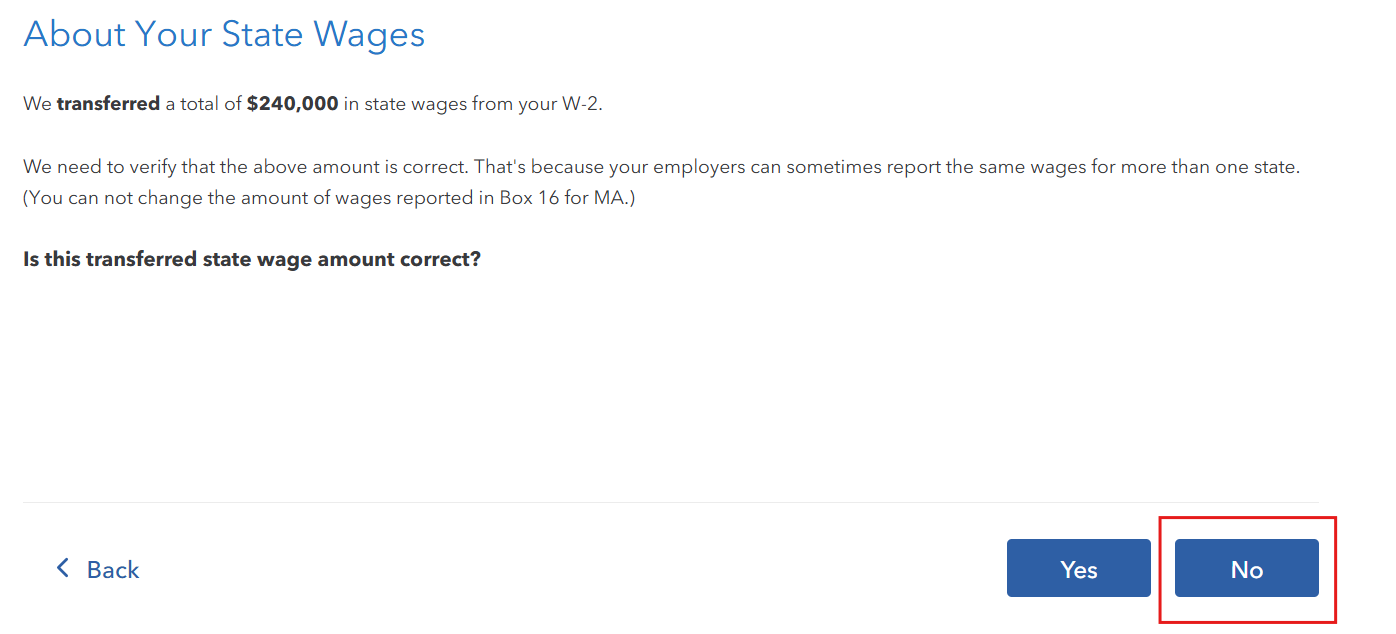

As you go through the section, you'll see a screen titled "About Your State Wages" (see example in screenshot below). This screen will show the total amount of income currently reported on your return and ask if this amount is correct. Choose No.

