- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Having trouble annualizing my state income to avoid underpayment interest on Maryland Form 502UP

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having trouble annualizing my state income to avoid underpayment interest on Maryland Form 502UP

Hi I'm also trying to annualize my state income but since I'm a "first time filer" the online version of turbotax is not letting me annualize my state income. I can't get to stage specified above because of this please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having trouble annualizing my state income to avoid underpayment interest on Maryland Form 502UP

Try these steps:

To do this in TurboTax Online and TurboTax CD/Download, follow these steps:

- From inside the program, enter estimated tax payments in the search box.

- Select the Jump to link in the search results.

- Scroll to 2021 State Estimated Payments and enter the date paid and the amount.

- After this is completed, then, run through the State interview again to get to the Underpayment section. Per KathrynG3

If this does not help? provide the name of your state so tht we can followup with links for your state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having trouble annualizing my state income to avoid underpayment interest on Maryland Form 502UP

These instructions do not work in 2021 TT Deluxe. After completing the "2021 State Estimated Payments" and clicking on Edit next to Maryland in State Taxes , I am brought directly to the "A few things before we wrap up your state taxes" page, which does not have an entry for underpayment.

I spoke with TT Customer Support and they said the only solution is to edit Form 502 UP directly instead of step-by-step. So I tried doing that. On the form, I clicked the "Check here to annualize" checkbox and entered the four amounts on Line 11 (income for each period). TT automatically calculated amounts on Lines 12 and 13. But entries on Line 14 (estimated tax paid and withheld for each period) cannot be made -- TT set these unchangeable amounts. Consequently, the calculation of underpayment for the first three out of four periods is incorrect. Is there any other solution to edit MD Form 502UP?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having trouble annualizing my state income to avoid underpayment interest on Maryland Form 502UP

mrk6

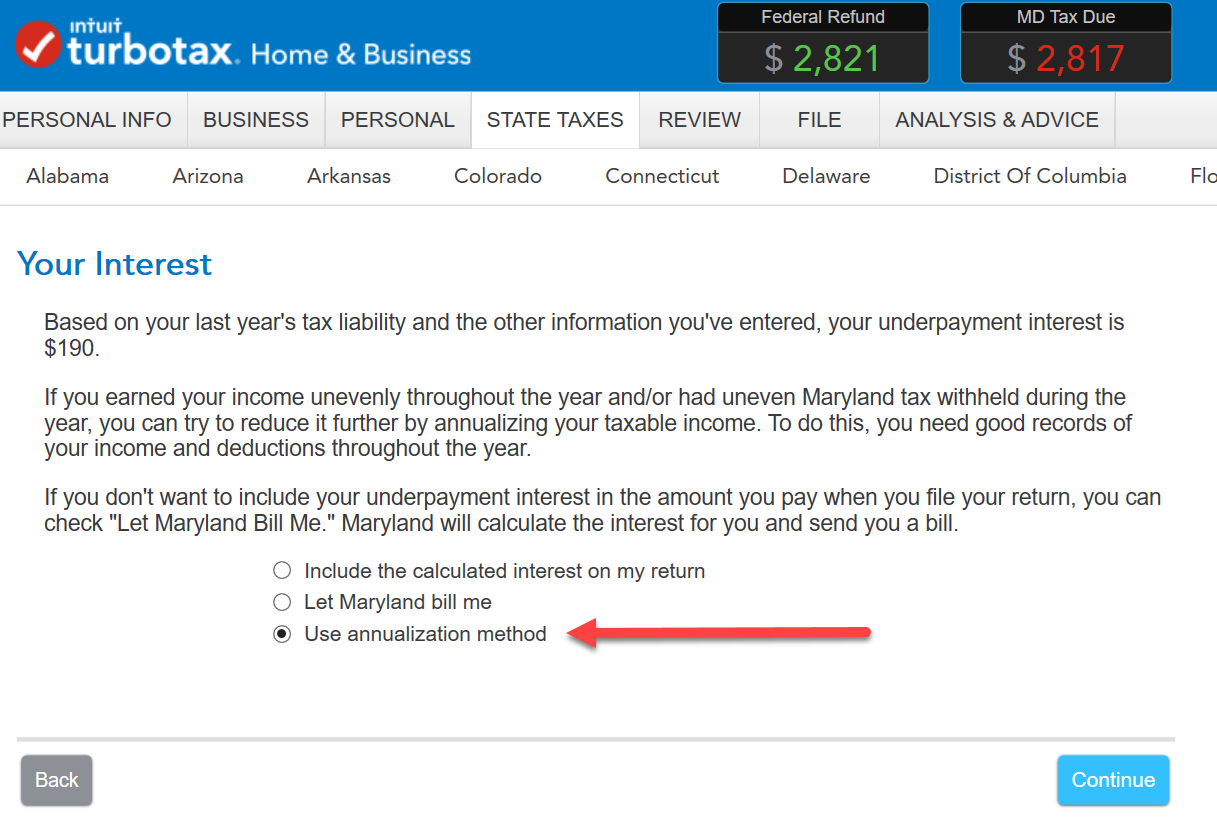

Here are the screens in TurboTax Home & Business to get to annualization on Maryland 502UP

