- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- New York State - Question about how to handle W2 Box 20 with "1127" displayed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State - Question about how to handle W2 Box 20 with "1127" displayed

Hello,

On my W2, I have a box 19 (local income tax) amount listed and "1127" listed in box 20 (locality name).

I entered "1127" in box 20 in Turbotax.

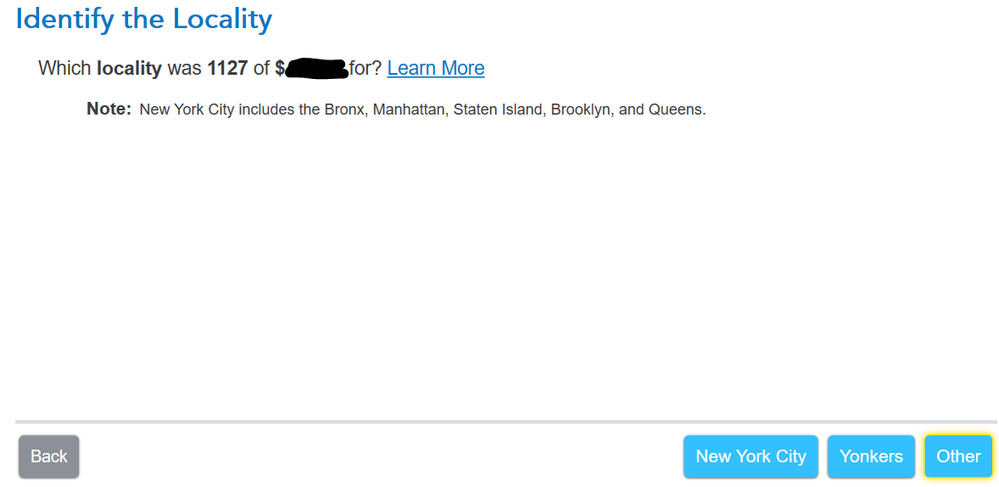

Since my income was taxed in NYC, I chose "New York City" as the locality in this part of the interview:

The amount is added to my total NYS payments on line 63 of IT-203, which increases my refund.

I work for the NYC government (NYC Hospitals Corp.) within the city. However, I live in Connecticut. Did I input this correctly?

I am asking this because NY state sent me a letter stating that the W2 amounts I entered for their taxes do not agree with what was reported to them. They need a copy of my W2.

Did I make a mistake, or did my employer?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State - Question about how to handle W2 Box 20 with "1127" displayed

It depends. By referencing your W-2 and your 2019 Form IT-203, you will better be able to tell if you over-reported tax paid.

I recommend checking what was reported by using the instructions beginning on page 30 of 2019 New York Form IT-203 Nonresident and Part-Year Resident Income Tax Return

2019 NYC Form 1127 Instructions

If your employer does not have your IT-2104 for 2020, click this link: IT-2104 Employee's Withholding Allowance Certificate

Thank you for working in NYC hospitals, especially now.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lukas1994

Level 2

Lukas1994

Level 2

matto1

Level 2

shanesnh

Level 3

Th3turb0man

Level 1