- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Maryland Additional Info for Part-Year Residents

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

@AbrahamT @RobertB4444 @ThomasM125 I still haven't seen a sufficient answer to @nicknack1 's question in regards to whether this calculation of the allocation of part-year resident income is BEFORE deductions or the Adjusted Gross Income. I would appreciate a clear answer. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

For most states the apportionment percentage is based on AGI of that state.

Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income. Adjustments to Income include such items as Educator expenses, Student loan interest, Alimony payments or contributions to a retirement account.

Adjusted Gross income is before your standard deduction, qualified business deductions and any tax credits are subtracted.

Click here for additional information on how to allocate your income for part-year state returns.

Click here for Maryland Form 502CR.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

Everyone else says to put the number directly from W-2. Then you say "For most states the apportionment percentage is based on AGI of that state."

The original question is what to put into the "boxes" in the TurboTax. NOT general principle about apportionment percentage. Please, clarify the answer in terms of what to put into the "boxes" in the TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

What if i was a part time resident and put full time resident on state tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

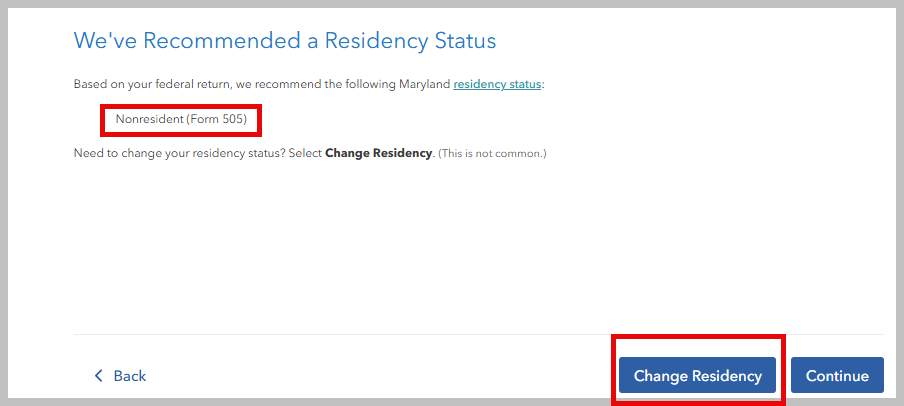

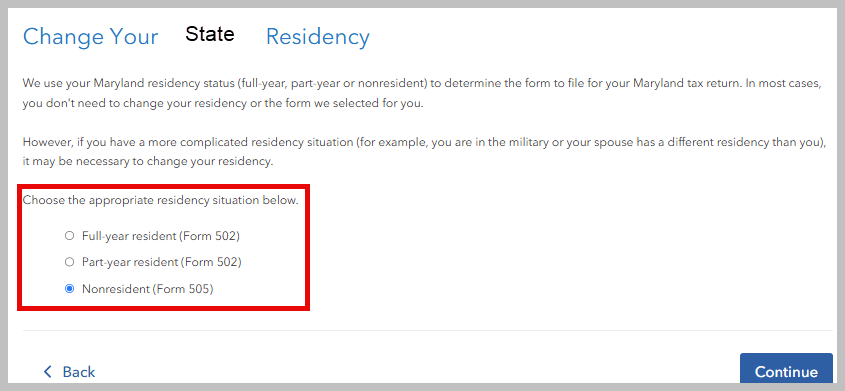

Not a problem at all. When you start or review the state return you can change your residency status at any time. See the image where TurboTax is recommending your residency status. Select to change it if necessary, then select the correct residency situation.

When preparing your state return, as a part year resident, be sure to prepare both state returns when income is earned in different states and your residency changed from one state to another during the tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

VJR-M

Level 1

jsefler

New Member

NeedHelpInWI

Level 1

ebohn99

New Member

krinsky

New Member