- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Part year Arizona resident; step-by-step not asking to allocate earned income

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part year Arizona resident; step-by-step not asking to allocate earned income

I have problem similar to RandyAZ. Full time resident of California; non-resident of Iowa. TurboTax interview for Iowa income allocation skips over common sources, e.g., wages or Fed Form 4835 Farm Rental.

Could there be problems in some, e.g. owa and Arizona, but not all of the State modules?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part year Arizona resident; step-by-step not asking to allocate earned income

I am having the same issue in 2022, unable to allocate W2 income for an Arizona part-year return. It prompts for other smaller income streams, but my W2 is not there. I have deleted the Form 140PY and the Arizona Return repeatedly but with no change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part year Arizona resident; step-by-step not asking to allocate earned income

TurboTax pulls Arizona wages directly from Box 16 (state wages) of your W-2 @vann1.

You can adjust your Arizona wages by changing the amount in Box 16. There is no place to make W-2 adjustments within the Arizona section of TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part year Arizona resident; step-by-step not asking to allocate earned income

Having the same problems as AZ non-resident: no option to specify a portion of Wages for AZ. Had no problem with 3 other states.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part year Arizona resident; step-by-step not asking to allocate earned income

Did you see the previous answer about entering AZ wages in Box 16 (State Wages) of your W2? That post came in after I had already submitted my return so I wasn't able to try it, but it seemed like good guidance. Outside of that, what I did was to declare those wages as "Other Income" in the AZ section and all the math worked out right. I paid AZ, AZ accepted my return, and so far I have not received any late-night knocks on the door....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part year Arizona resident; step-by-step not asking to allocate earned income

Hi @vann1 thanks for the advice. I will try the Other Income idea. I was a bit afraid to modify the W2, and have already filed my federal and other states now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part year Arizona resident; step-by-step not asking to allocate earned income

Actually I just went through the interview again and I don't see an option for Other Income...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part year Arizona resident; step-by-step not asking to allocate earned income

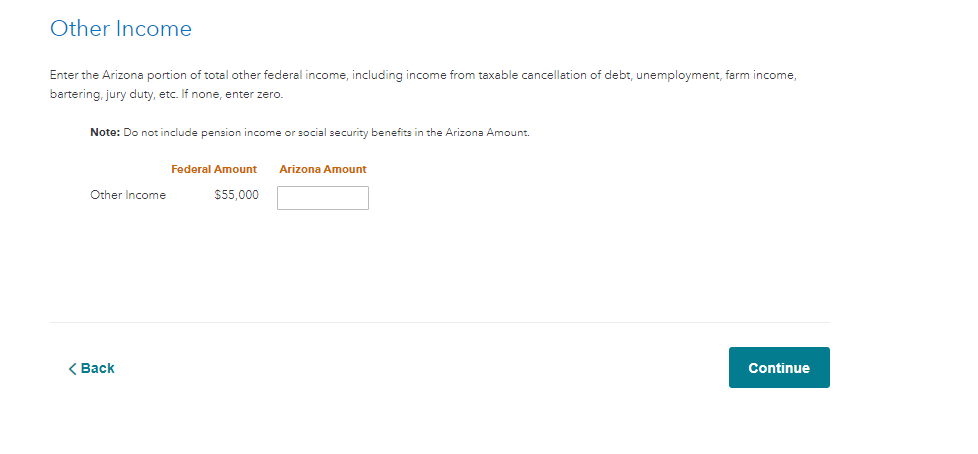

The Other Income screen will only appear if you have Other Income on your federal return.

Other Income for this purpose includes:

- Taxable amount from cancellation of debt

- Retirement income

- Unemployment benefits

- Farm income

- Other income

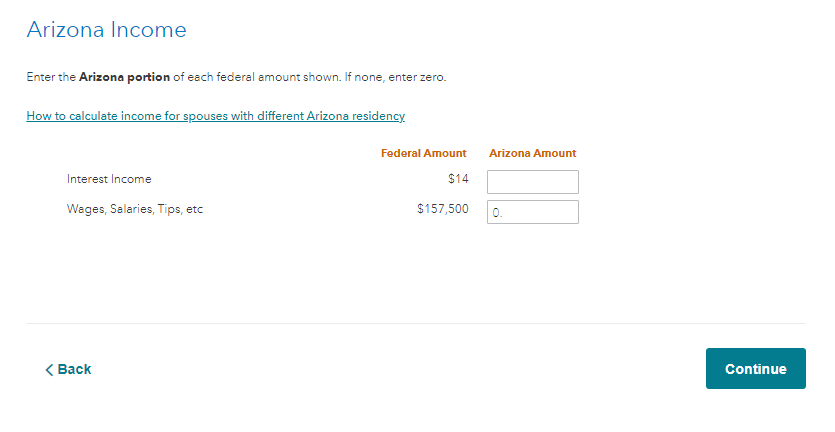

However, a few screens prior to this screen, you can adjust the amount of Arizona sourced wages on the screen Arizona Income. I have attached a screenshot for additional guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part year Arizona resident; step-by-step not asking to allocate earned income

Thanks @LenaH. The issue for me is that I don't see the Other Income or Wages options in this part of the flow. I only see Interest, Dividents and Gains+Losses. Apparently the issue is that AZ is not listed on my w2. (I worked remotely from a few states during the pandemic and they don't show up on my w2.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part year Arizona resident; step-by-step not asking to allocate earned income

You can create a line in federal so you will have an Other Income line in Arizona.

- In TurboTax Online click on Federal on the left column

- Click on Wages & Income at the top

- Scroll down to Miscellaneous Income, 1099-A, 1099-C. Start

- Choose Other reportable income

- Say Yes to Any Other Taxable Income?

- In Other Taxable Income, enter a Description and $1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RyanK

Level 2

dpa500

Level 2

dpa500

Level 2

rlb1920

Returning Member

Waylon182

New Member