- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NY tax on federal retirment TSP rollover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY tax on federal retirment TSP rollover

Turbotax deducts my federal TSP rollover withdrawals from my New York taxable income, but New York is billing me for annuity withdrawals ovef $20,000. Who is wrong--TurboTax or NY state?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY tax on federal retirment TSP rollover

Turbotax deducts my federal TSP rollover withdrawals from my New York taxable income, but New York is billing me for annuity withdrawals over $20,000. Who is wrong--TurboTax or NY state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY tax on federal retirment TSP rollover

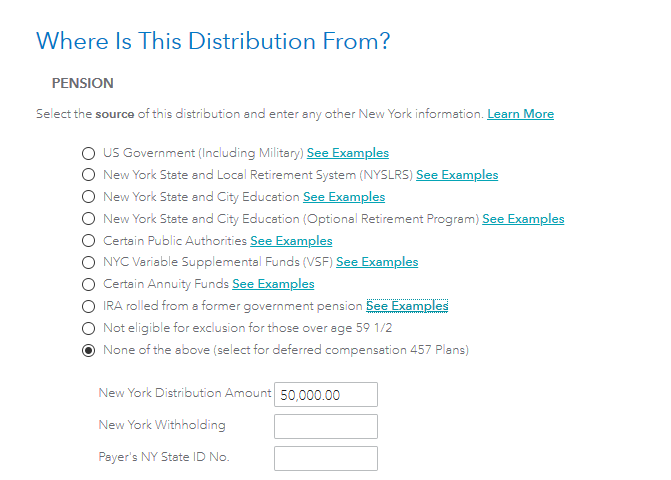

It depends. The TSP as a federal government pension, is excludible from your New York state income. If you indicated in TurboTax that your distribution was an IRA rolled over from a former government pension but the rollover account also had non TSP contributions, you would have been limited to the $20,000 deduction. If the entire distribution was TSP rollover, you must send the New York proof of the rollover from TSP funds.

Also, did you indicate in TurboTax that is was a qualified plan?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tomodwyer2005

New Member

Slowhand

New Member

pdon-musicfan

New Member

s-jturb0

Level 2

Minalde

New Member