- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Massachusetts Teachers Retirement not allowing e-file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

I'm trying to file a return with two 1099-R forms from the Commonwealth of Massachusetts / MA Teacher's Retirement System.

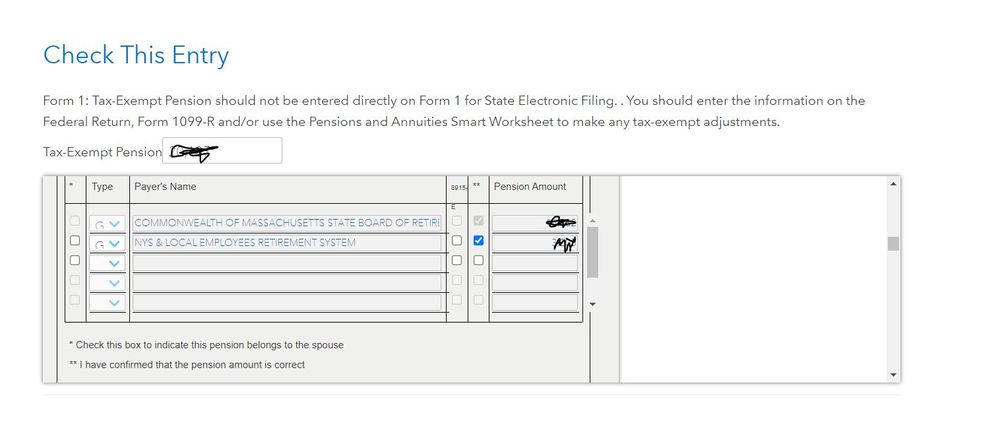

After entering the 1099-R in the federal section and answering the question about it being from the Mass Teachers Retirement system, and going through the MA state section "Pensions and Annuities Summary" to verify the 1099-R was excludable from MA tax (G - Tax-Exempt), I'm still getting this error when attempting to e-file:

Form 1: Tax-Exempt Pension should not be entered directly on Form 1 for State Electronic filing. You should enter the information on the Federal Return, Form 1099-R and/or use the Pensions and Annuities Smart Worksheet to make any tax-exempt adjustments.

This hasn't been an issue in prior years, and this error occurred after paying.

I'm using TurboTax Deluxe 2020 Online edition.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

You say that this occurred when you tried to e-file? Did you run the state review?

Usually, this kind of error occurs in the review when TurboTax says that something is missing and gives you a picture of the form. You naturally enter the missing item right there, and TurboTax is happy until it's time to e-file.

This is because despite what is implied, you need to go back to the original input screen in the interview and enter it there.

For this situation, you have two places to enter things:

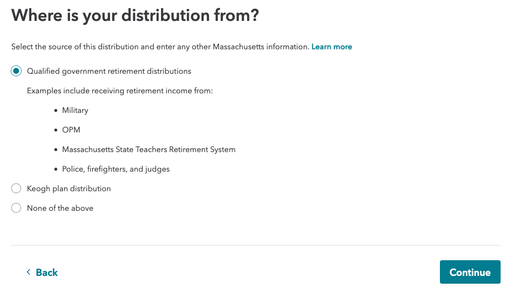

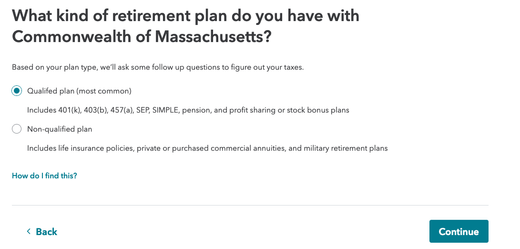

1. Immediately after you enter the 1099-R on the federal return, you will be asked what the source of the pension is. You will check "Qualified government retirement distribution".

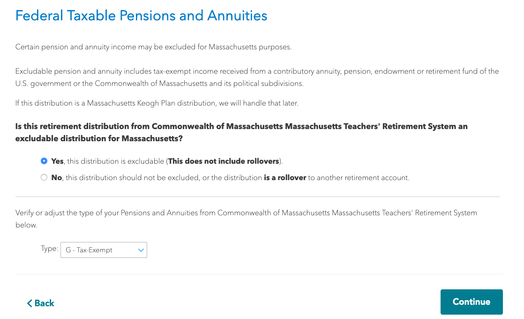

2. In the MA interview, for reasons not clear to me, you are asked again about the source of the pension. You will see a screen, "Pensions and Annuities Summary".

- Here you must click the Edit button for this pension.

- You must answer that the pension is excludable on the next screen.

- Then you must indicate the type of Pension ("G - Tax-Exempt").

Did you do all these steps? It is acting like you skipped something, reasonably thinking that you had done enough.

Anyway, walk through the 1099-R portion of the federal interview again and the Pensions and Annuities Summary on the state interview, and see if walking through this with fresh answers will help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

You say that this occurred when you tried to e-file? Did you run the state review?

Usually, this kind of error occurs in the review when TurboTax says that something is missing and gives you a picture of the form. You naturally enter the missing item right there, and TurboTax is happy until it's time to e-file.

This is because despite what is implied, you need to go back to the original input screen in the interview and enter it there.

For this situation, you have two places to enter things:

1. Immediately after you enter the 1099-R on the federal return, you will be asked what the source of the pension is. You will check "Qualified government retirement distribution".

2. In the MA interview, for reasons not clear to me, you are asked again about the source of the pension. You will see a screen, "Pensions and Annuities Summary".

- Here you must click the Edit button for this pension.

- You must answer that the pension is excludable on the next screen.

- Then you must indicate the type of Pension ("G - Tax-Exempt").

Did you do all these steps? It is acting like you skipped something, reasonably thinking that you had done enough.

