in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Minnesota Student Loan Credit (M1SLC) blocked from e-file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

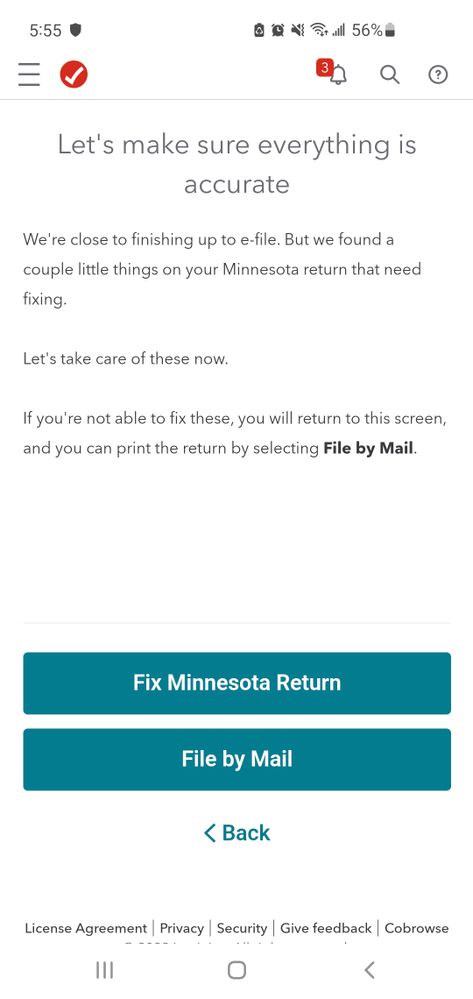

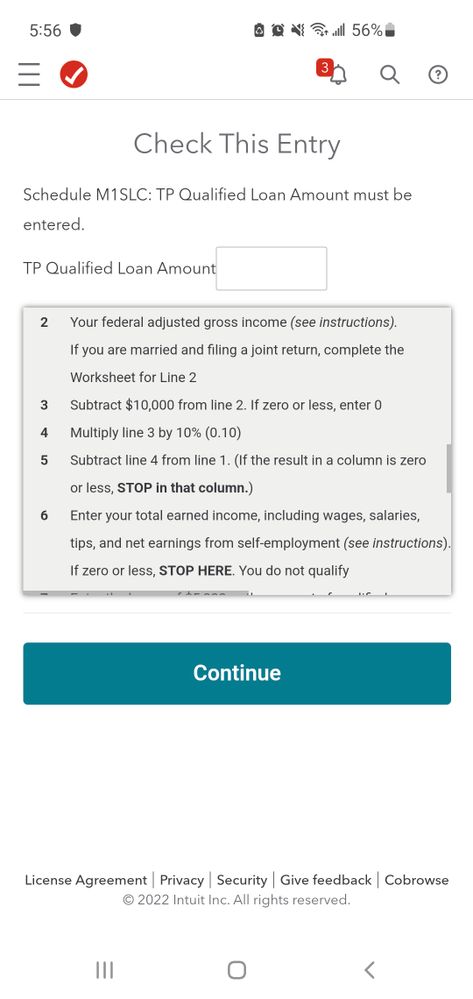

Yesterday I successfully got my Federal Return e-filed and accepted, but for some reason it won't let me e-file my Minnesota State taxes as it continuously tells me I need to fix my M1SLC.

