- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- RDP Itemized Deductions versus Standard Deduction for Mock Federal Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RDP Itemized Deductions versus Standard Deduction for Mock Federal Return

I am a CA resident and my RDP and I are not able to file jointly for Federal. So, we file separately for federal using community property rules. However, we can and do file "married filing jointly" in CA. According to how RDP's are to file: https://ttlc.intuit.com/community/family/help/how-do-i-prepare-our-rdp-return-if-we-live-in-californ... I am preparing the Mock Joint Federal return, to be used to file our CA return. Going through the interview, adding my RDP's income, deductions, credits and other information, and at the point I entered a CA Refund for the prior year, I was asked "Did you take the standard deduction last year, or did you itemize your deductions?". For our Federal returns, I took the standard deduction and my RDP itemized. Since I was entering information for my RDP in the Mock return, I selected "I itemized my deductions in 2018". Next, the interview says: "Let's Confirm You Got the Standard Deduction in 2018" and "Our records show that you got the standard deduction in 2018 instead of itemizing your deductions." I assume TT thinks my RDP got the standard deduction since the original return used to create the Mock return was mine, and I took the standard deduction. So, it asks me again to select either "Yes, I got the standard deduction last year" OR "No, I didn't get the standard deduction last year". In bright red letters it says it is Recommended, next to "Yes, I got the standard deduction last year". Since my RDP itemized, I selected No, I didn't get the standard deduction last year. Then the interview is asking to enter info from my RDP's 2018 federal return to see if my California refund we received is taxable. After a few more questions, it asks to enter more info from my 2018 return. i.e. *AGI, Itemized deductions, Tax, Tax Before Credits and Tax After Credits.

Before I go much farther, I want to be sure I'm not going down a rabbit hole here. Is the above correct, all just to confirm if the CA refund we received in 2018 is taxable? And, when they ask the *above questions, should I be entering both mine and my RDP's AGI etc? Again, I took the standard deduction and my RDP itemized. So, what would we enter for the question "Itemized Deductions or Standard Deductions"? Should we add my standard deduction to his itemized deduction and enter the total?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RDP Itemized Deductions versus Standard Deduction for Mock Federal Return

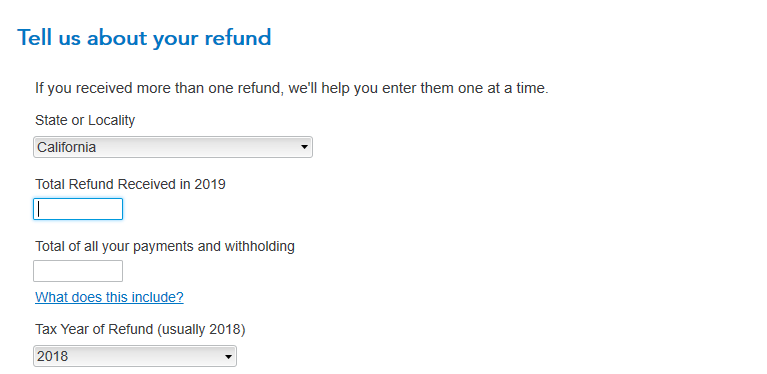

For this mock return, you will want to enter that you itemized, then only include his CA refund amount. If you see the questions as below, you will just want to enter his refund then for Total of all your payments and withholding- only include any estimated CA taxes or CA refunds from the prior year(2018) he had them keep to apply yo taxes. (Let me know if this does not make sense).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jackkuj

New Member

wcp0031938

New Member

d-fotopoulos

New Member

hixen26

Level 2

decassity

New Member