- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: how not to carry investment income to a non-resident state return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how not to carry investment income to a non-resident state return

I live in IL, Wi withheld one pay check tax. When i file iL tax return, my investment income was transferred to non-resident state of WI, which is wrong. It should report all to IL. how to correct that in Turbotax step by step format? Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how not to carry investment income to a non-resident state return

When you need to prepare a resident state return and a nonresident state return, prepare the nonresident state return first. Then, if you had to pay tax to the nonresident state (tax shown on a tax return, not withholding), your resident state normally provides a credit for taxes paid to the other state.

If you started preparing the Illinois resident return first, but haven't filed it, you can delete it and prepare it again after you complete the Wisconsin nonresident return. All of your taxable income should be taxable by Illinois since you are a resident.

When you complete the nonresident Wisconsin state return, answer all of the questions in the state interview section, so that you identify only the income that was taxable to Wisconsin. If the Wisconsin withholding was an error by your employer, then report that you had no Wisconsin income. Wisconsin only taxes nonresidents on income from Wisconsin sources. See this Wisconsin Department of Revenue webpage for more information.

Then, prepare the Illinois return again and do not answer that you had income taxed by another state unless you showed a tax liability on the Wisconsin return.

Some states have reciprocity agreements so that you normally don't have to prepare two returns if you only receive wages in the nonresident state. Illinois and Wisconsin have such an agreement. See this article for information on states with reciprocity agreements. In your situation, you need to file a Wisconsin return to get the withholding back.

See also this TurboTax article and this one on multiple-state situations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how not to carry investment income to a non-resident state return

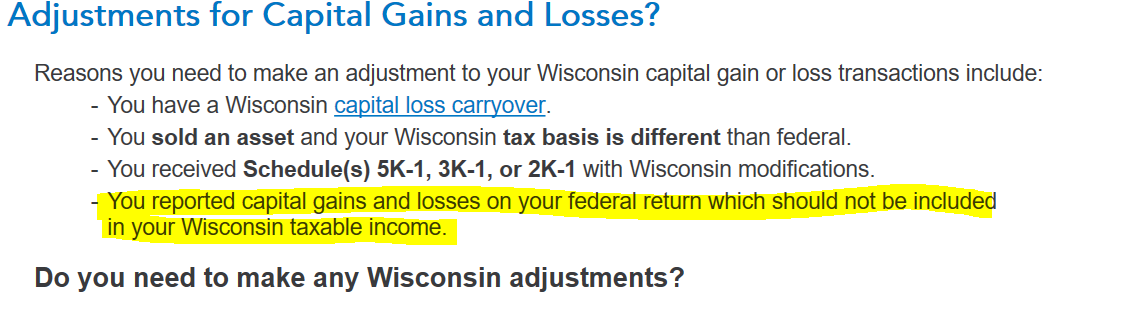

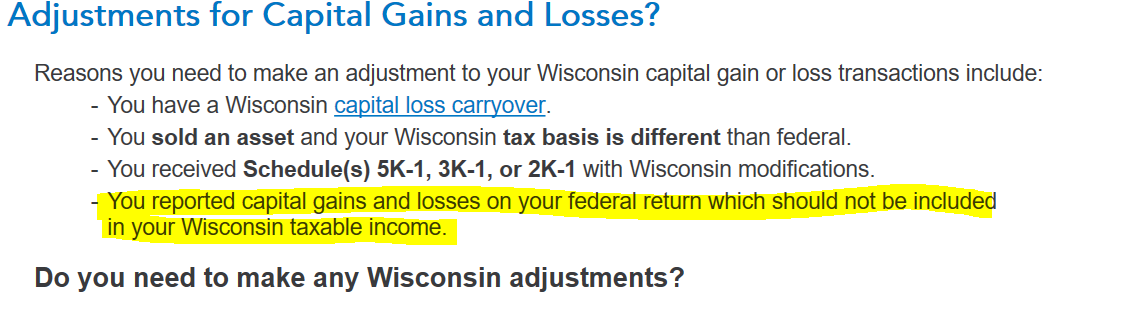

If your investment income consisted of capital gains or losses, there is mention of that in the Wisconsin return on the screen that says Adjustments for Capital Gains and Losses?:

