- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Non Resident PA return PA Schedule NRK-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non Resident PA return PA Schedule NRK-1

When I post the income for the estate/trust amount, Turbo Tax calculates an amount of tax due. When I post the amount of PA tax withheld no adjustments are made to the amount due or refund.

However, if I change the amount of income, the amount due or refund is recalculated. It appears as though the amount of PA tax withheld in not being considered. Please help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non Resident PA return PA Schedule NRK-1

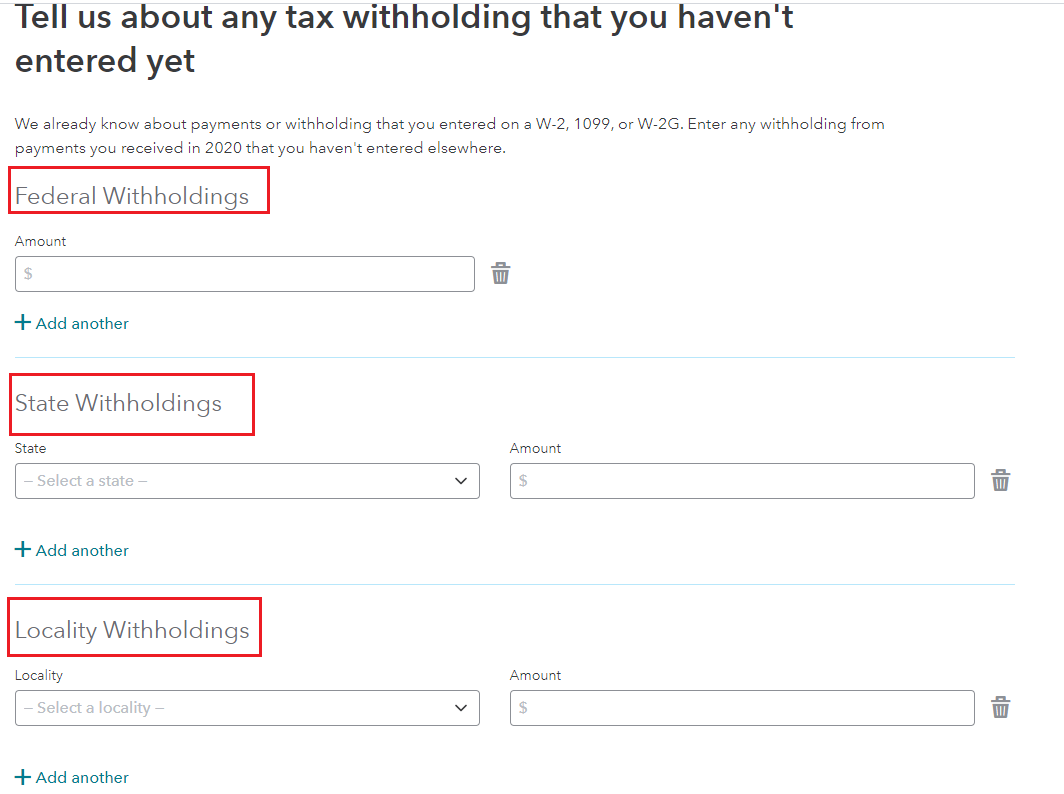

Your nonresident Pennsylvania (PA) return should recognize the state tax withheld from the trust income. Let's make sure you have it entered in the right location for TurboTax to recognize it.

If you do have withholdings on a form where there doesn't seem to be an entry for those withholdings then you can enter them by using the steps below.

- Deductions and Credits > Estimates and Other Taxes Paid > Other Income Taxes Paid in 2020 > Income Taxes Paid

- Scroll to Other Income Taxes Paid in 2020 > Withholding not already entered on a W-2 or 1099 Revisit/Update

- Select your state from the drop down under State withholding > enter the amount

- See the image below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non Resident PA return PA Schedule NRK-1

Thank you. Your reply was easy to follow, corrected the issue, and allowed the PA taxes withheld to be used in the calculation for the PA refund or amount due. Again, thanks for the quick response.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girishapte

Level 3

stevenp1113

New Member

ttla97-gmai-com

New Member

douglasjia

Level 3

johntheretiree

Level 2