- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New York State - Question about how to handle W2 Box 20 with "1127" displayed

Hello,

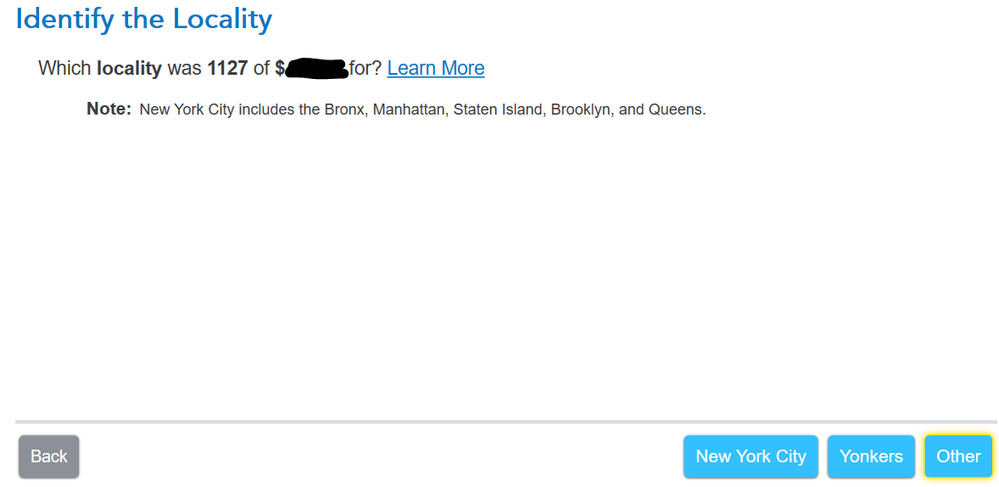

On my W2, I have a box 19 (local income tax) amount listed and "1127" listed in box 20 (locality name).

I entered "1127" in box 20 in Turbotax.

Since my income was taxed in NYC, I chose "New York City" as the locality in this part of the interview:

The amount is added to my total NYS payments on line 63 of IT-203, which increases my refund.

I work for the NYC government (NYC Hospitals Corp.) within the city. However, I live in Connecticut. Did I input this correctly?

I am asking this because NY state sent me a letter stating that the W2 amounts I entered for their taxes do not agree with what was reported to them. They need a copy of my W2.

Did I make a mistake, or did my employer?

April 5, 2020

1:56 PM