- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ1040 for part year resident

Hello Community experts,

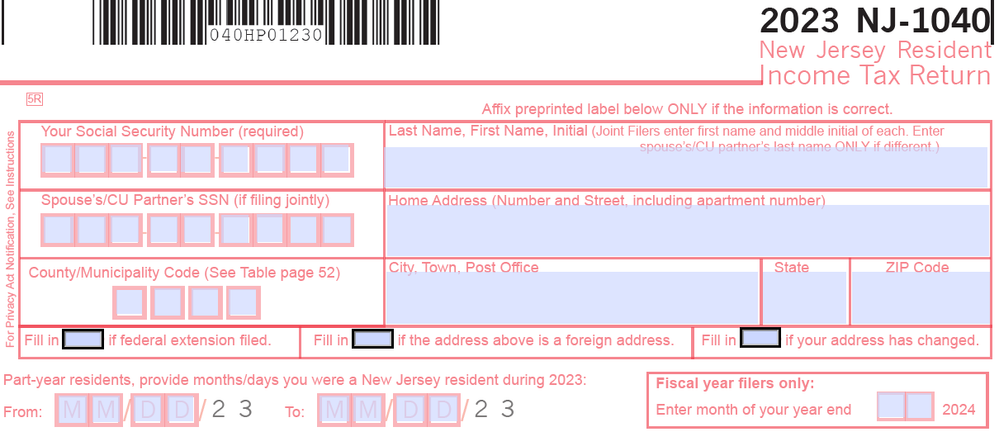

We lived in three states in the previous tax year. However, my work state and residence state were always the same at anytime. New Jersey was my second state that year. So, I am filling NJ-1040 as part year resident this year. I am filling it as "Married filling jointly". I have following questions about it. It will be helpful if you could respond to them point wise:

- Please refer to the screenshot below. What would I fill my address there? I assume my current address which is not a New Jersey address. Right?

- If your answer to the above is "Yes, it will be my current non New Jersey address.", then what will I fill in the field "County/Municipality Code" box (toward middle right corner of the screenshot)?

- This form doesn't have boxes to provide bank account details. If I am filling a paper return can I not get my refund electronically?

- The form requires both, me and my spouse, to sign as we are filling jointly. However, my spouse is currently traveling outside the US and may not return until before April 15th. Can this be a reason to file for extension? We do not owe taxes and would get a refund.

Topics:

February 24, 2024

9:23 PM