- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: How to apply state refund to 2022 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to apply state refund to 2022 taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to apply state refund to 2022 taxes?

To elect to have your 2021 state refund be applied to 2022 North Carolina taxes, you can follow these steps:

- Open your tax return.

- Search for estimated tax payments with the magnifying glass tool on the top of the page.

- Click on the Jump to estimated tax payments link at the top of the search results.

- Click on Start next to 2021 refund applied to 2022 state taxes.

- Follow the on-screen instructions.

[Edited 2/19/22 l 7:21AM]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to apply state refund to 2022 taxes?

@LenaH Not that one Lena

....they have a refund indicated on their 2021 NC taxes, and want to apply it to next year...2022.

Your instructions are for last year's 2020 refund applied to 2021.

____________________________________________

I don't really recommend that you do this....If NC changes that Refund for any reason, then next year's tax file you will need to remember how much (if any) ended up being applied. You are better off just getting the refund, and then paying NC whatever you think is needed on the NC website's NC 40 Online payment page.

___________________________

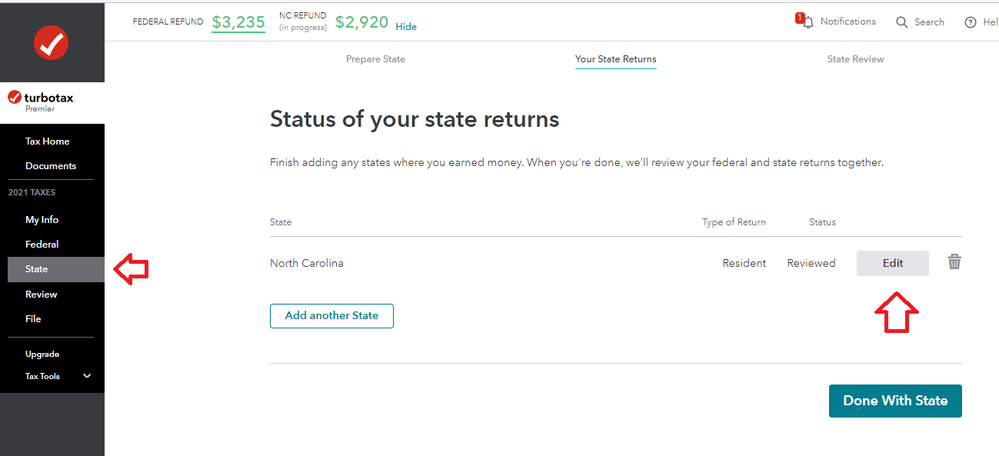

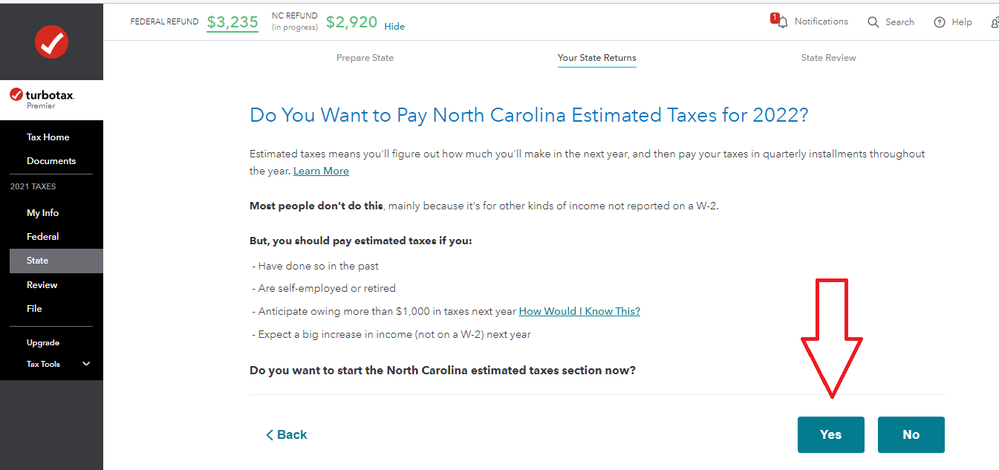

But, if you still want to do this. Edit your NC tax return, get to the NC menu page:

