- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

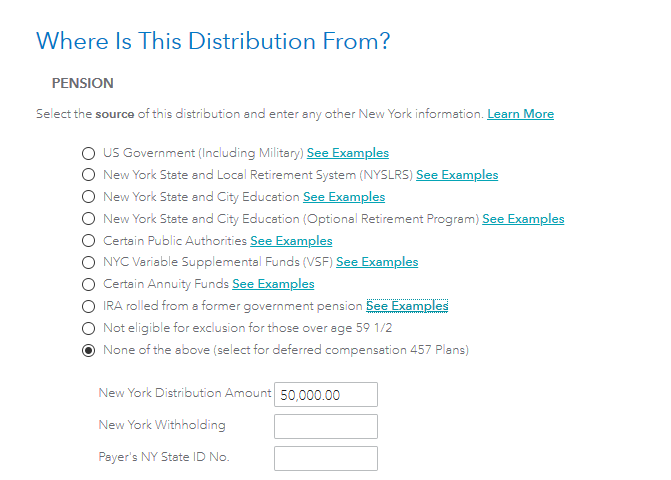

It depends. The TSP as a federal government pension, is excludible from your New York state income. If you indicated in TurboTax that your distribution was an IRA rolled over from a former government pension but the rollover account also had non TSP contributions, you would have been limited to the $20,000 deduction. If the entire distribution was TSP rollover, you must send the New York proof of the rollover from TSP funds.

Also, did you indicate in TurboTax that is was a qualified plan?

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 28, 2020

3:53 PM