- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Shows incorrect taxable ira distribution on state

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shows incorrect taxable ira distribution on state

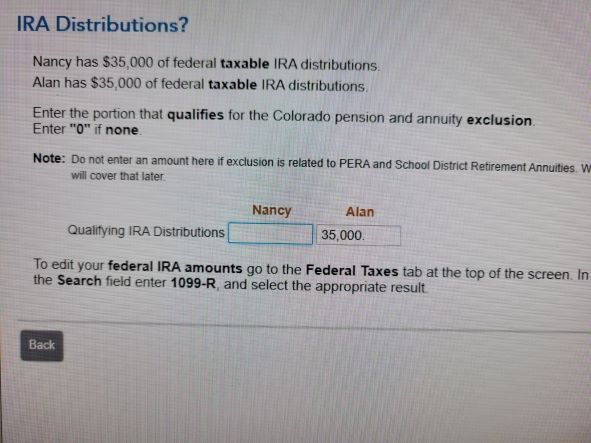

I had some trouble entering a 1099R as it originally went to my wife (Nancy). I fixed it on federal, but in the Colorado return it shows we both had a distribution of $35K. It says to fix it go to the federal 1099R. That 1099R is correct as it only applied to me, so there is nothing I can fix. This is the state screen called "IRA Distributions. It says Nancy and Alan both had $35K in taxable distributions. Only Alan had the distribution. There is no 1099R for Nancy to fix.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shows incorrect taxable ira distribution on state

Try this fix. Go to your state return section and delete your Colorado State return. Then go back and reenter your Colorado State return again. At this point, the information from your federal return should flow correctly to your Colorado return.

Let us know if this works.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shows incorrect taxable ira distribution on state

Thanks. That sounds like a good plan, but I have no idea how to delete my Colorado return. It is saved in the same file as the federal return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shows incorrect taxable ira distribution on state

I still haven't found a way to delete my state return. Please help as I can't file taxes without correcting my state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shows incorrect taxable ira distribution on state

I did figure out how to delete my state return and restart it. It didn't seem to matter. Nancy did not have an IRA distribution of $35K. See picture

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549435158

New Member

tianwaifeixian

Level 4

anonymouse1

Level 5

in Education

Th3turb0man

Level 1

tcondon21

Returning Member