- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- NJ State tax income calculation error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State tax income calculation error

I found an error when the software calculate state income.

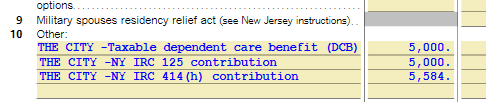

On my W-2, there is $5,000 in box 10 (Dependent Care Benefit), and Item 14 also report this $5,000 benefit.

I live in NJ, and work in NYC. The problem is that when the software to calculate the NJ state income, it added the $5,000 twice. (see the picture below). The first line is the amount in Box 10, and the second line is the amount reported in Box 14. These two are actually same thing. They shall not be added twice. Should I just remove this from Box 14?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State tax income calculation error

I double checked my NY State income calculation, and it is correct.

I think someone need to correct that NJ state module........

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NJ State tax income calculation error

The problem isn't TurboTax, the problem is the W-2.

New Jersey does not permit the deduction of a number of pre-tax items that are allowed on the federal return. Therefore, these items are added back to the NJ return.

However, if there is an entry in box 10, there is no need to have the same entry on box 14 (I don't know what your employer was thinking).

Box 14 is usually used for items that the employer wants the employee to be aware of, but for the most part have no effect on the return, but a few do.

When you entered the W-2 on box 14, what category did you choose for the box 14 entry, "NY Sec 125"? Try changing it to Other and see if that changes the NJ return so that there is only one $5,000 addback. And you should let your employer know that TurboTax (and likely other tax software products) keys off of some box 14 entries, so they don't need to duplicate the box 10 entry in box 14.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dddandddd

New Member

dmcrory

New Member

IDK68

New Member

Rejected Federal

Returning Member

ahulani989

New Member