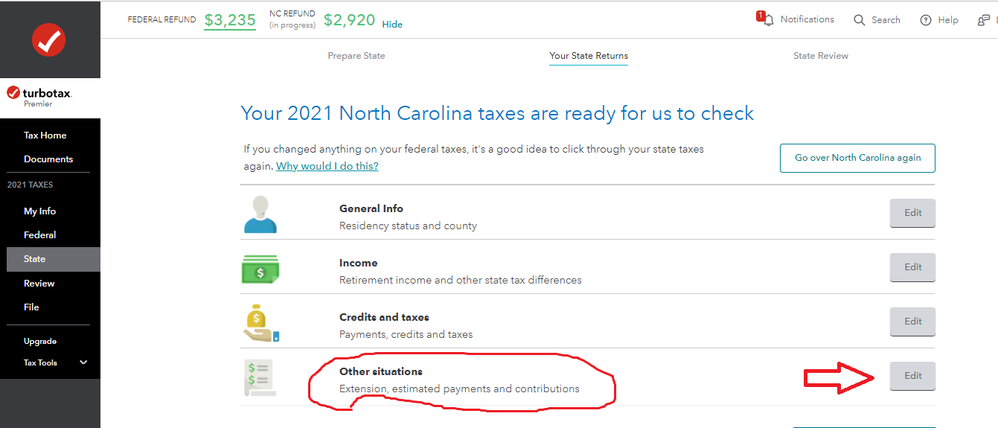

1) and go into "Other Situations"

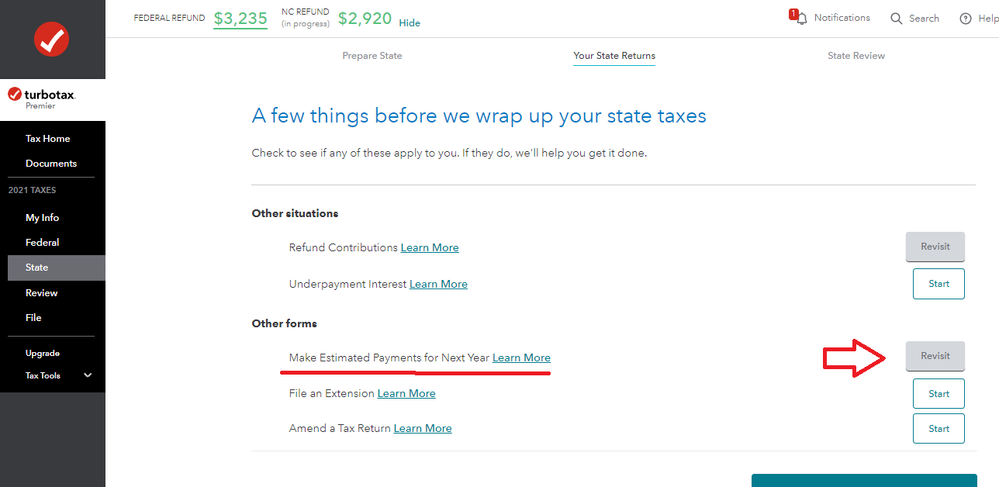

2) then "Start" or edit at "Make estimated payments for next year"

