- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

@LenaH Not that one Lena

....they have a refund indicated on their 2021 NC taxes, and want to apply it to next year...2022.

Your instructions are for last year's 2020 refund applied to 2021.

____________________________________________

I don't really recommend that you do this....If NC changes that Refund for any reason, then next year's tax file you will need to remember how much (if any) ended up being applied. You are better off just getting the refund, and then paying NC whatever you think is needed on the NC website's NC 40 Online payment page.

___________________________

But, if you still want to do this. Edit your NC tax return, get to the NC menu page:

1) and go into "Other Situations"

2) then "Start" or edit at "Make estimated payments for next year"

3) Proceed as-if you were going to prepare the 4 quarterly estimated tax payments, filling in the various boxes appropriately.

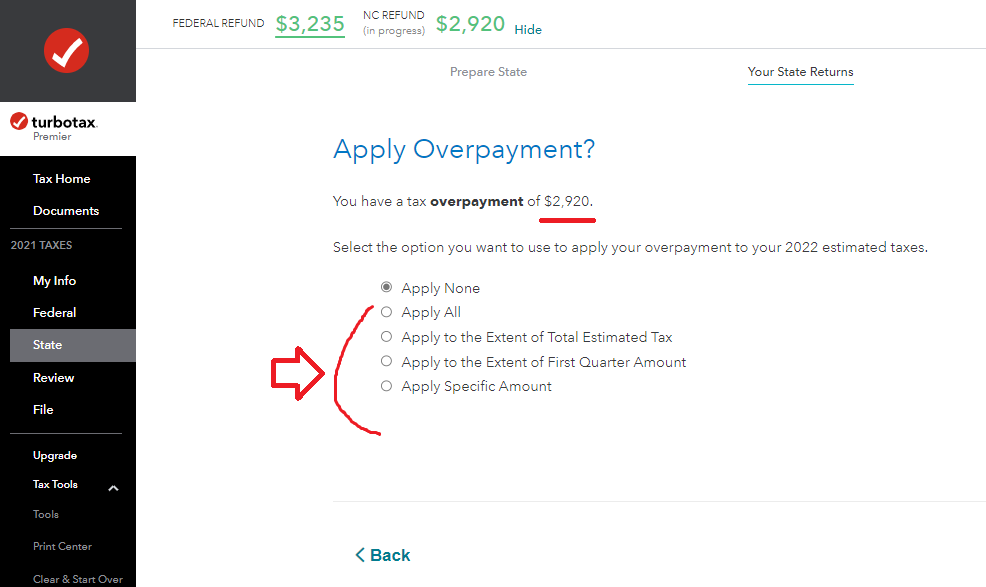

4) Eventually you will get to the page below, where you can select how to treat your current NC refund.

5) Then proceed thru the pages that follow.

IF a page comes up that asks if you really want to prepare the estimated tax vouchers.....go ahead and say Yes....mostly because I don't know if saying No will cancel your refund-applied-to-2022 choice or not. If you don't need the NC Estimated tax forms, you can then just ignore them, since the fact they were prepared is not transmitted to the NCDOR.

__________________________________________