- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NJ1040 for part year resident

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ1040 for part year resident

Hello Community experts,

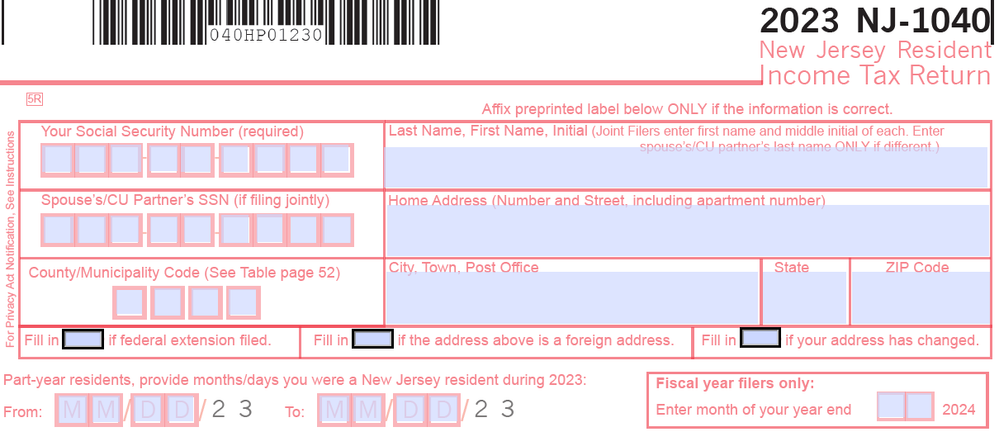

We lived in three states in the previous tax year. However, my work state and residence state were always the same at anytime. New Jersey was my second state that year. So, I am filling NJ-1040 as part year resident this year. I am filling it as "Married filling jointly". I have following questions about it. It will be helpful if you could respond to them point wise:

- Please refer to the screenshot below. What would I fill my address there? I assume my current address which is not a New Jersey address. Right?

- If your answer to the above is "Yes, it will be my current non New Jersey address.", then what will I fill in the field "County/Municipality Code" box (toward middle right corner of the screenshot)?

- This form doesn't have boxes to provide bank account details. If I am filling a paper return can I not get my refund electronically?

- The form requires both, me and my spouse, to sign as we are filling jointly. However, my spouse is currently traveling outside the US and may not return until before April 15th. Can this be a reason to file for extension? We do not owe taxes and would get a refund.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ1040 for part year resident

1. Enter your current address. Enter the county/municipality code for the last place that you lived in New Jersey.

2. If you file a paper New Jersey tax return you cannot get your refund by direct deposit.

3. You should file an extension, and file your tax return when your spouse is available to sign it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ1040 for part year resident

Thanks, a lot @rjs for the responses.

I have following followup questions about filing extension for NJ. I prepared my return and I am going to get a refund.

- So do I still need to file the form NJ-630 (form for extension request: https://www.nj.gov/treasury/taxation/pdf/current/630.pdf).

- If the answer to the above is yes can I do that online? Given that I am a first time filer in NJ and I was a part-year resident only.

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ1040 for part year resident

Technically you should file an extension, but since you do not owe any NJ tax there is no need to do so. If you file a federal extension you do not need to file a NJ extension. There does not seem to be any way to file a NJ extension online unless you are making a payment with the extension. That indicates that they really do not expect you to file an extension if you don't owe any tax. The bottom line is that you do not have to file a NJ extension.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kabh1201

New Member

Katie1996

Level 2

jackkgan

Level 5

IndependentContractor

New Member

Danielvaneker93

New Member