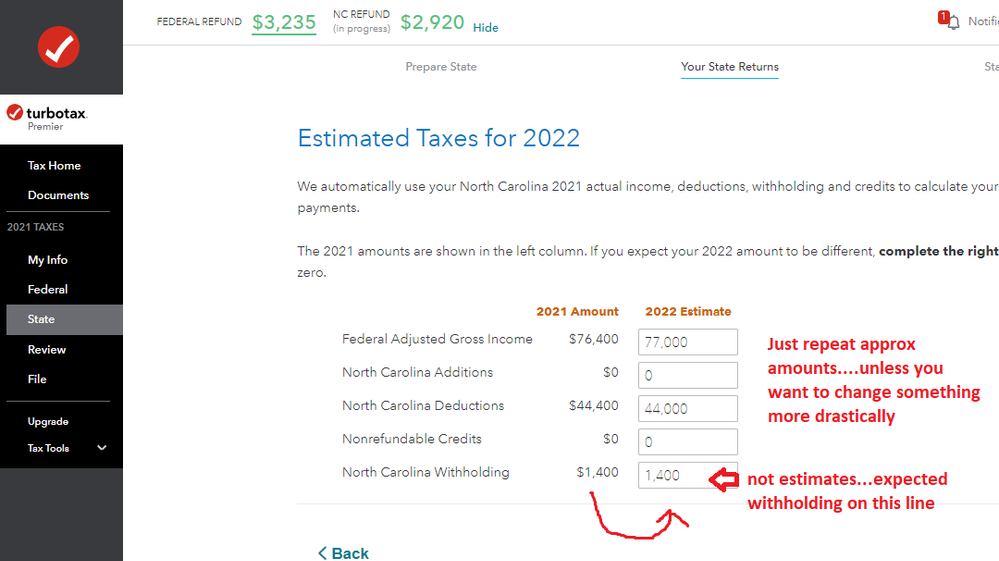

3) Proceed as-if you were going to prepare the 4 quarterly estimated tax payments, filling in the various boxes appropriately.

