- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NYC Employee Retirement System pension is not reflected as tax exempt on the NYS/NYC return.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYC Employee Retirement System pension is not reflected as tax exempt on the NYS/NYC return.

Thank you Dave!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYC Employee Retirement System pension is not reflected as tax exempt on the NYS/NYC return.

I wish that TurboTax would include the New York City Employees Retirement System in their list of qualifying NYS tax-exempt Pension plans! It isn't listed anywhere and it should be! Every year I go through the same thing of having to figure out which box to check! Infuriating!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYC Employee Retirement System pension is not reflected as tax exempt on the NYS/NYC return.

Thank you for this detailed instruction. Unfortunately, it did not work for me. I have the same issue as everyone else in this thread and the TurboTax software product I am using needs to be fixed. There is no category for the NYS and Local (Police and Fire) (Employees) Retirement System. The fixes don't work and I have spent hours trying to track this down.

Help!!!

Brian

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYC Employee Retirement System pension is not reflected as tax exempt on the NYS/NYC return.

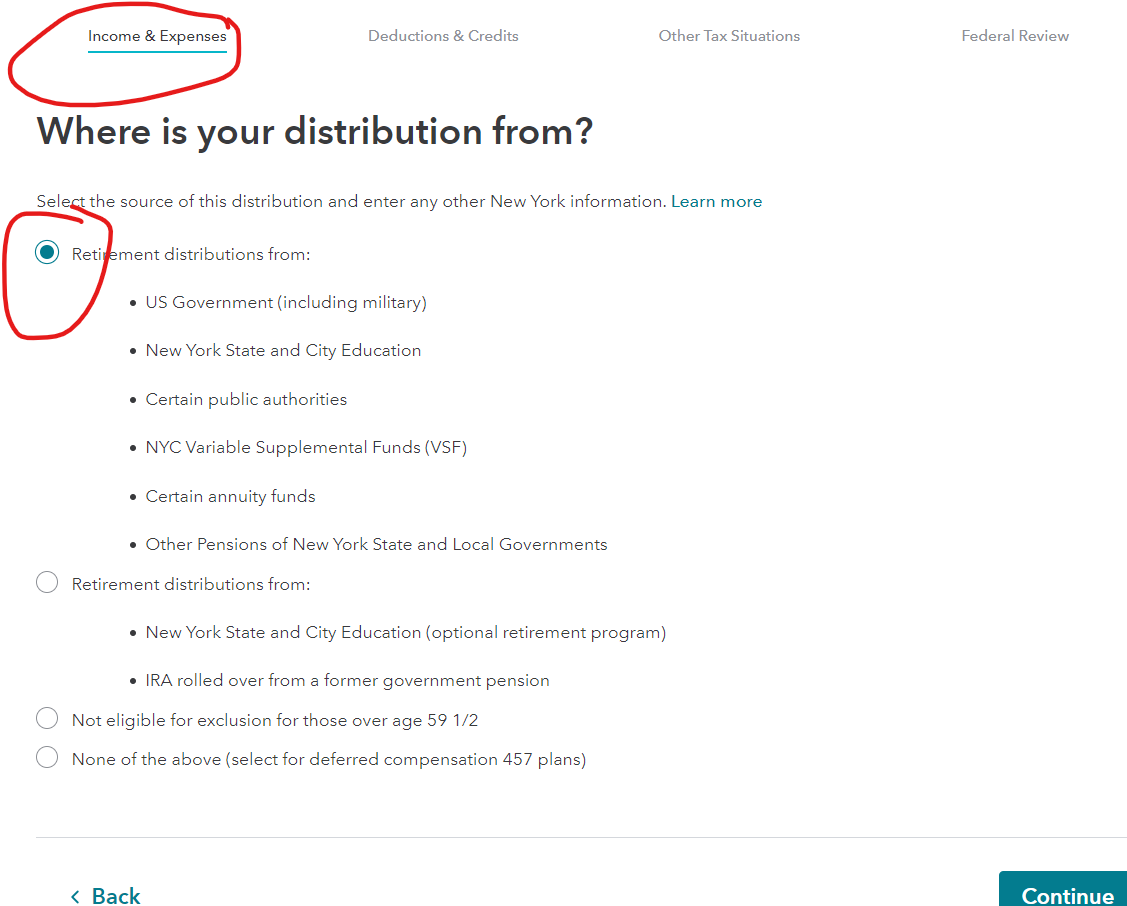

To make it exempt from NYS taxation, when you enter your 1099-R form, let TurboTax know that it is a retirement distribution from NYS or NYC education or other pensions of NYS or local governments. Here is a screenshot when you enter your 1099-R:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NYC Employee Retirement System pension is not reflected as tax exempt on the NYS/NYC return.

Thank you for weighing in. You are correct - I did that and things came together nicely. My problem was that the "examples" given for the "Other pensions of NYS..." didn't match what I was used to seeing in this section.

Thanks again.

Brian

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

michelleroett

New Member

lanyah88

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Waylon182

New Member

alice-danclar

New Member

Lstewart3718

New Member