- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: The NJ state software does not separate tax exempt dividends between NJ and multiple states t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The NJ state software does not separate tax exempt dividends between NJ and multiple states to compute NJ tax amounts

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The NJ state software does not separate tax exempt dividends between NJ and multiple states to compute NJ tax amounts

Yes, there is a place to enter tax-exempt interest dividends in TurboTax. Here is how to find it:

- Login and continue your return.

- Select Federal from the menu on the left, then Dividends.

- Add a new 1099-DIV or edit the one you have already entered.

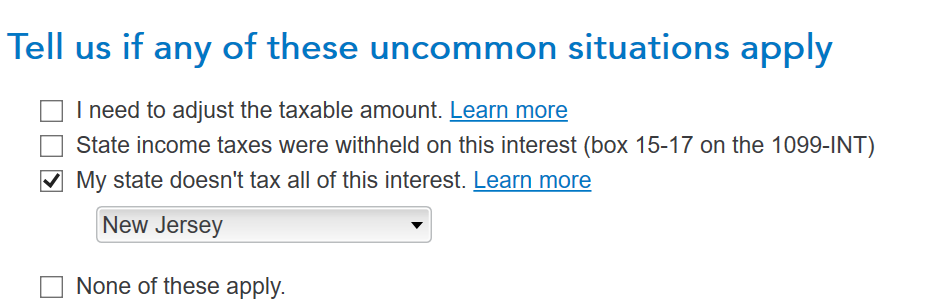

- The next screen should show Tell us if any of these uncommon situations apply

- Click on 3rd option. My State doesn't tax all of this interest

- Then select in the box below New Jersey (screenshot 1)

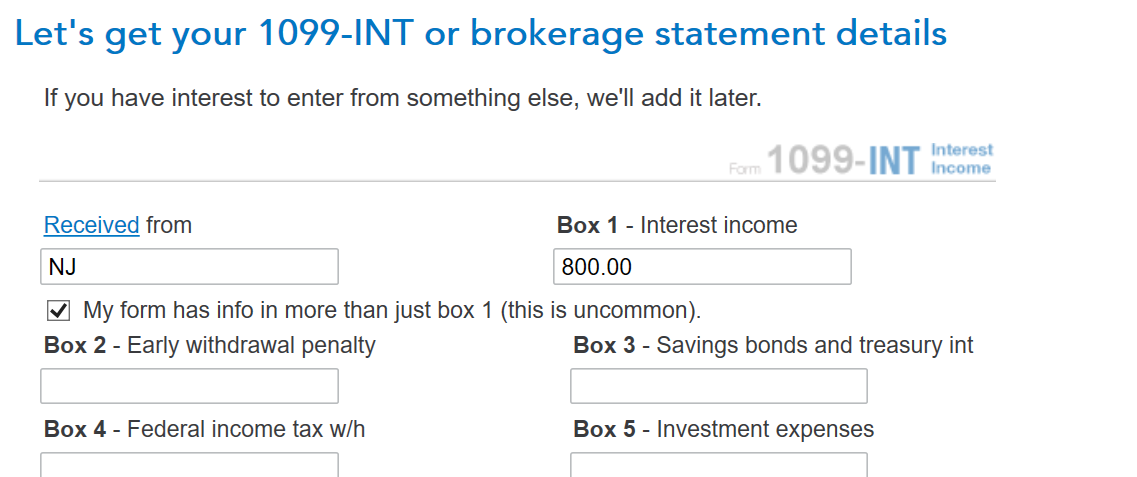

- On the next screen click on My form has info in more than just box 1, this will open the detail where you will add the exempt interest on box 14 (screenshot 2)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The NJ state software does not separate tax exempt dividends between NJ and multiple states to compute NJ tax amounts

The steps provided in the solution was not available in my Turbo Tax. I ended up deleting the accounts information and re-entered it. I was able to allocate the tax exempt dividends in the proper manner.

I think it was a random software bug that was resolved when I re-input the information

thank you for your assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The NJ state software does not separate tax exempt dividends between NJ and multiple states to compute NJ tax amounts

The nj.gov website has the document git5.pdf.

In that document, page 3 states:

- A qualified investment fund must:

- Be a regulated investment company;

- Invest 80% or more of its funds (other than cash or receivables) in securities that are exempt from New Jersey Income Tax; and

- Complete and retain Form IF-1, Certification of Qualified Investment Fund, to document its status. This certification does not need to be filed with us, but must be made available upon request.

Consider a mutual fund that invests in the municipal bonds of multiple states. That mutual fund breaks out the percentage of dividends paid by state. Are the dividends from the NJ portion of that fund tax exempt in NJ if the NJ portion is < 80% of the total dividends received? An example fund is the Invesco AMT-Free Muni Income fund. The breakdown by state is in the document at this link Invesco AMT-Free Municipal Income Fund This fund is in the 1st column of the table. NJ portion is 7.41% on page 3.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524270358

New Member

M_S2010

Level 1

dllundgren

Level 1

Rockpowwer

Level 4

SueWilkinson2

Returning Member