- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: NonQualified Deferred Comp taxed twice -MA return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NonQualified Deferred Comp taxed twice -MA return

Non-Qualified Deferred Comp payment reported on a W-2 is correctly entered on federal Schedule 1, Line 8t. However, when TT transfers this amount to my MA state return it is included as both W-2 income and Other Income-MA Schedule X, Line 4. How does this get fixed? The state return is incorrect due to automatic double reporting of this income.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NonQualified Deferred Comp taxed twice -MA return

If you have an amount in Box 1 and in Box 11 on your W-2 reporting deferred compensation, this may be causing your issue with Massachusetts Schedule X.

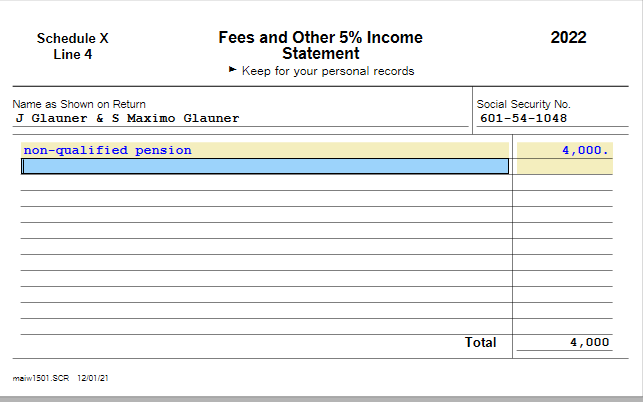

In TurboTax Desktop, I was able to resolve this in FORMS by opening Schedule X and clicking on the magnifying glass next to the amount on Line 4.

This opened the Fees and Other Income Statement for Line 4, Schedule X.

Delete this form and the amount on Schedule X, Line 4 is removed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NonQualified Deferred Comp taxed twice -MA return

I tried deleting Schedule X and it did not work for me. So instead, I changed Box 16 (state wages) on my Deferred Comp W-2 to zero. This now excludes the deferred comp from Wages and includes it in Schedule X. So proper bottom line, but concerned that the W-2 in TT does not agree with W-s that was issued. Any other suggestions? Hopefully TT Team can fix this glitch.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NonQualified Deferred Comp taxed twice -MA return

That was smart thinking! The MA INC form is not yet supported and may be part of the issue.

The federal government won't care about the state portion of the w2. Federal only matches federal.

The state will have a copy of the w2 also. It is nice when all things line up as they should. The worst case scenario would be the state sends a letter saying you did not report the income and you reply saying that you did and where it shows on the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NonQualified Deferred Comp taxed twice -MA return

So to avoid audit/questions from Massachusetts, would it be better to do disregard TT and just do a paper filing? I can manually adjust to report Deferred Comp as W-2 Income and delete the Schedule X. This would then align with MA reporting requirements and reduce the risk of audit. But sort of deletes the purpose of using TurboTax in the first place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NonQualified Deferred Comp taxed twice -MA return

I just tried filing my MA return using TT Online and my filing was rejected. I got a reply from TT indicating there is a known problem with NQ Def Comp in MA and they are working on a fix. The fix for MA is scheduled to be completed on March 9, 2023 and TT recommended I check back after the fix and attempt to refile my MA return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lsrippetoe

New Member

Abchaim26

New Member

Desmo72

Level 1

joannyberg

New Member

jdwcaw

Level 2