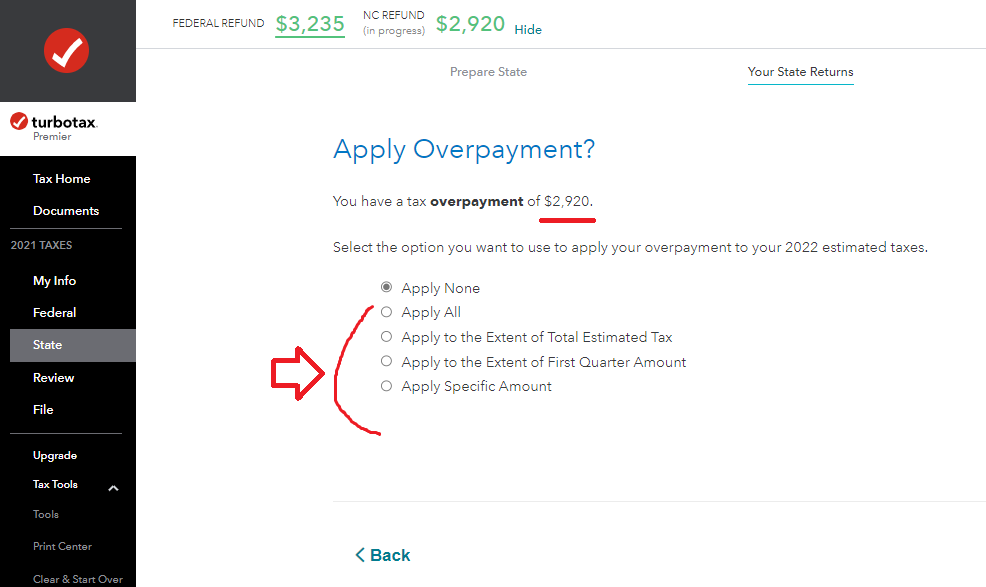

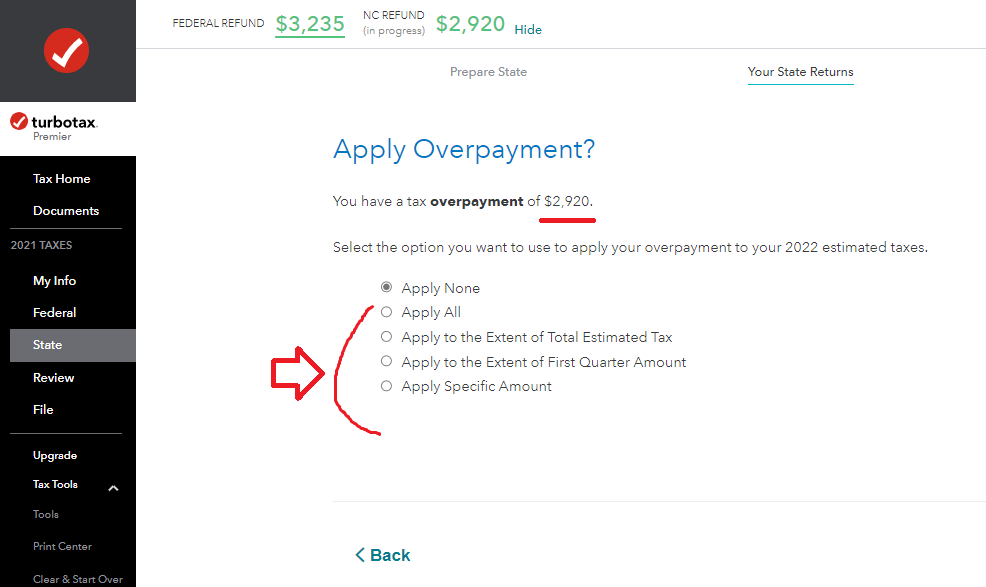

4) Eventually you will get to the page below, where you can select how to treat your current NC refund.

5) Then proceed thru the pages that follow.

IF a page comes up that asks if you really want to prepare the estimated tax vouchers.....go ahead and say Yes....mostly because I don't know if saying No will cancel your refund-applied-to-2022 choice or not. If you don't need the NC Estimated tax forms, you can then just ignore them, since the fact they were prepared is not transmitted to the NCDOR.

__________________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to apply state refund to 2022 taxes?

And remember this...do NOT attempt to E-file until after 24 February

(Of course, no one has any idea if NC E-filing might be delayed even further)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to apply state refund to 2022 taxes?

That option never came up on my state taxes. I swear Turbo Tax is the worst ever . Have used it for 20 years but this is the first (and last ) time I will try to use it on Turbo Tax. Much easier to just mail it in. thanks for your input but it's not one of my choices on my premier version of Turbo Tax........

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to apply state refund to 2022 taxes?

OK...try again. The longer you use TTX, the better you'll be able to navigate......... (in spite of all of the NC forms issues for 2021)

______________________________________

_______________________________________

______________________________________

________________________________________

______________________________________

Farmer or Fisherman? page ....NO

_______________________________________

______________________________________

Step thru a few more pages and finally:

______________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to apply state refund to 2022 taxes?

At least for the AL state tax, TurboTax has the option at the end of the "Other Forms". Total Path:

> State Taxes

> Other Forms (Est Taxes for Next Next…)

> Start Est Taxs: Yes

> No

> 2022 Est Tax

> Married

> 90%

> Apply Over Payment = * Apply None

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to apply state refund to 2022 taxes?

At least for the AL state tax, TurboTax has the option at the end of the "Other Forms". Total Path:

> State Taxes

> Other Forms (Est Taxes for Next Next…)

> Start Est Taxs: Yes

> No

> 2022 Est Tax

> Married

> 90%

> Apply Over Payment ==> Select Option

Note, it appears that TurboTax thought it was cute to have each state do this differently.

This year, TurboTax needlessly had me spend around 8 hours extra filling out crap that did not matter in end. List follows:

- And Turbo reported a low threadhold for deducting medical expenses. I spend 4hr digging the stuff up that I didn’t thing mattered. Turns out it was not deductible. Why did it waste my time? Stupid code!

- Also it encouraged listing all the charity that I generously give to. Turns out, only $600 (10% of the entered donations) are deducible. Why did TurboTax waste my time? Stupid code!

- Why are all the details of the 1099s entered when only the company’s name is provided to the IRS? Stupid waste of my time!

- Mistakenly, when it read my wife's and my financial accounts info, it doubled the joint accounts we have. >> Should check the account numbers!

- I got reported income from a company that did not provide an EIN. Turbo has no method to note this. In fact: It absolutely insists that something be provided. Further, it did not note that since it was under $600, it did not need reported.

