- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I live in IL, but work in St Louis MO. They have a city income tax, IL lets me get a tax cred...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in IL, but work in St Louis MO. They have a city income tax, IL lets me get a tax credit for that. TurboTax won't add that to my IL Credits.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in IL, but work in St Louis MO. They have a city income tax, IL lets me get a tax credit for that. TurboTax won't add that to my IL Credits.

It depends. You are correct that Illinois does allow you to claim local taxes paid to another state as a credit against Illinois taxes. However, that credit is limited to the amount of Illinois state taxes you are paying on the same income. And Illinois will already be giving you a credit for Missouri state taxes. When you come across this credit calculation, you can add the amount of local taxes you are paying to St. Louis also. The total figure will be compared to what you have to pay to Illinois on that same amount of income. The credit can lower your Illinois tax down to $0 but cannot increase your refund beyond Illinois tax that was withheld from your paycheck.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in IL, but work in St Louis MO. They have a city income tax, IL lets me get a tax credit for that. TurboTax won't add that to my IL Credits.

Please see this link to a previous answer I provided on this subject for additional information: Solved: Don't check the box. The amount that is reported ...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in IL, but work in St Louis MO. They have a city income tax, IL lets me get a tax credit for that. TurboTax won't add that to my IL Credits.

I am not able to find that at all. I went back into the MO tax section and looked for St Louis City income tax and it is not on there at all. TurboTax is missing the St Louis City income tax in their software. I called TurboTax about this and they where of zero help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in IL, but work in St Louis MO. They have a city income tax, IL lets me get a tax credit for that. TurboTax won't add that to my IL Credits.

TurboTax does not support the St. Louis Personal Earnings Tax. If you need to file the E-1 Form, do it outside TurboTax. Your Missouri W-2 should have your St. Louis income and tax listed on lines 18-20.

As @DanielVO1 said, you can claim a credit for St. Louis income tax on your Illinois return.

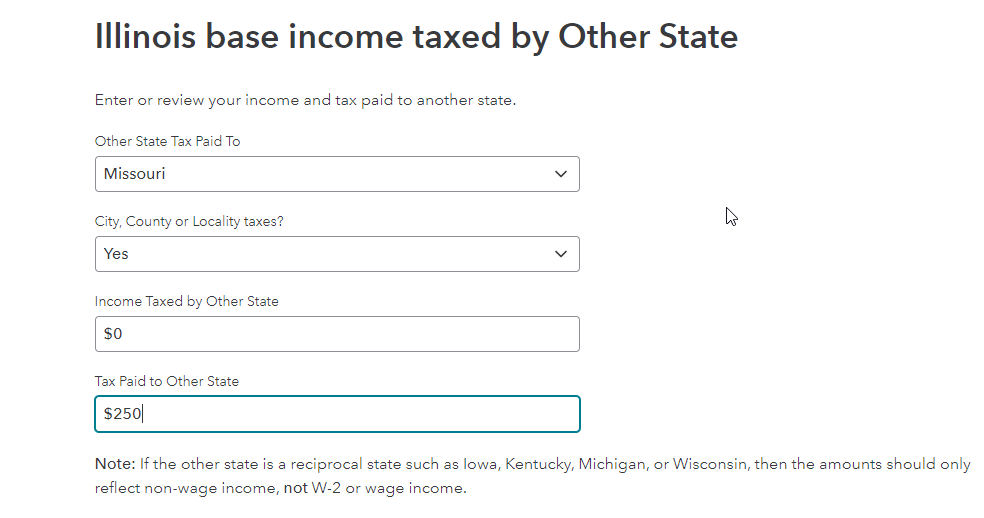

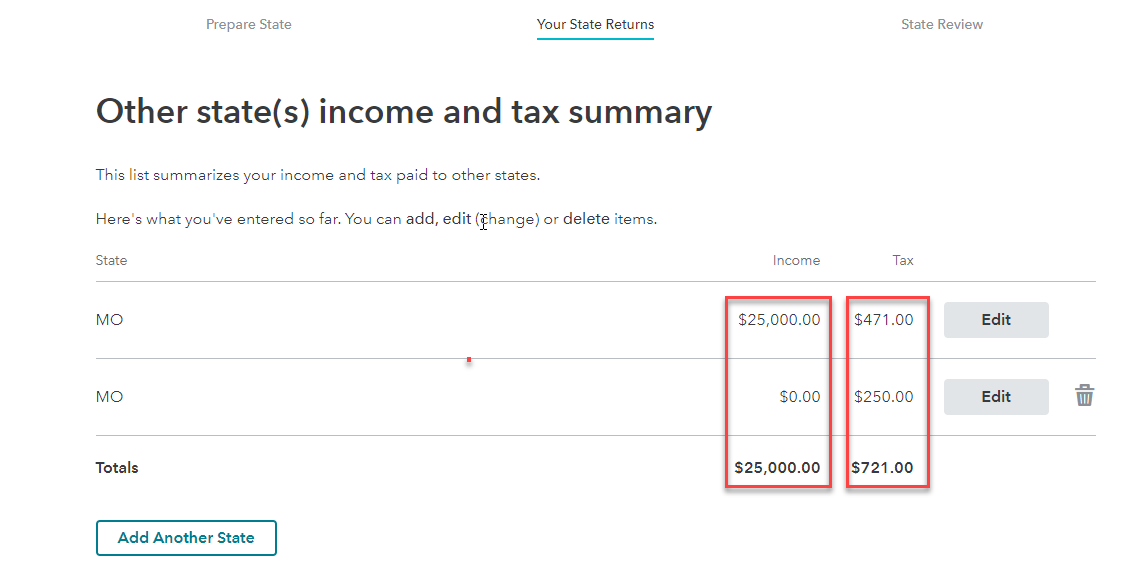

In the Illinois state section,

- Go to Take a look at Illinois Credits and Taxes

- Edit Credit for taxes paid to another state

- Add Another State on Other states(s) income and tax summary

- On Illinois base income taxes by Other State

- Select Missouri as Other State Tax Paid To

- Yes to City, County or Locality taxes?

- $0 to Income Taxed by Other State

- Enter your St. Louis tax paid in Tax Paid to Other State

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

TRWYKL

New Member

Silva878

Level 1

FOTBOB

New Member

vivianrose84

Returning Member

jmw43290

New Member