- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

TurboTax does not support the St. Louis Personal Earnings Tax. If you need to file the E-1 Form, do it outside TurboTax. Your Missouri W-2 should have your St. Louis income and tax listed on lines 18-20.

As @DanielVO1 said, you can claim a credit for St. Louis income tax on your Illinois return.

In the Illinois state section,

- Go to Take a look at Illinois Credits and Taxes

- Edit Credit for taxes paid to another state

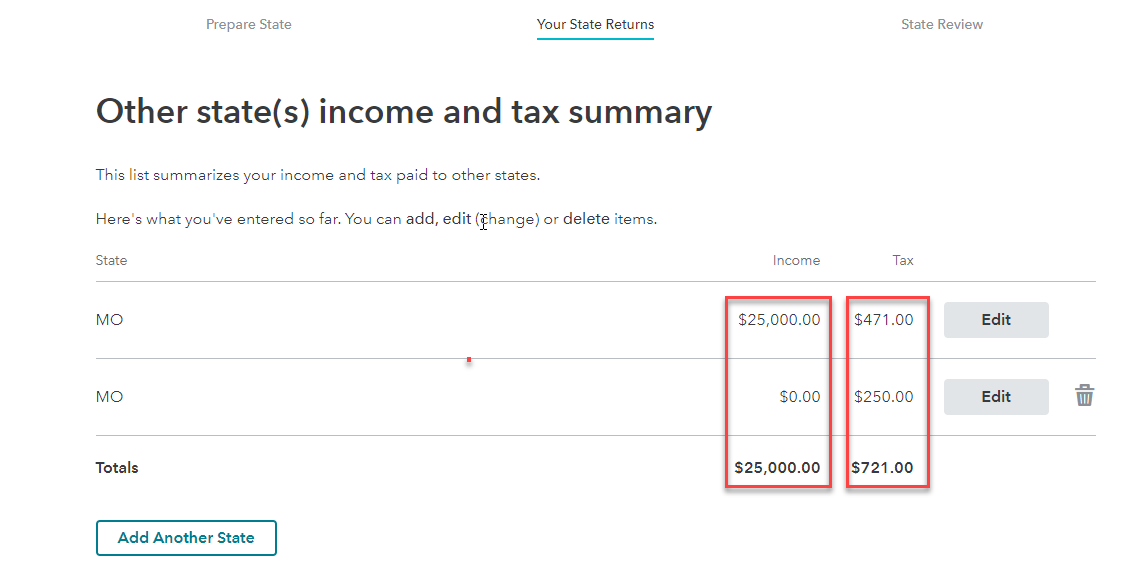

- Add Another State on Other states(s) income and tax summary

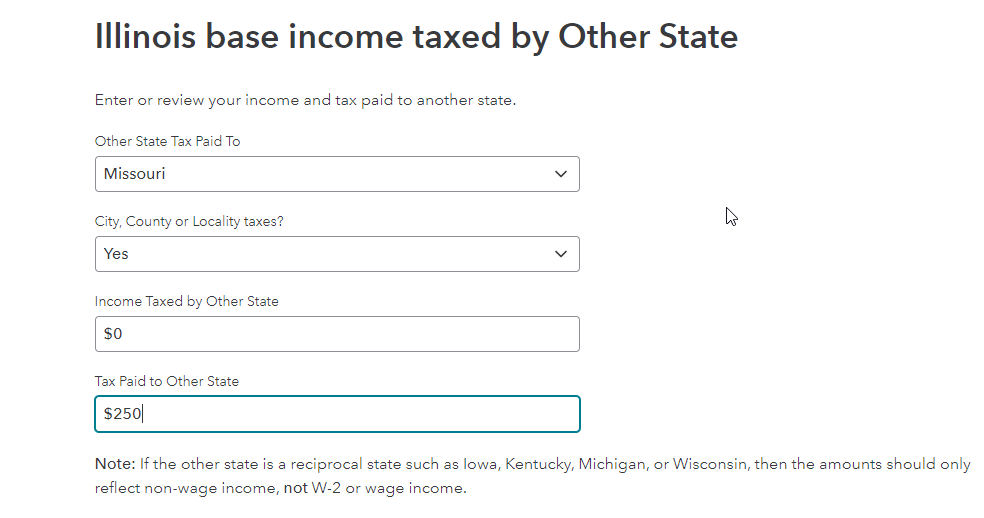

- On Illinois base income taxes by Other State

- Select Missouri as Other State Tax Paid To

- Yes to City, County or Locality taxes?

- $0 to Income Taxed by Other State

- Enter your St. Louis tax paid in Tax Paid to Other State

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 24, 2021

1:26 PM