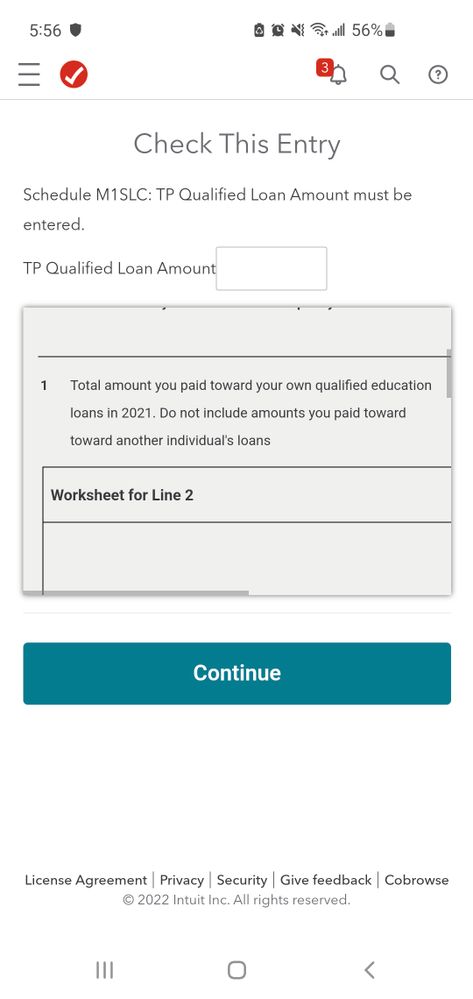

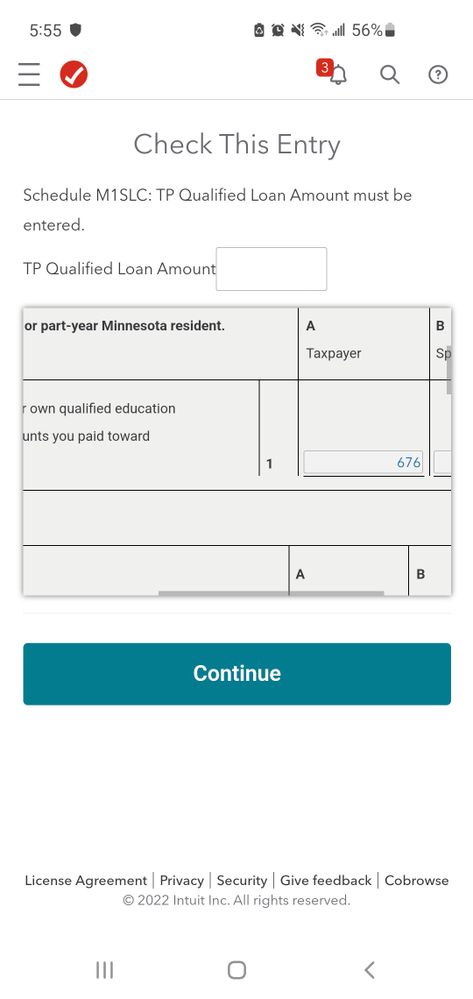

I enter my "TP qualified Student Loans" which I'm pretty positive means you enter exactly how much you've paid in principle and interest in Student loans. I enter 676 there and then I enter 5,000 dollars in line 7 for total amount of loans out that paid for post secondary education (lesser than 5000). I put those two numbers in, press continue and it just constantly sends me in a loop of pressing e-file and then making me "fix one last thing" (which is again the M1SLC) and so I can't e-file.

What is going on? Is this an error woth turbo tax or is something actually wrong with my M1SLC? The descriptions as to what to do with the M1SLC are non existent or don't help at all. I don't know what I'm doing wrong.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

I have not seen any other questions on this subject.

Which program are you using, Desktop or Online

Does the program only ask you for

Interest paid

Amount of loan (up to 5,000)

It seems like it would also be asking for the total payments made (principal and interest)

Ae you making three entries for that form or does it only ask for two?

Here is a link to the form and instructions

https://www.revenue.state.mn.us/sites/default/files/2021-12/m1slc_21.pdf

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

I saw one guy below me having the same issue. His question refers to the "TP qualified student loans" which is the same issue I see. It is happening on both mobile and desktop.

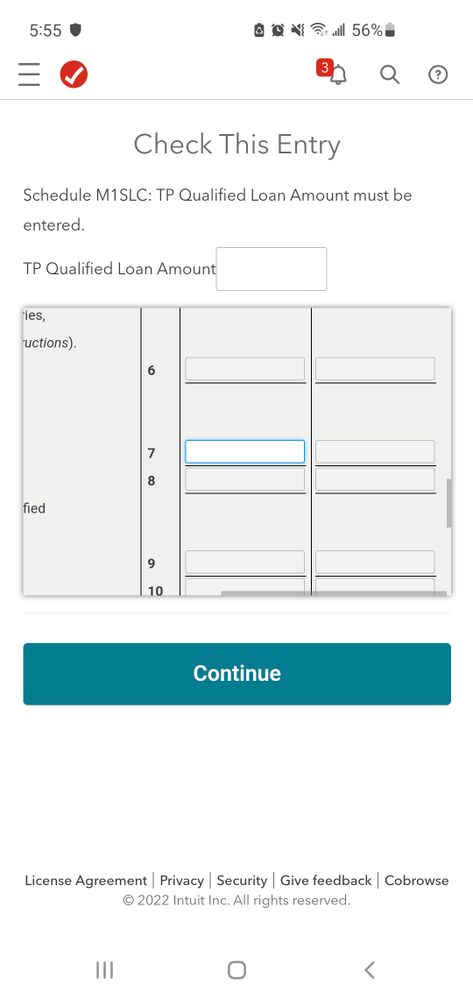

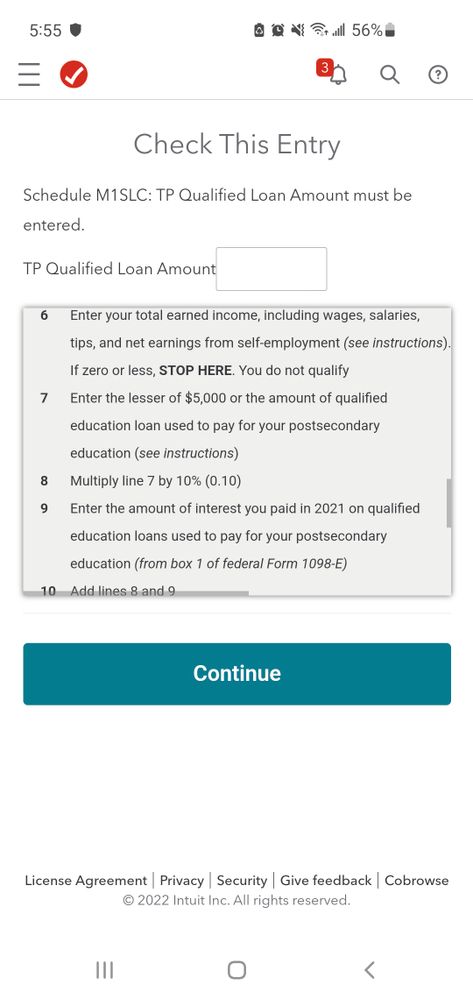

It is only asking me to input "TP qualified Student loans" on the top which is confusing in itself (no other description) and also allows me to enter into line 7 which is total outstanding loans used to pay for secondary education (up to 5000 dollars). It does not seem to ask for interest paid, although I already entered that on my Federal forms and it should carry over. MN is unique in that it wants to know how much principal and interest you pay.

