- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Annualization information not passed from Fed to MA, how to enter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualization information not passed from Fed to MA, how to enter?

All of my income was in the 4th quarter, so that's when I made an estimated tax payment. I entered annualization information in my federal form so it was handled correctly there. That information (like anything beyond the very basics) was not passed to the MA form, so I'm getting hit with an underpayment penalty.

I can see the form 2210 in my MA return, but not edit it in Forms. It says it is calculated, but doesn't link back to tell me where the calculation came from.

There used to be a checkbox in the dialogs for entering an exception to penalties in past years, which is how I entered it before, this year that is gone.

How can I tell the MA return to annualize my income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualization information not passed from Fed to MA, how to enter?

Yes, you can return to this section of your return. Follow these steps to get there in TurboTax:

- From the left menu, select State

- Continue

- Massachusetts click Continue/Edit

- You should see You've Finished Your Massachusetts Return

- Scroll down to Your Bottom Line and click Update

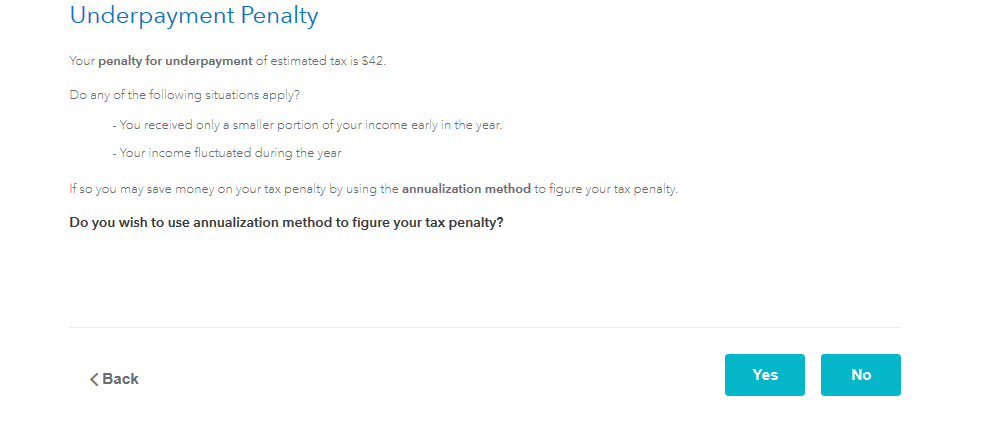

- The third question in starts in with the Underpayment Penalty details

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualization information not passed from Fed to MA, how to enter?

You will see the Underpayment Penalty Selections-- None apply

2018 Massachusetts Tax Liability- enter amount

Underpayment Penalty--see below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualization information not passed from Fed to MA, how to enter?

Yes, that would be lovely, and the way I handled it in past years. I wish it were that easy!

Now the dialog does not present a section on underpayment penalties at all, and if I navigate to that topic using the Topic List menu it takes me to a window titled "Apply refund to 2020 Estimated Tax?" (pretty completely irrelevant, as far as I can tell), I can enter an amount to apply to 2020 estimated taxes. Clicking the Continue button takes me directly to "Your Massachusetts Bottom Line" with no further questions or choices related to underpayment penalties. It's as if the link in the "Topics List" is pointing to the wrong page. I don't know of another way to navigate to that point, and there is apparently no longer any way to report bugs.

Thank you for responding!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualization information not passed from Fed to MA, how to enter?

Yes, you can return to this section of your return. Follow these steps to get there in TurboTax:

- From the left menu, select State

- Continue

- Massachusetts click Continue/Edit

- You should see You've Finished Your Massachusetts Return

- Scroll down to Your Bottom Line and click Update

- The third question in starts in with the Underpayment Penalty details

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualization information not passed from Fed to MA, how to enter?

I also discovered, just a few minutes ago. that if you squint your eye just right and click in the exact right pixel of the box on the form you can also enter annualization information directly on form m2210. Must of tried 50 times before hitting the right spot that opened up a data entry field.

Thanks for your patience and help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualization information not passed from Fed to MA, how to enter?

Concerning if I should annualize my return for fed and state. I assume I would have to annualize both to lessen the tax penalty assigned by both? If I decide after checking option to annualize, can I back out of this later, and decide not to in the program? I know I have to calculate income to each quarter, but do I have to do the same for interest and dividend income, and money made with exempt bond interest, etc? My federal AGI, is much more than my state of Mass amount shown for the prepopulated field in annualization program for Mass. Have any idea why this is so?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualization information not passed from Fed to MA, how to enter?

Possible to get an answer? Thanks

Concerning if I should annualize my return for fed and state. I assume I would have to annualize both to lessen the tax penalty assigned by both? If I decide after checking option to annualize, can I back out of this later, and decide not to in the program? I know I have to calculate income to each quarter, but do I have to do the same for interest and dividend income, and money made with exempt bond interest, etc? My federal AGI, is much more than my state of Mass amount shown for the prepopulated field in annualization program for Mass. Have any idea why this is so?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annualization information not passed from Fed to MA, how to enter?

@sonzoil The annualization has to be entered to reduce the penalty. If all of your income lands in December you should be able to reduce your penalty. If you change your mind and decide not to annualize you just need to go back and change the check box from annualize to don't annualize and you're all set.

As for why Massachusetts income is lower than federal it would depend on what type of income you have in your return. Massachusetts has different rules for what is taxable than the federal government, as well as what is deductible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Inugasuki

Level 2

rwiegand

Level 2

gallo1991

New Member

jstetson

New Member

turbokaust2019

New Member