Anyway, walk through the 1099-R portion of the federal interview again and the Pensions and Annuities Summary on the state interview, and see if walking through this with fresh answers will help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

Hi BillM223,

Turbotax initially caught this during the final review of the MA state return after I selected eFile. I'd assumed that I'd missed something, so I'd double checked the 1099-R entries and then it caught it during the state review.

Both 1099-R forms have the Qualified government retirement distribution" selected:

In the MA interview, both are listed as excludable and G - Tax-Exempt

However, when I just stepped through it again to get the screenshots above (didn't change anything), it cleared the state review and allowed me to eFile the state form. But thank you for confirming I wasn't missing anything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

As one boss of mine once told me, "It's time to declare victory and go home".

I am glad it works for you now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

Please help! I have tried ALL of these steps many times and it still keeps going back to the Fix the State return screen, it is all correct, and I can not get past this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

When you input your pension into the federal area of the return, did you indicate that it was from a tax-exempt source for the state of Massachusetts? To do this:

- Verify your 1099-R entry under Federal > Wages & Income > Retirement Plans and Social Security > IRA, 401 (k), Pension Plan Withdrawals (1099-R)

- If this is a tax-exempt pension in the state of Massachusetts, it should fall under one of the categories of Qualified government retirement distributions listed on the Where is your distribution from? screen.

- Continue through the remaining 1099-R screens.

If you do it this way, the system should automatically exempt it on the state return and should clear the error you are encountering. If you entered everything correctly the first time, you may want to try to delete it and re-enter the information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

This happens to me as well (it seems every year). I review on the Red and the State and it still gived this error on review. Please advise when fixed or how to fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

If you entered your 1099-R in your Federal return as instructed by @BillM223 above, you should not get an error.

If you're using TurboTax Online, go through the 1099-R entry in your Federal return again, then close TurboTax, clear your Cache and Cookies and open your Federal return.

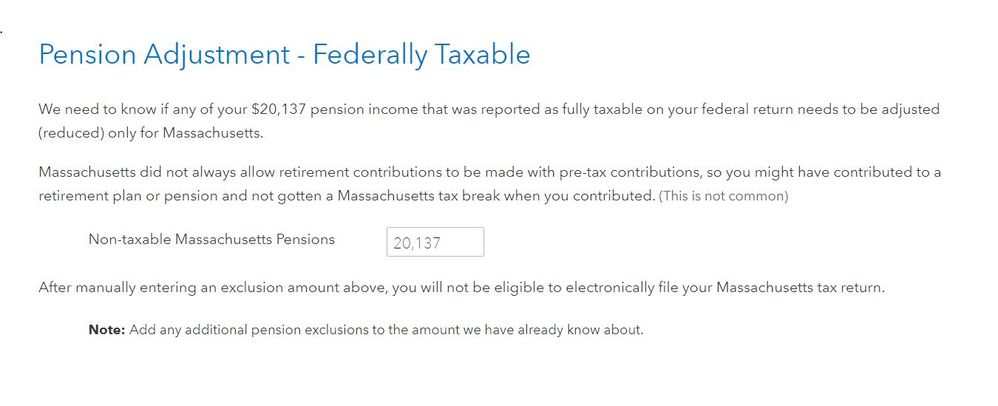

Do the Federal review and click on State. Step through the state interview and see if this resolves your error. Don't enter a '0' in the MA Taxable portion field, leave it blank.

Since we can't see your return in this forum, if this does not resolve, you may want to Contact TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

Thanks. The whole key seems to be to leave the Non Taxable Massachusetts Pensions box blank. Even though it was brought over and filled in automatically. It needs to be blanked out. I wonder whether the app is comparing a rounded number with an original value with cents applied and believes them to be different.. Whatever, I filed and it seems to work now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

I worked through this with the help from calling Turbo Tax, I had to manually remove Form 1 from the State section, then run the review again and it worked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

I'm not able to edit the Forms with the online version. How can I correct that TurboTax is not seeing MTRS pension as exempt from Mass Tax? Anyone else having this problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

To enter your exempt State employee pension, you will first have to enter the necessary information in your Federal Income tax return and then in the State income tax return. Here are full instructions.

On the Federal Income Tax portion:

- In the search or find box, type in 1099-R

- Click on Jump to 1099-R

- Scroll down to Retirement Plans and Social Security

- At IRA,401(k), Pension Plan Withdrawals (1099-R), click Start (or Update)

- Enter your 1099-R or if you have entered it, click on Edit then Continue

- Answer the next questions until you get to the Where Is This Distribution From? screen

- Select the source State Employees and enter the information requested:

- Click on Continue

- Click on From a Qualified Plan

- Continue answering the questions

On the State return portion:

- At the Changes to Federal Income page, scroll down to Received retirement income, click Start (or Update)

- At the Retirement Distributions Summary page, click on Edit State

- If no additional information is required, click on Continue

- Click on Done

Here is a link to the MA state website, which discusses the taxability of MA pensions.

@kd5campbell

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

I've filled in everything you mention but it still tells me that I can't efile

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

Try deleting your Form 1099-R and reentering it.

Is it giving you error codes? When you go through the review process is it coming up as something that needs review?

Follow these steps to delete your 1099-R in TurboTax:

- Go to Form 1099-R

- Select the trash can next to your 1099-R and then answer Yes

Click here for where to enter your Form 1099-R

If this does not help please feel free to come back to TurboTax Community with additional details or questions or click here for information on Turbo Tax Support. You can connect with a Live TurboTax Agent and share your screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Massachusetts Teachers Retirement not allowing e-file

This is it. Entering 0 is not enough, this field has to be blank, then it works.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jean-peterson

New Member

Sheryl23

New Member

aditim93

New Member

smmeyers

New Member

anitakennick

New Member