- I do not want my phone number provided to the IRS, and yet TurboTax insists that I divulge it. Stupid code.

- In the record of W-2, my field 12a reported D:8200. I typed it in that way. Somehow, Turbo turned that into another tax hit with some wildly different coding number. No warning, nothing. I only found it with a box-by-box checking the PDF file. I do not buy TurboTax to have to manually scan a 118-page document number by number.

- Plus 2hr spent trying to find where to turn off Apply State Refund to Next Year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to apply state refund to 2022 taxes?

@gguessa You spend a lot of time blaming TurboTax for issues that have nothing to do with the software or the company.

- The amount of medical expense required to"matter' in your return is a function of your total income - this can't really be determined for you unless and until you enter all of your data.

- Unless you know for certain that your total deductible items are less than your standard deduction, and most people do not have a clue, entering everything that you gave is the only way for the program to determine the best deduction for you.

- If you file electronically, the company name is NOT the only detail sent to the IRS - this is why the information is collected. It is required by the IRS when filing electronically

- An import/user error cannot be blamed on the software (doubling of numbers). This is either a function of user input or the company from which the data was imported.

- If a company did not provide you their EIN for income, you should report it as "other income". You are entirely mistaken that income under $600 does not need to be reported. It absolutely does need to be reported!!

- The IRS requires a phone number on your tax return. When you paper file, you can get by without it because what can they do? But a return that isnt complete cannot be electronically filed, and phone number is required for the return to be complete.

- This sounds again like a user error - How is TurboTax supposed to know if you make a typo? You are the only one with the actual form to compare the entries to. What warning did you want? Did you want it to reach through the screen and read your form and alert you that you typed it in wrong?

- every state software program is an entirely separate program that ties to the federal program to make things easier for the taxpayer. This is because every state has its own complete different forms, rules, tax rates, etc. I found it to be obvious where the apply to state refund goes in Alabama - but if it had taken me more than 10 minutes, I'd have just taken the refund and then mailed a check to the state. Problem solved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to apply state refund to 2022 taxes?

- Medical Expense: TurboTax asked me for the medical expense info after I had entered all the income and deductions info. It was the check for Missing Deductions phase. It even provided an oddly specific value of expenses such as $4123. That clearly implies any amount over this would be deductible.

- Company info to the IRS: The complete PDF of the 1040 return does not list anything more than the company name. So, I dispute your statement that more info than that is transmitted. How would you know that?

- 1099-NEC: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf states on page 10 for Box 1 instructions that a 1099-NEC must be filed when paying more than $600 to a contractor. So specifically, in my case, No 1099-NEC was filed, so there is No EIN to enter.

- Phone Number: from page 64 of 1040 Instructions (Cat. No. 24811V):

“You have the option of entering your phone number and email address in the spaces provided. There will be no effect on the processing of your return if you choose not to enter this information.”

Therefore, a phone number is not required. Additionally, plenty of people do not have phones. I have considered cancelling my useless and overly expensive phone and just get a cellular data plan. TurboTax is Stupid to demand it since tax fraud is rampant. The last thing anyone needs is a hint that the IRS might really call.

- W2 Box 12a input: How about TurboTax not randomly generating a code for a user input. I put in exactly what the box said. TurboTax choose to corrupt the data instead of noting it did not understand. In addition, TurboTax does not note that only a single character can be inputted for the Box. Several of my 1099s have multiple codes in the box.

- State Tax Form: There is no reason that TurboTax has to have a different user interface just because the state form specifics differ. I do wonder how you possibly could find the flag for applying the refund to next year quickly. BTW, I specifically stated I was trying to turn off the flag. A search within TurboTax’s help did not return anything useful. The forum returned a few cases of people providing incorrect methods to change the flag. Of course, possibly correct procedures changed between states, meaning even the title of the location (path) changed.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mjbrown37

New Member

4md

New Member

2022 Deluxe

Level 1

Kiwi

Returning Member

user17561777520

New Member