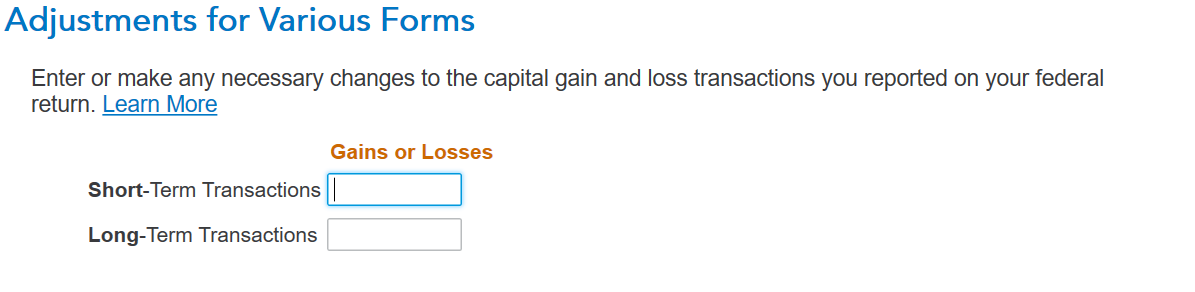

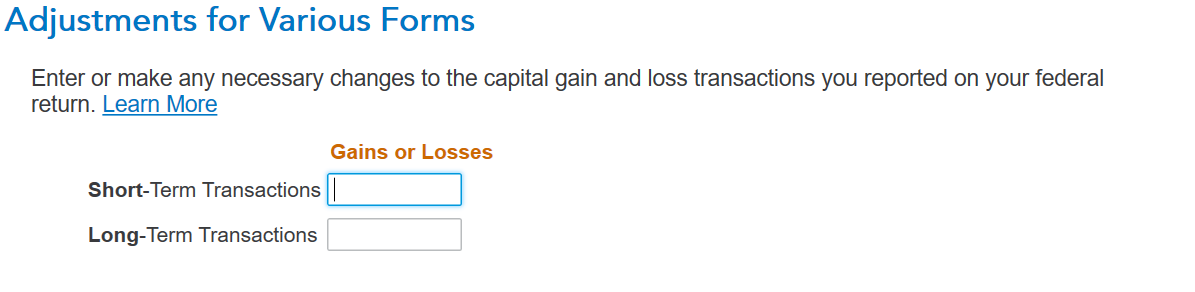

Later in that section you will have an opportunity to remove the capital gains or losses from the Wisconsin return:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how not to carry investment income to a non-resident state return

When you need to prepare a resident state return and a nonresident state return, prepare the nonresident state return first. Then, if you had to pay tax to the nonresident state (tax shown on a tax return, not withholding), your resident state normally provides a credit for taxes paid to the other state.

If you started preparing the Illinois resident return first, but haven't filed it, you can delete it and prepare it again after you complete the Wisconsin nonresident return. All of your taxable income should be taxable by Illinois since you are a resident.

When you complete the nonresident Wisconsin state return, answer all of the questions in the state interview section, so that you identify only the income that was taxable to Wisconsin. If the Wisconsin withholding was an error by your employer, then report that you had no Wisconsin income. Wisconsin only taxes nonresidents on income from Wisconsin sources. See this Wisconsin Department of Revenue webpage for more information.

Then, prepare the Illinois return again and do not answer that you had income taxed by another state unless you showed a tax liability on the Wisconsin return.

Some states have reciprocity agreements so that you normally don't have to prepare two returns if you only receive wages in the nonresident state. Illinois and Wisconsin have such an agreement. See this article for information on states with reciprocity agreements. In your situation, you need to file a Wisconsin return to get the withholding back.

See also this TurboTax article and this one on multiple-state situations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how not to carry investment income to a non-resident state return

I deleted both tax return of IL and WI as you suggested, and then started WI return first, it still carried interest to WI tax return. It seems a bug of TT. Any other idea? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how not to carry investment income to a non-resident state return

If your investment income consisted of capital gains or losses, there is mention of that in the Wisconsin return on the screen that says Adjustments for Capital Gains and Losses?:

Later in that section you will have an opportunity to remove the capital gains or losses from the Wisconsin return:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how not to carry investment income to a non-resident state return

Thank you very much for providing the answer. I did that in the step by step for capital gain. But I wasn't prompted to edit interest portion. I then went to the form format, was able to change to 0 in the worksheet. I was trying in the form directly, which did not work. Thanks again

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

zenmster

Level 3

ke-neuner

New Member

ilenearg

Level 2

balld386

New Member

ajm2281

Level 1