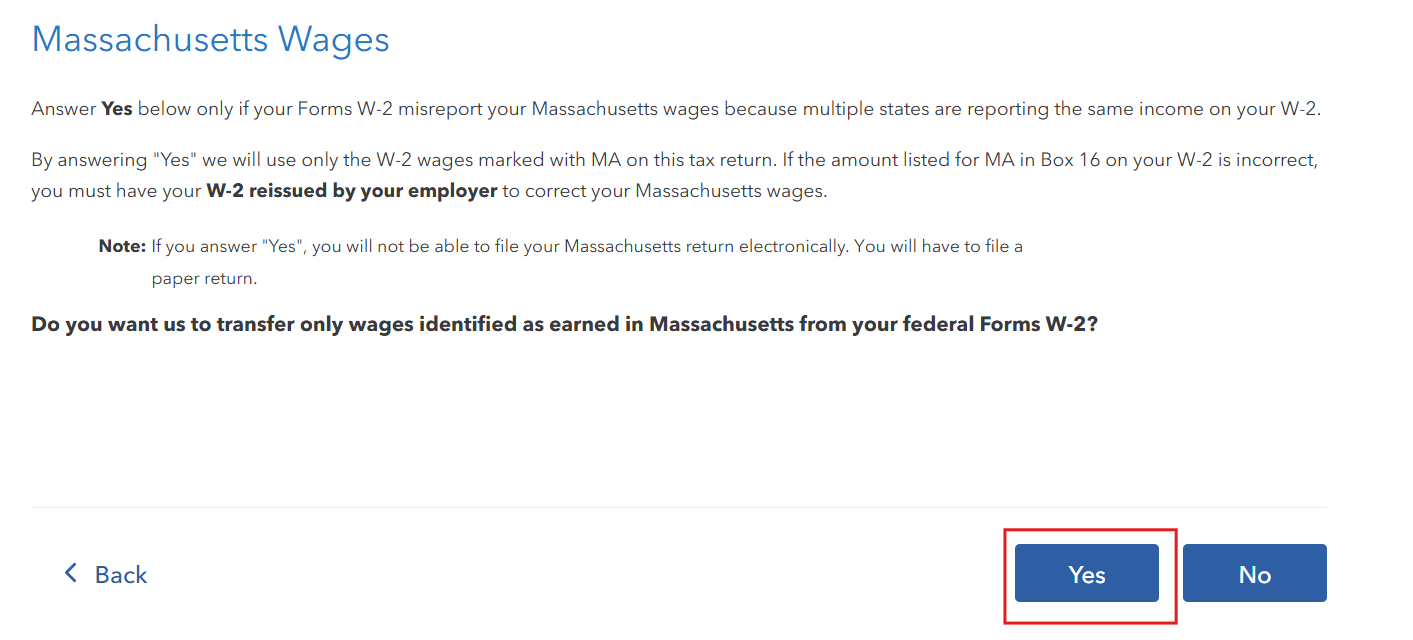

On the next screen, you'll be asked if you want to only include MA income from the W-2. Choose Yes.

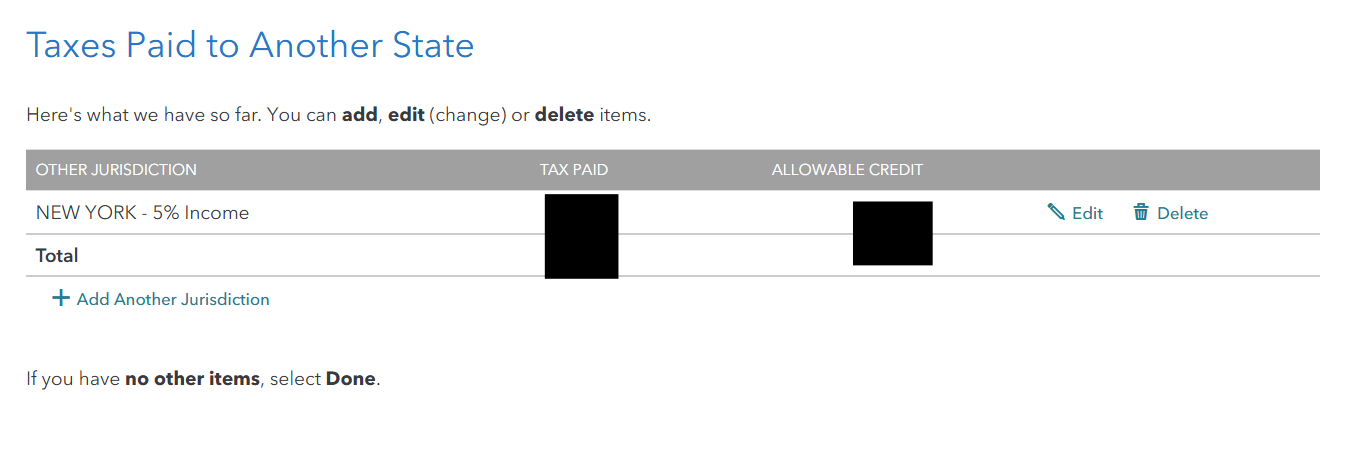

You should get a credit on your MA return for a portion or all of the tax that was paid to NY so you don't pay tax twice on the same income. As you continue through the section you should get to a screen that shows you taxes paid to NY and the credit you qualify for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 from 2 states lists same wage earned for both.

Thank you. Looks like I did it correct based on what you posted. I wanted to double check and make sure that I was filing it properly. According to Turbotax I have to mail in my return to MA due to this way of filing as MA does not allow electronic filing with this option that I had to do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W2 from 2 states lists same wage earned for both.

That's correct, you'll have to mail in your return. TurboTax should provide you with instructions on where to file your return and what to include.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Holly-Hale

New Member

austinsjj

New Member

zbennett24

New Member

deissewel

New Member

bethann7137

New Member