- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

I looked over your return with the token provided. I was able to clear the message with the following steps:

- Opened the New York return.

- Noted that the issue was the qualified dividends ($95) and the 199a dividends ($5) that was inputted from your 1099-DIV was not flowing correctly to an IT-225 form. This was creating an error because the $100 was on your IT-360.1 and your state adjusted gross income was not calculating due to these state additions.

- Per NYS IT-201 Instructions (page 17), these items (which were not in your federal adjusted gross income), should be added back to your return as a NY addition.

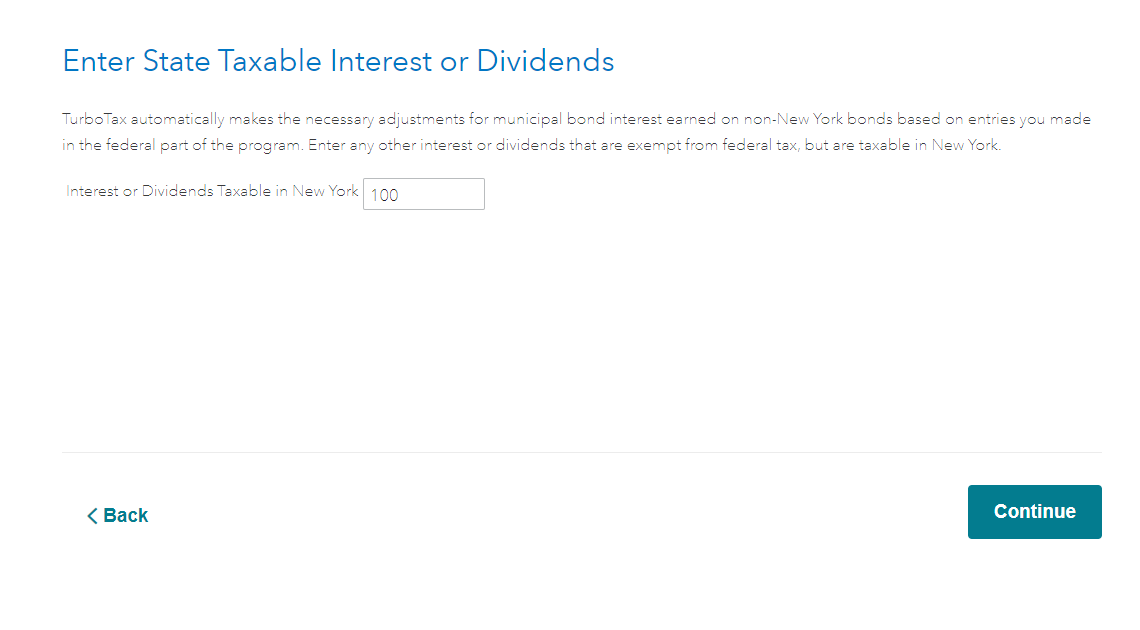

- On the page titled Changes to Federal Income, click Start next to NY taxable federally tax-exempt US obligations (under the section Investment Adjustments). Enter 100.

- Continue through the state interview.

- On the page Allocate New York State Adjustments, enter 100 as your total NY adjustments and 55 for NYC (55% allocation used).

- Your error should be cleared.

Please comment below and provide another token with the updates if this does not clear your error.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 29, 2021

2:24 PM