- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: State return requires an ID

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State return requires an ID

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State return requires an ID

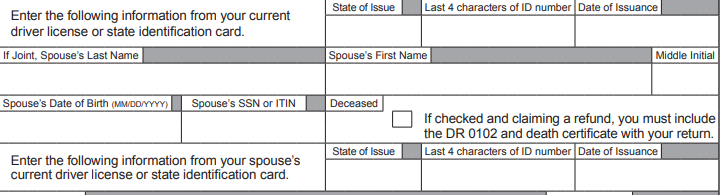

The 2022 Colorado Individual Income Tax Return requests a current drivers license or state identification card. See here.

If you mailed a Colorado state tax return for processing and the tax return reports an incorrect Social Security number, the state tax return cannot be correctly processed. It likely will be return to you in the US mail many weeks from now.

You should be able to submit a correct Colorado state tax return. Hopefully, you have access to additional copies of W-2's, 1099's, etc. to include with the tax return.

I would recommend that you include a letter with the Colorado state tax return outlining your situation. Hopefully, the Colorado Department of Revenue will be able to assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

grantchaffin05

New Member

Fishwish

Level 2

runnadaroad

New Member

virgie-noble

New Member

jennysrainbow

New Member