I have tried inputting total interest and principle and 5000 dollars, I have tried total I + P and nothing in line 7. I've tried just putting in total interest (with and without 5000 in line 7). It will not accept it either way. It just brings me back to "fix the problem or send by mail" everytime while trying to e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

So I've looked at it again. Confirmed I can only enter in the "TP qualified loan amount" and line 7.

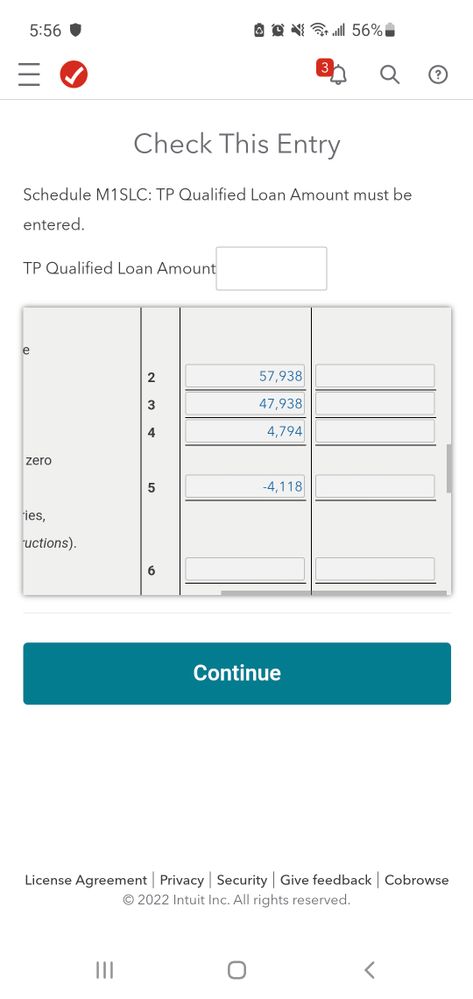

I am seeing that this year (unlike other years due to covid student loan relief) my line 5 is negative which means I stop there, but it still insists I fill in line 7. It doesn't appear I'm doing anything wrong by the prompts.

Above is what I see and it just brings me through a loop of "fix Minnesota return" and brings me to the same M1SLC form over and over asking me to reinstall data.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

Once your income is too high for the credit, the program fails during the review without letting you know the reason. Delete the M1SLC in order to file your return.

Here is the form.

Choose your method of deletion:

- Online: A simple way to delete forms in TurboTax online is to use the Tax Tools menu option, which is on your left menu bar when you are working in your program. Then, choose Tools and then Delete a form.

- Desktop: If you are working in the download TurboTax program, use the Forms Mode on your menu bar to bring up the form you want to delete, then choose the Delete Form option at the bottom of the form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

Once your income is too high for the credit, the program fails during the review without letting you know the reason. Delete the M1SLC in order to file your return.

Here is the form.

Choose your method of deletion:

- Online: A simple way to delete forms in TurboTax online is to use the Tax Tools menu option, which is on your left menu bar when you are working in your program. Then, choose Tools and then Delete a form.

- Desktop: If you are working in the download TurboTax program, use the Forms Mode on your menu bar to bring up the form you want to delete, then choose the Delete Form option at the bottom of the form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

Thank you this helped me so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

I am having the exact same problem on my MN taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

Once your income is too high for the credit, the program fails during the review without letting you know the reason. Delete the M1SLC in order to file your return.

Here is the form.

Choose your method of deletion:

- Online: A simple way to delete forms in TurboTax online is to use the Tax Tools menu option, which is on your left menu bar when you are working in your program. Then, choose Tools and then Delete a form.

- Desktop: If you are working in the download TurboTax program, use the Forms Mode on your menu bar to bring up the form you want to delete, then choose the Delete Form option at the bottom of the form.

@houg0096

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

THANK YOU AMYC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

I was so stressed and frustrated about this. I'm so grateful for your post. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

I created my account just to say Thank you for this! I was stuck trying to file and not sure what was going on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

I am having the exact same issue. Same loop and unable to even submit my Federal return due to this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

Thanks for this Amy. You saved the day for me here as well. I was having the same issue as the rest. I just deleted the form and on I went. Cheers!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Minnesota Student Loan Credit (M1SLC) blocked from e-file

Amy, you are my hero.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

benjaminserickson

New Member

LauDiet

New Member

tanner-jones

New Member

tkscherf1

New Member

in Education

kt50

Returning Member