- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

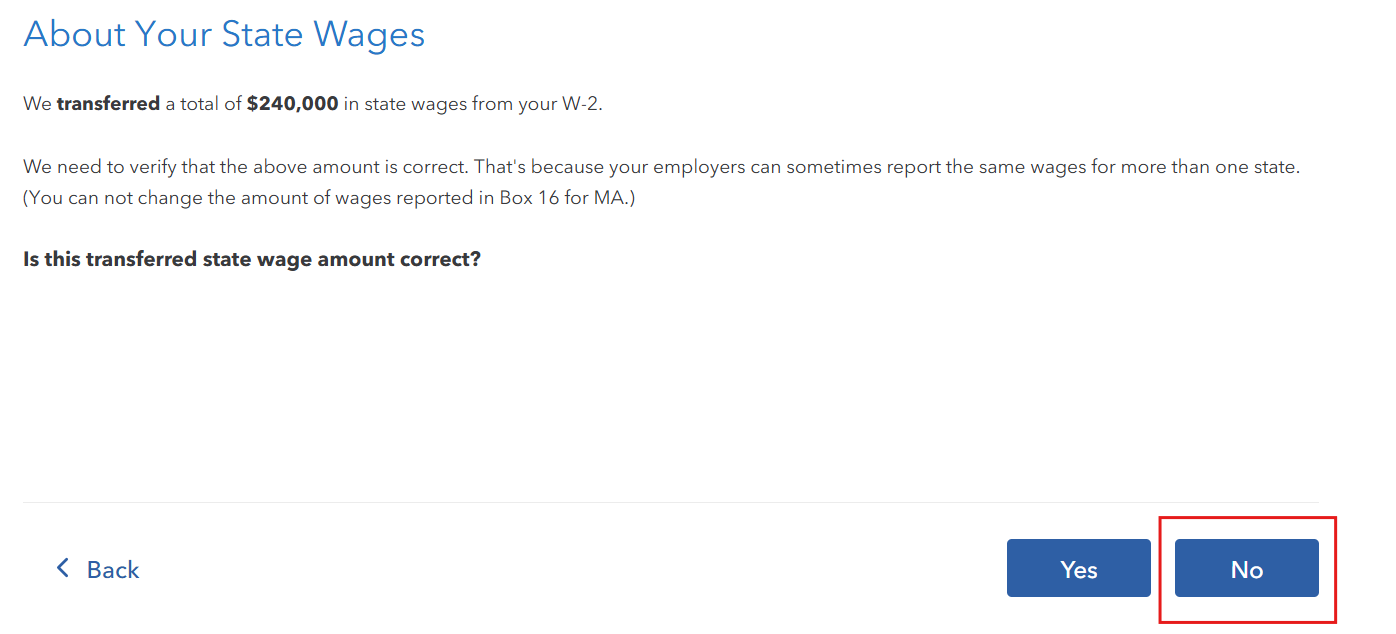

Both NY and MA are states that require that box 16 of your W-2 reflect all of the income that your employer paid you during the year, even if you didn't earn all of that income within the state. To avoid including that income twice on our MA return, you'll need to tell TurboTax to only transfer the amount from the MA line on your W-2.

As you go through the section, you'll see a screen titled "About Your State Wages" (see example in screenshot below). This screen will show the total amount of income currently reported on your return and ask if this amount is correct. Choose No.

