- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: MA Alimony is still deductible but not tranferring from Federal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

First. I am aware the tax law change regarding alimony on federal taxes. I don't need that explained (again and again).

Because the date of my agreement falls after the date of the change alimony is no longer deductible for federal taxes.

HOWEVER it is still considered deductible in Massachusetts and TurboTax is not transferring the amount from Fed to State. The Federal form treats it as zero because the date makes it ineligible. I would expect TurboTax to transfer the actual amount (displayed as zero on Federal) to MA schedule Y on MA state.

I can override the amount in forms (MA Schedule Y) mode (and have it work correctly), but I cannot e-file when there is an override.

I believe this is a bug

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

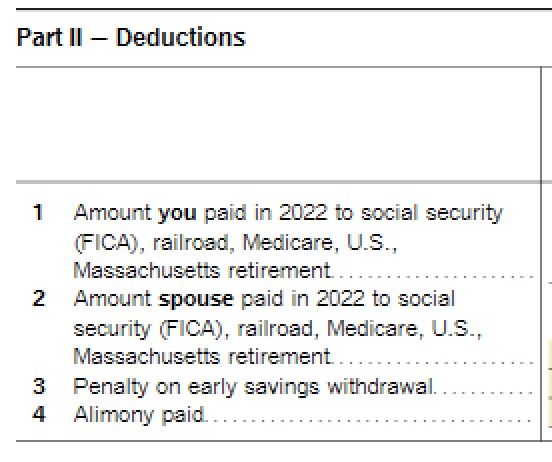

At this point, you will need to override to include your deductible alimony. The data source for Schedule Y Other Deductions is "federal Form 1040 or 1040-SR, Schedule 1, line 19a, if filing as a resident" and line 4, Part II of the Form 1-NR/PY Income Worksheet if filing as a part-year or non-resident.

The worksheet will populate Schedule Y and deductible federal alimony will not carry forward in your situation.

You are correct that alimony payments remain deductible in Massachusetts.

See Massachusetts law about alimony.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

At this point, you will need to override to include your deductible alimony. The data source for Schedule Y Other Deductions is "federal Form 1040 or 1040-SR, Schedule 1, line 19a, if filing as a resident" and line 4, Part II of the Form 1-NR/PY Income Worksheet if filing as a part-year or non-resident.

The worksheet will populate Schedule Y and deductible federal alimony will not carry forward in your situation.

You are correct that alimony payments remain deductible in Massachusetts.

See Massachusetts law about alimony.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

You I see the source mentioned on Fed Sched 1 line 19a. That line exists.

I'm not following what you said about the source for the NonResident MA form. Where does that get entered?

Edit: Disregard, I found it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

How can I override the income section to include my Alimony on the Mass State Income? I know I have to pay taxes on the funds - but it doesn't populate from the Federal side, and I don't see anywhere to add it to income in the Massachusetts state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

You can't be using "online" TT.

You must use "Forms" mode, It cannot be done in Step-By-Step mode

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

Massachusetts aligned with IRS rules as of January 1, 2022 to conform with the federal deduction on alimony. Alimony can only be deducted from the MA return if it's deductible on the Fed return. (i.e. on or before 12/31/2018).

Do not override as suggested in the original answer below. TurboTax is correct.

Yes. You can only override in Forms mode in TurboTax CD/Download. Find Massachusetts Schedule Y and right-click on line 3 and select Override (or Ctrl-D). The field will change color and you will be able to enter your alimony paid.

If you can't find Schedule Y, select Open Forms at the top of the left column, tap the + sign next to Massachusetts and double-click on Schedule Y.

[Edited 03/07/23 | 15:13 PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

When I did it on schedule Y it would not let me e-file on the non-resident form

See below

Quoting your previous post

At this point, you will need to override to include your deductible alimony. The data source for Schedule Y Other Deductions is "federal Form 1040 or 1040-SR, Schedule 1, line 19a, if filing as a resident" and line 4, Part II of the Form 1-NR/PY Income Worksheet if filing as a part-year or non-resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

Yes. You are not able to e-file a return with an override. You will have to print and mail your return. You can still e-file federal.

See How do I print and mail a return in the TurboTax for Windows CD/Download software?

You can e-file Massachusetts without an alimony subtraction and mail in an amended return later for the balance of your refund.

An override will also void the TurboTax 100% Accurate Calculation guarantee.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

Ahhh but I could e-file if I made the change (in the NR form anyway) in the income worksheet instead of directly in Schedule Y

That was the work-around. It seems if there is an override in a form that is filed (as opposed to a worksheet) e-file doesn't work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

Will this be fixed before filing deadline so we can e-file with the proper alimony deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

Probably not, but you can e-file now

You have to make a manual entry in the income worksheet (not schedule Y) so it propagates to schedule Y. If you do it directly in schedule Y it won't let you e-file. It says it can't with an override.

In my case if was in forms

MA Income WKS

Part 2 Line 4

Filing in the correct alimony amount there propagated it to schedule Y and allowed me to e-file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

Ok thanks! But I have to buy and download the desktop version correct? Doesn't seem to allow me to override online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

I'm guessing that is the case. I've never used the online version so I can't be of much help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

You can pretty easily import everything you've already done from the online version into the desktop version to continue working and have the functionality that you need.

Here is how to move from online to desktop.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MA Alimony is still deductible but not tranferring from Federal

Massachusetts has updated their IRC conformity date from as amended on January 1, 2005 to as amended on January 1, 2022. Meaning that they now conform to many federal provisions and calculations - including the deductibility of alimony paid and the taxability of alimony received. Alimony paid is only deductible if it is deductible on the Federal return, and alimony received is only taxable if it is taxable on the Federal return.

The product is handling the calculations correctly. Overrides are not needed.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rjandbj

New Member

rtoler

Returning Member

itsagirltang69

New Member

cindy-zhangheng

New Member

av8rhb

New Member