- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Your nonresident Pennsylvania (PA) return should recognize the state tax withheld from the trust income. Let's make sure you have it entered in the right location for TurboTax to recognize it.

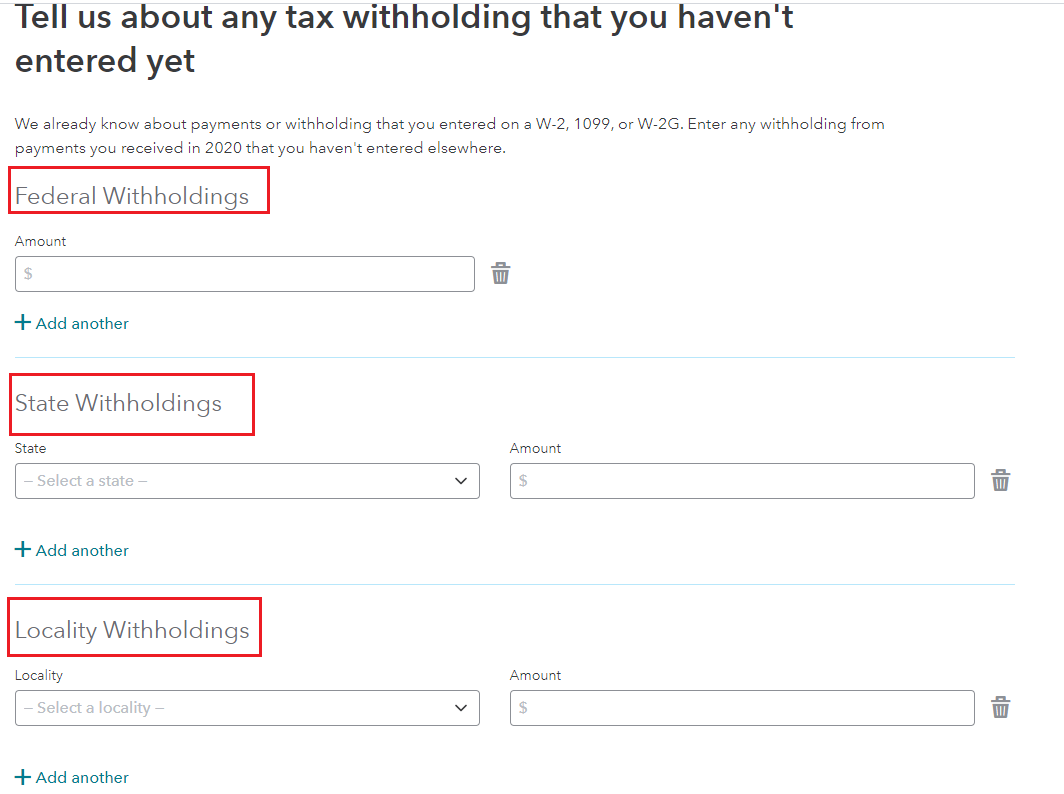

If you do have withholdings on a form where there doesn't seem to be an entry for those withholdings then you can enter them by using the steps below.

- Deductions and Credits > Estimates and Other Taxes Paid > Other Income Taxes Paid in 2020 > Income Taxes Paid

- Scroll to Other Income Taxes Paid in 2020 > Withholding not already entered on a W-2 or 1099 Revisit/Update

- Select your state from the drop down under State withholding > enter the amount

- See the image below for assistance.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 7, 2021

7:38 AM