- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

Yes, that is correct. However, there appears to be an error that has been populating for this contribution add back for those that file IT-360.1.

I will take a look at your token today.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

I looked over your return with the token provided. I was able to clear the message with the following steps:

- Opened the New York return.

- Noted that the issue was the qualified dividends ($95) and the 199a dividends ($5) that was inputted from your 1099-DIV was not flowing correctly to an IT-225 form. This was creating an error because the $100 was on your IT-360.1 and your state adjusted gross income was not calculating due to these state additions.

- Per NYS IT-201 Instructions (page 17), these items (which were not in your federal adjusted gross income), should be added back to your return as a NY addition.

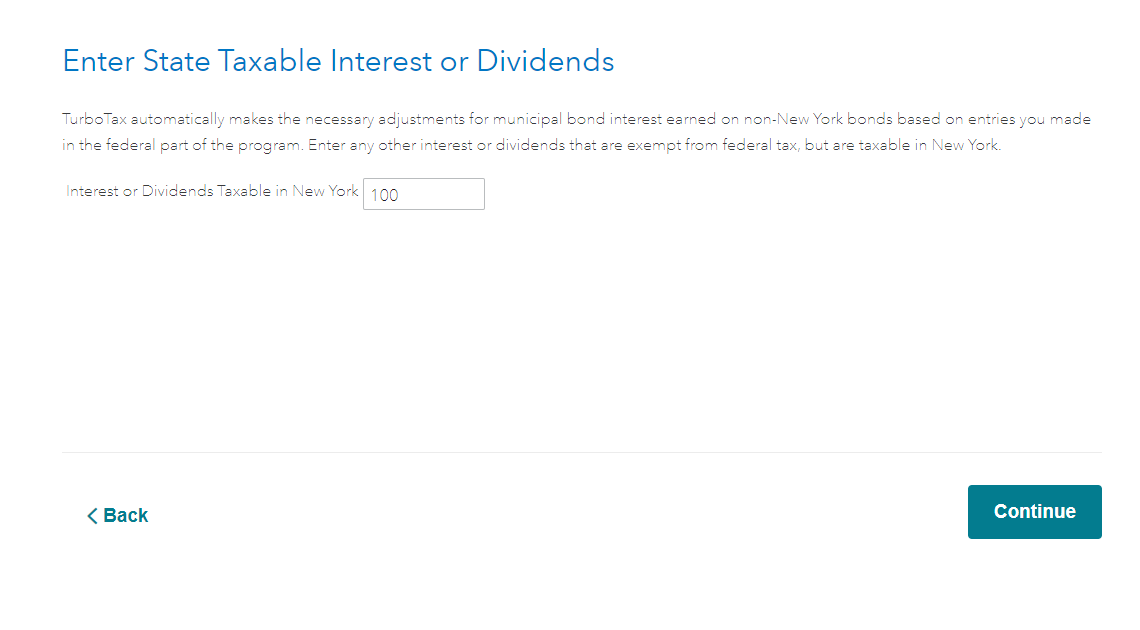

- On the page titled Changes to Federal Income, click Start next to NY taxable federally tax-exempt US obligations (under the section Investment Adjustments). Enter 100.

- Continue through the state interview.

- On the page Allocate New York State Adjustments, enter 100 as your total NY adjustments and 55 for NYC (55% allocation used).

- Your error should be cleared.

Please comment below and provide another token with the updates if this does not clear your error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

This didn’t work - I’m still getting the same error message unfortunately.

My token is 805201

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

I am having the same issue on line 17 of form IT-360. It says the total should add up to $0 but will not let me type into the form to change this error. Token is 822914. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

Same. It appears to be a glitch in the system? FYI-I am using Safari on a Mac to access Turbo Tax. The IT-360.1 TP keeps telling me to change the amounts in Column A of the Line 18a - IT-558 (because) they do not agree with the total transferred from the income Allocation Worksheet to Line 18a Column A. Above line should total ______. I go to type (blank amount) and click continue and it brings me to this "IT-360.1 TP -- Change of City Resident Status Stmt - TP: Total Fed Adj, Federal -- The amounts entered in Column A of the Line 17 - Federal Adjustments to Income Worksheet do not agree with the total transferred from the Income Allocation Worksheet to Line 17 Column A. Above line(s) should total $0"

which I change, click continue and random numbers populate both these entries OTHER than what I had been told to type. I've done this 10 times and can't bypass the glitch. When will it be fixed? NYS as a independent contractor/LLC requires that I e-File and not mail. If I mail I get penalized for your glitch? Please help.

My token is: 840271

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

How do I even go back to the "Allocate Federal Adjustments to Income" page or "Taxable HSA Distribution" page? I have literally tried every single links and never been prompted again for those pages

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

I am also experiencing the same issues with the form, but none of the fixes seem to be working.

Token: 860899

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY IT-360.1 TP column A of line 17 Federal adjustments to income worksheet not agree to total transferred from income alloc worksheet line 17 col A lines should total $0

Token Number 874005

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

atn888

Level 2

johnba1

New Member

MICKEY79

Level 3

MS461

Returning Member

leviton11

Level 3