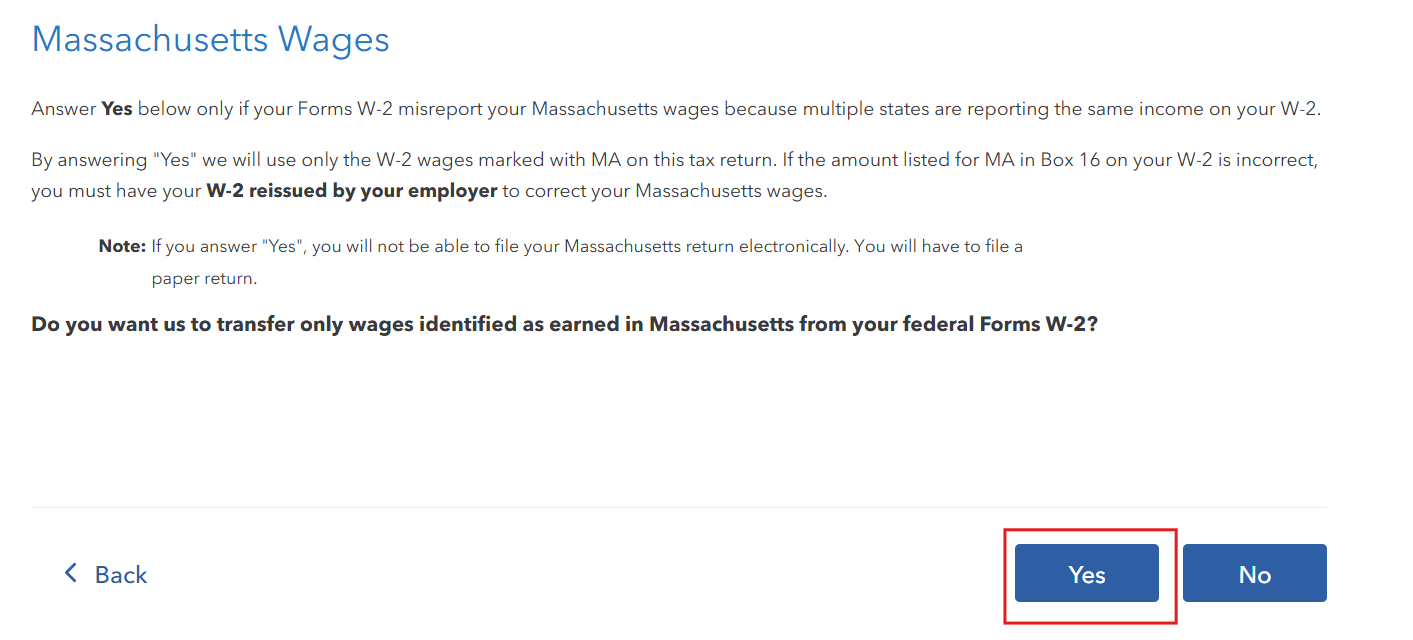

On the next screen, you'll be asked if you want to only include MA income from the W-2. Choose Yes.

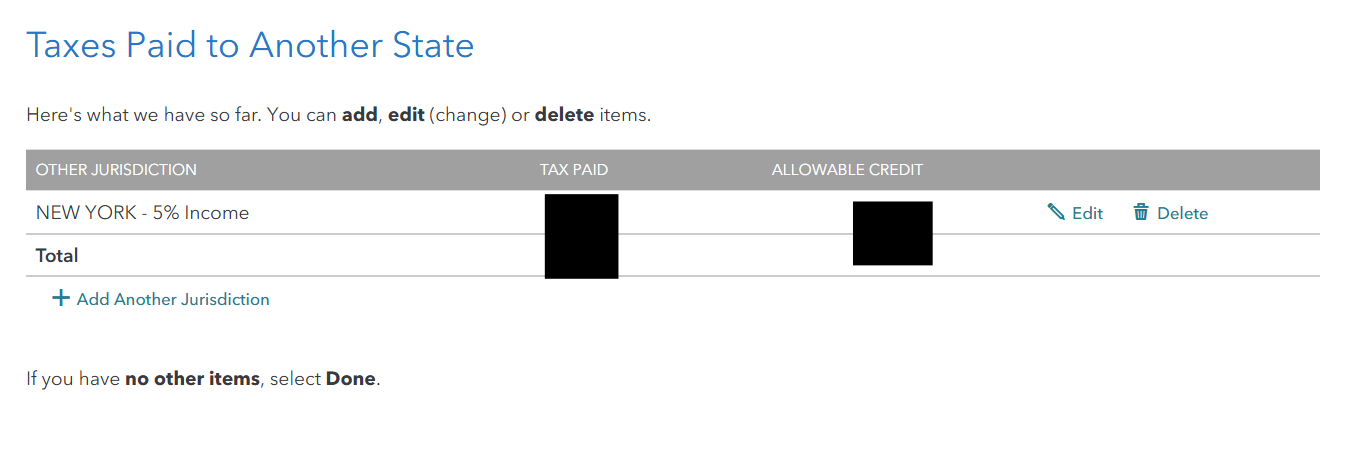

You should get a credit on your MA return for a portion or all of the tax that was paid to NY so you don't pay tax twice on the same income. As you continue through the section you should get to a screen that shows you taxes paid to NY and the credit you qualify for.