- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Please follow the steps below to change your state reside...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

Please follow the steps below to change your state residency:

- Select the Personal Info tab

- Select the blue Edit next in the same row as your name

- Scroll down to question 2. Tell us the state(s) you lived in

- Select the correct State

- Continue through the program

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

Well, that does not work. I have California in the "Personal Info"

It shows "State of Residence" : California

The UI to input the county in California tax return does not show up. So the Principal Residence of CA 540 is blank. There is no way to update the "county" and also click the check on "If your address above is the same as your principal/physical residence address at the time of filing, check this box "

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

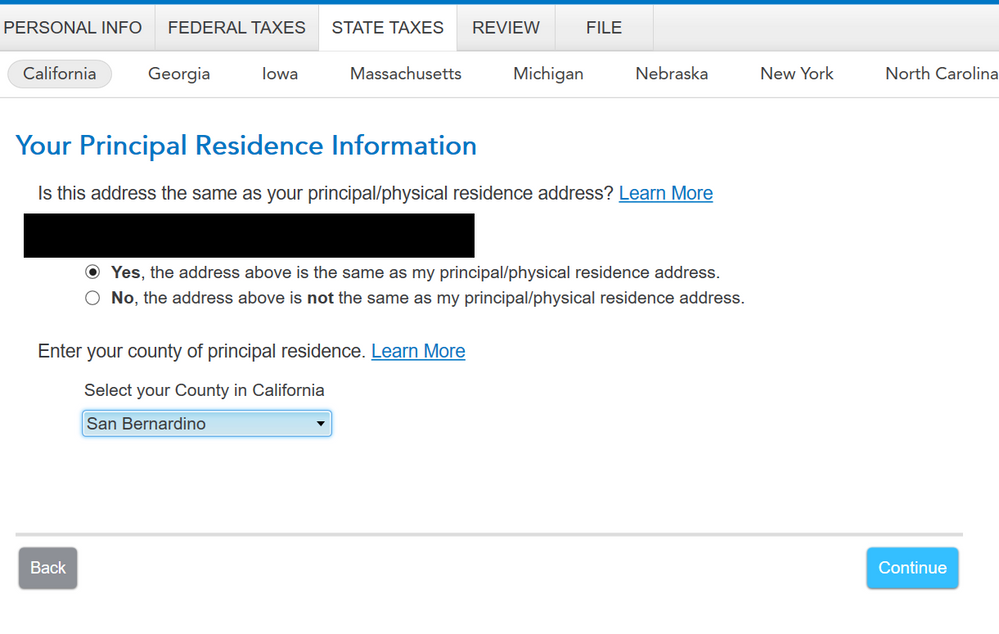

You have to pick your California county on the screen titled Your Principal Residence Information. This screen will appear under General info in your California return. Use the drop-down menu to pick your county.

I have attached a screenshot below for additional guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

As I said in the previous message, this "screenshot" does not show up in the "work through" in CA tax return.

I did see this "screenshot" for my other CA tax returns.

Note: This return is for my daughter as student (age < 18) and someone else can claim her as dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

The CA return will not ask if it thinks you were a non-resident. I know you have CA marked in the federal section so something is missing between the two.

For stuck information follow these steps:

- Delete the CA return, see How to Delete

- Log out of your return and try one or more of the following:

- Sign in using a different browser.

- Sign in using a different device.

- Log back into your return.

- Enter the CA again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

I use Turbo Tax Download App on Mac.

So the step 2 ...?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

I do it again from scratch.

The result is same, and the principal residence of CA 540 is blank.

The page of asking to input county and "

If your address above is the same as your principal/physical residence address at the time of filing, check this box" check box does not show up in the CA turbo tax UI.

You can try it by

1 create a Fed tax return with age < 18, student and "

If someone can claim you (or your spouse/RDP) as a dependent, check the box" checked the box (yes).

2. input a W2 form

3. No any other income and deduction

4 Finish Fed Error check

5. Then start the CA tax return and go over "General Info".

(Then you could see the UI page for county input does not show up at all)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

On a MAC, you can go to the FORMS mode and see what is being done. You can fill in some things without having to override them. Overriding a value is bad because that voids the accuracy guarantee. However, adding the county should no be an override. If something does need to be overridden, you can usually go back to Step by Step and let the program pick up and understand what you are trying to do. Then, go back to forms mode and cancel the override.

So go to Forms view and look through your return. Enter the county if needed. If it requires an override, you should click on the field, then click edit up in the menu bar, select override from the choices.

To get help with forms, you can click on whichever form you would like help, then click the Help Center button on the top right of the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

Well, Turbo Tax does not allow me to overwrite the county field. I select the county but it does nothing at all. Same as that check box. You can click/select the check box. It shows "X" and then disappear right away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

The form is "California Information Worksheet". And I cannot "overwrite" the county name.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

If you're using TurboTax Online, try closing the program, clearing your Cache and Cookies, then revisit your California state return.

Once you choose your county from the dropdown list, it should stick. Make sure you didn't choose 'Non-Resident' as your status, in which case you can't choose a County of Residence.

Since we can't see your return in this forum, if this doesn't resolve your issue, you can Contact TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can i change the state residency

Please see the above message thread. I use TurboTax installed App on mac.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Afful

New Member

tmatras

New Member

fpho16

New Member

23crazyagnes

New Member

fivegrandsons

New Member