- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: New Jersey taxing backdoor roth IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey taxing backdoor roth IRA

I did a backdoor ROTH IRA this year and for some reason NJ is taxing it. A previous article (link) said to "mark an X in the column labelled 'Check if Non-taxable'", however, I am not seeing this popping up anywhere in my turbotax prompts. How do I fix it so that NJ won't tax a backdoor ROTH IRA?

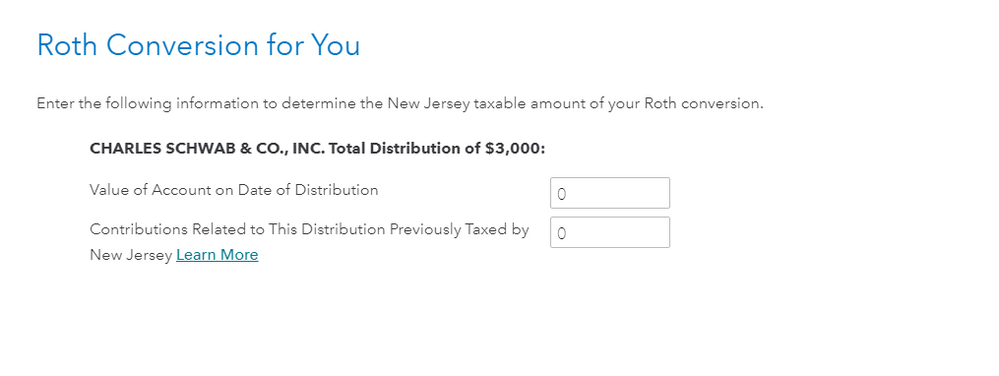

Should I be setting value of account field here to 0?

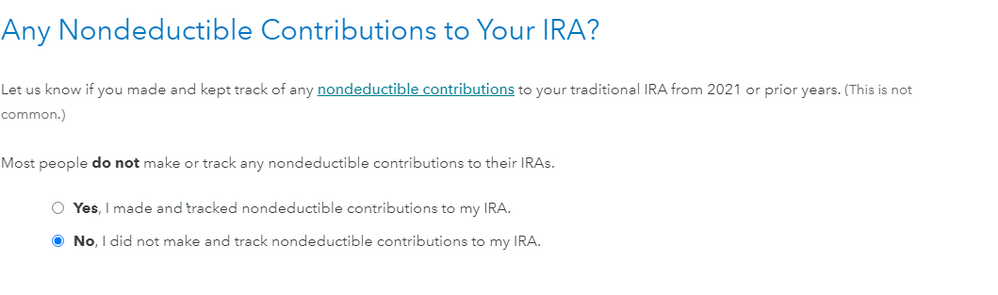

Also, when I tried to follow: "How do I enter a backdoor Roth IRA conversion?" in the federal component, Step 11 never shows up and instead I see this. Not sure if this is resulting in the problem I'm having.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey taxing backdoor roth IRA

you probably did not do a true backdoor roth contribution.

did you start with a zero balance in your traditional IRA before beginning this adventure?

did you end up with a zero balance in your Traditional IRA by converting it all to Roth?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey taxing backdoor roth IRA

Yes I started with a zero balance and ended with a zero balance in the Traditional IRA when I executed this. I didn't invest anything before rolling over.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey taxing backdoor roth IRA

You have to tell TurboTax NJ Worksheet C that you had a contribution.

Set line 4a of the worksheet to the amount of your distribution/conversion.

TurboTax doesn't call it Worksheet C (last I looked) but it will ask you for the amount for 4a.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Username5

Level 4

drahcirpal

Level 2

zenital

Returning Member

Ebun1

New Member

april15comingsoo

Level 2