A Few Things before we wrap up

Enter date you will file your return (to cut off any running interest on the underpayment)

First time filer? NOTE as darkcam said above, if you answer "first time", you will never see any additional screens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Having trouble annualizing my state income to avoid underpayment interest on Maryland Form 502UP

Interest on underpayment. NOTE I made last year's tax really big, so I would not accidentally meet an exception.

Farmer or Fishermen - these have reduced requirements for paying taxes.

Underpayment exception. Answer NO or you will meet an exception and not get to the Annualization section.

Underpayment interest - yes, you want to review the calculation.

Your Interest - Click the Annualization button

Annualization Method - enter your income for each of the first three quarters

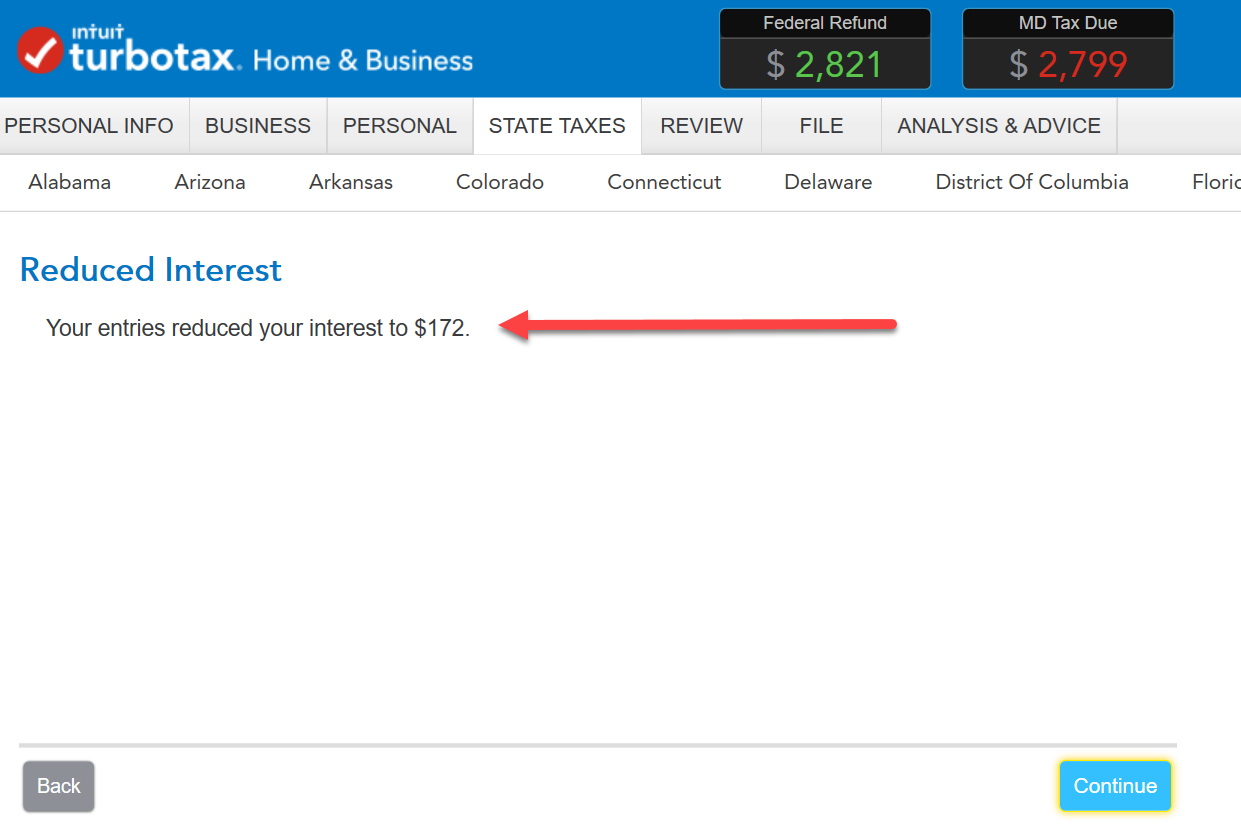

Reduced interest - annualization actually worked!

Back to Wrap up a few things...

The Annualization Table from Maryland 502UP

Note that there are several steps along the way where a "wrong" answer will stop your progress to being able to annualize.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jstan78

New Member

sakilee0209

Level 2

altheaf

Level 1

km2438

Level 2

miller429

New Member