- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Utah State Military Retirement Credit (code AJ)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utah State Military Retirement Credit (code AJ)

Any updates to whether Turbo Tax has updated the fix for this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utah State Military Retirement Credit (code AJ)

They did fix it. You have to go back to your income and edit your Military Retirement 1099-R. As you re-review your entries you will find a new box asking if this is Military Retirement/Pension. It will be unchecked. Check it and when you complete the edit of your Military retirement 1099-R your State Income Tax Due will change to reflect the adjustment for the AJ Credit. When you review your State Tax Forms you will see the AJ credit in Part 3 of your TC-40A. You can then submit/electronically file your state tax forms and the State of Utah will accept them.

It's unfortunate that TurboTax did not inform everyone that it was fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utah State Military Retirement Credit (code AJ)

I don't think the fix is universally adopted. I've reloaded my 1099-R 3 times and have yet to find a "box" which allows me to declare this mil retired pay. Please make this a universal fix across all versions of TurboTax and make this more intuitive. As it is, I will NOT use Turbo Tax to file my Utah taxes since it does not allow the SB 11 Tax credit. Truly disappointing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utah State Military Retirement Credit (code AJ)

That's unfortunate and I understand your frustration. I can't get back to my 1099R since I've filed and it was accepted to tell you where to look for the box. I know I was plenty frustrated when they released the state version with a known bug. Utah State rejecting my electronic filing the first time I tried to efile saved me lot's of money and the need to file an amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utah State Military Retirement Credit (code AJ)

Are you filing a resident return for Utah? The box that rclayton22 is referring to will appear only for a resident of Utah.

Are you using an Online product or a product on Windows or on a Mac?

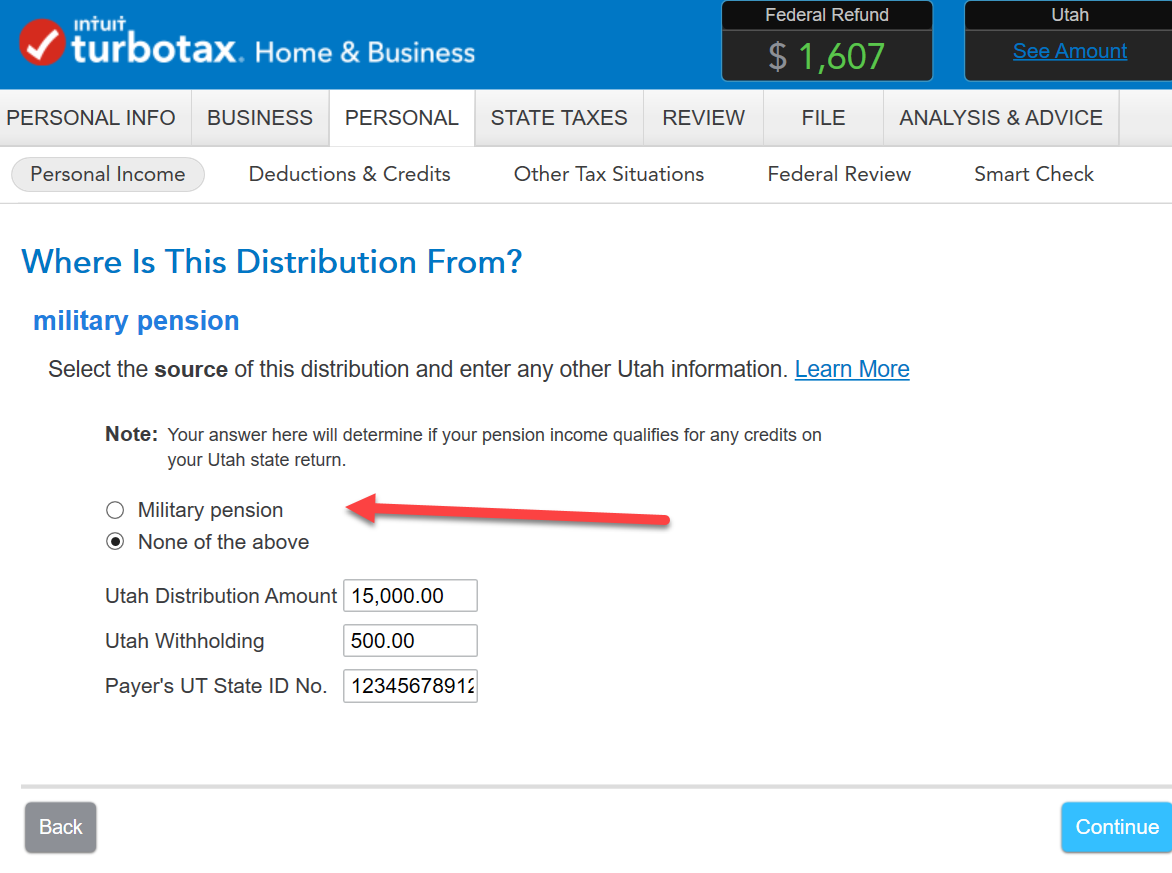

After you deleted and re-entered the 1099-R for your military pension, did you not see this screen (NOTE: you must finish the 1099-R interview, don't jump away immediately).

@CGUTAH

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utah State Military Retirement Credit (code AJ)

Turbotax Utah state tax program is a waste of time. There are may exemptions and deductions that are available to filers, but Turbotax completely ignores them. I had to go to the state tax commission online to get information on the allowed deductions and instructions on their implementation (Forms, etc.)

I was able to find two deductions that lowered the taxes due.

Next year I may have to go elsewhere for complete tax advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utah State Military Retirement Credit (code AJ)

To clarify, what Utah forms wasn't addressed by Turbo Tax?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utah State Military Retirement Credit (code AJ)

This is still an issue with TurboTax two years later. Try putting the code AJ into the TC-40A, Part 3 portion of your return as per UC §59-10-1043 and it will be rejected as an invalid code. This tax code went on the books January 2023 and TurboTax still hasn't caught up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utah State Military Retirement Credit (code AJ)

No. There doesn't seem to be any issues with the Turbo Tax program. I have tested the program and it seems to be working properly. Follow these steps.

Re: FORM TC-40A: Part 3 Credit Code AJ still not recognized by TurboTax (Utah Military Retirement...

It depends. I have tested this in Turbo Tax and it is working normally with no errors at the end of the return. Possibly, you may be entering the information on your own so here is how to enter your 1099R in your federal return so that the information will flow to your FORM TC-40A.

Start TurboTax:

- Open TurboTax and sign in or start a new return.

- If you have already started the return, navigate to the "Wages & Income" section.:

- In the "Wages & Income" section, scroll down to Retirement Plans and Social Security.

- Go to RA, 401(k), Pension Plan Withdrawals (1099-R) Or Social Security ( SSA 1099, RRB 1099)

Now after entering your 1099R that reports your military income, there will be some follow-up questions. When you reach a screen that is labeled "Where is the Distribution From", indicate it is military pay. This will then flow to your Utah Form TC-40A with . You do not need to do anything additionally. Here is how the screen(s) should appear in your return.

Please note this is for illustration only so the amount next to the code will be different in your return.

Please note this is for illustration only so the amount next to the code will be different in your return.

Post Edited

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Safetyguy

Returning Member

cnorshedric650

New Member

traceetk

New Member

jefferssd

New Member

keithfin

New Member