- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Public employee 414(h) and IRC125 Question for NY

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public employee 414(h) and IRC125 Question for NY

New York City advises that 414(h) and IRC 125 should be reported on IT-201 or IT-203 as addition modifications, however turbo tax has the entry of these elements merely listed as box 14 entries, but doesn't seem to be incorporating the tabulation into the income tax deductions. Can you please advise?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public employee 414(h) and IRC125 Question for NY

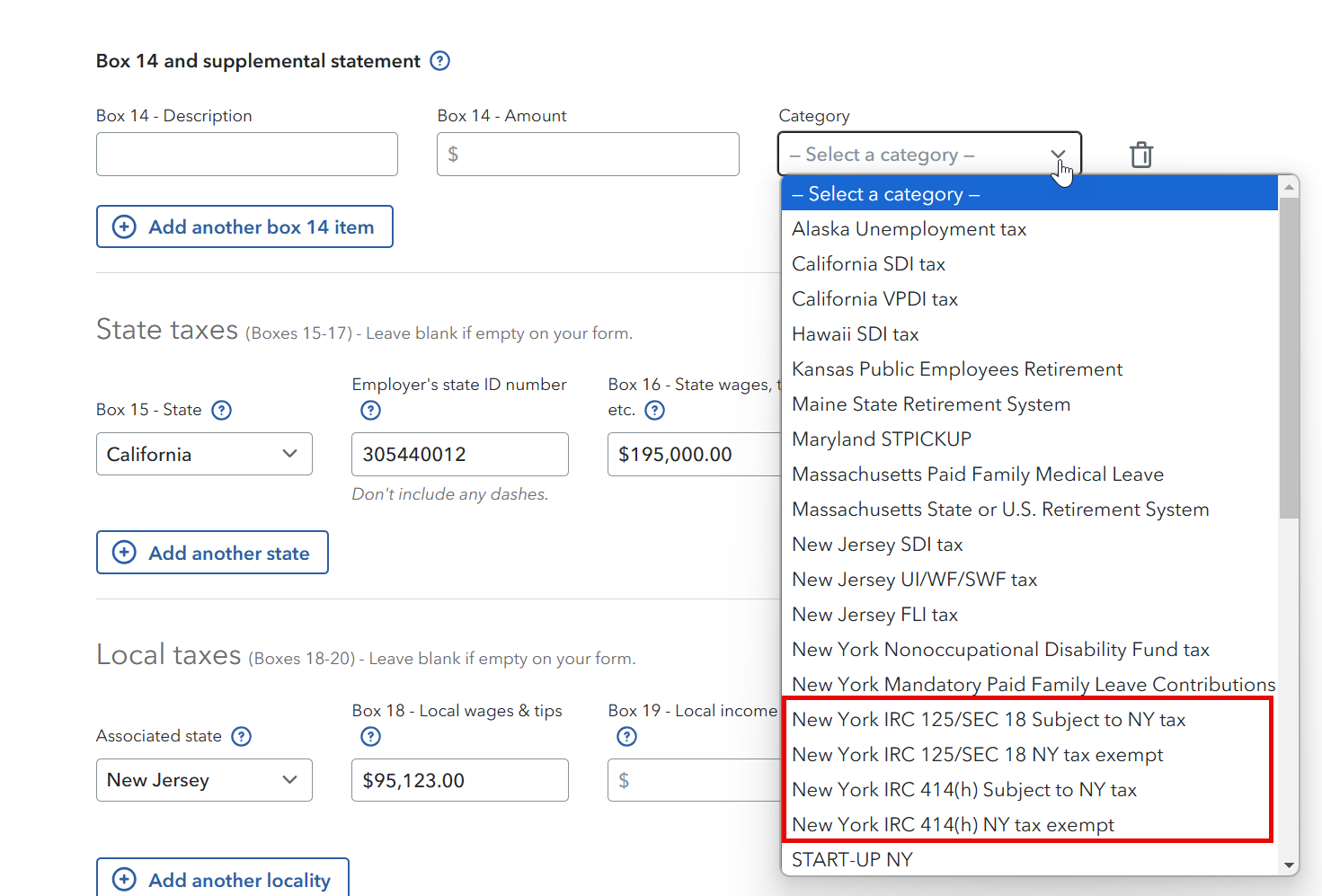

For the W2 entry, you must indicate in the drop down for Box 14 the correct category. TurboTax will then be able to carry the information to the New York Modification section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public employee 414(h) and IRC125 Question for NY

Where is the IRC 132 Tax Exempt in the drop down?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Public employee 414(h) and IRC125 Question for NY

You can choose Other (not classified) for Section 132 benefits. These benefits are not subject to NYS tax and therefore don't need to be added back to your return like some 414(h) and 125 benefits. They should already be taken out of your federal (box 1) and state (box 16) wages on your W-2.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

test5831

Returning Member

user17553787901

Level 2

hojosverdes64

New Member

Questioner23

Level 1

mudtech61

Level 1