- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: New Jersey Software Bug 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Software Bug 1099-R

Entered a 1099-R only for spouse on Federal. New Jersey return indicates a 1099-R for spouse and another one for me - not correct! Please fix bug.

Trying to inform TT of a bug in their software is made nearly impossible.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Software Bug 1099-R

Please ensure that there is only one 1099-R entered on your federal return.

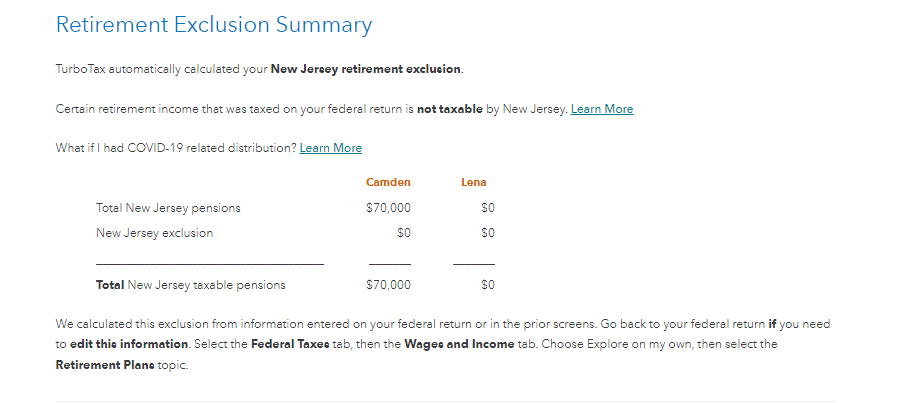

I did a mock-up New Jersey return and could not replicate your problem. As you can see from the image attached, there was one pension entered for the husband on the federal side and only one is showing on the New Jersey return. Where are you seeing a duplication of retirement income?

If you are still getting an error, it would be helpful to have a TurboTax ".tax2021" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions: Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Software Bug 1099-R

Oops, I initially replied by email.

Token [removed]. I confirmed there is only one 1099-R on Fed for Sandra but NJ shows one for Sandra (correct) and another one for Brian in the same amount for Brian (incorrect – never input in Fed).

Attachments show just one 1099-R entry in Fed for Sandra, yet state shows one for Sandra (correct) and Brian (incorrect)

Thank you. I am unable to file NJ state with this bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Software Bug 1099-R

Is it possible you entered a pension by mistake under your name first and then deleted it?

You don't say whether you are using TurboTax Online or CD/Desktop.

If you are using Online

- Click Tax Tools in the left column

- Click Tools

- Select Delete a Form in Tools Center

- Scroll down to the New Jersey section

- Find Pensions Wks-TP is you are listed first or Pensions Wks-SP if your wife is first on the return and Delete

- Click Continue With My Return in the lower right

In TurboTax CD\Desktop

- Select Forms in the upper right

- In the left column find the appropriate Pensions Wks and delete

- Click Step-by-step at the top right (where Forms was) to go back

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Software Bug 1099-R

TT Online.

Pensions Wks-TP is not one of the listed forms to delete on my New Jersey return.

However it does give me the choice of one Form 1099-R to delete, but it does not specify whose it is so I'm a little hesitant to blindly delete it.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Software Bug 1099-R

The screenshot you shared above seems to indicate that there has been Form 1099-R information entered for both you and your spouse.

Try deleting your Form 1099-R entries and enter them again, including all follow-up questions. Then, delete your state return and start it from scratch. This will allow the Federal information to be re-transferred to your state.

Here are the steps:

First, go to the Form 1099-R summary page, then click Delete or the trash can icon beside any 1099-R entries you see.

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-R” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-R”

- Click on the blue “Jump to 1099-R” link

Then, re-enter the Form 1099-R for your spouse.

Next, use the detailed instructions in the following TurboTax help article to delete your state return and then go through it again.

How do I delete my state return in TurboTax Online?

@Fuzznuts

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Software Bug 1099-R

I did as instructed (delete Fed 1099-R, and re-enter, delete state return and add back) and both of our names again showed up on NJ State as being 1099-R holders in the same $ amount even though it is just my spouse.

As a further test, I deleted all 1099-R's from Fed and deleted then reloaded a new NJ return. I then went back to Fed and input just one 1099-R for my spouse. I returned to the new NJ return and both of our names were there as 1099-R holders in the same dollar amount.

This bug is very persistent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Software Bug 1099-R

BTW the screen shot was from the NJ return showing the erroneous 1099-R for Brian. Also included was a screen shot from Fed showing just one 1099-R for Sandra. Purpose was to show one 1099-R in Fed results in two 1099-R in NJ state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Software Bug 1099-R

It seems clear TT's intent is to suggest it's user error instead of accepting there's a bug in their program. Has my token even been opened by anyone to see for themselves? If not contact me and I'll step you through.

This bug is not fixed and won't be until someone takes responsibility.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tracibill

New Member

rmbiggs02341

New Member

rmbiggs02341

New Member

thehonakers

New Member

demitriosnc

New Member