- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Moved from MA to CO in July, but employer didn't update state of residence (and state taxes) until October

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved from MA to CO in July, but employer didn't update state of residence (and state taxes) until October

I moved from MA to CO (and became a CO resident) on July 1, 2024. However, my state of residence wasn't updated in Workday and ADP until October, so my July-September earnings were incorrectly taxed MA taxes, when they should have been subject to CO taxes. I asked my employer to issue me a corrected W-2 (W-2c) statement, but I was told it's not possible since earnings and taxes withheld are determined and reported by my state of residence in Workday. They won't retroactively update my earnings and taxes withheld for July-September.

I know I should file a MA Part-Year Resident tax return for January 1, 2024 - June 30, 2024 and a CO Part-Year Resident tax return for July 1, 2024-December 31, 2024. Then, based on what I've read online, such as https://ttlc.intuit.com/turbotax-support/en-us/help-article/printers-printing/file-nonresi[product k... and https://ttlc.intuit.com/community/after-you-file/discussion/my-employer-paid-income-tax-to-a-state-i..., I should also file a MA Non-Resident tax return (first) for July 1, 2024 - September 30, 2024 to receive a refund for the taxes that were incorrectly withheld by MA, when I was in fact a CO resident. The instructions state, "If preparing a nonresident return solely to recover erroneous tax withholdings, enter 0 on the screen that asks for the amount of income earned in that state. This will eliminate your tax liability for that state, resulting in a full refund."

Can someone please clarify, "enter 0 on the screen that asks for the amount of income earned in that state."? Does this mean I should specify $0 of earnings for the non-resident state (MA) for July 1, 2024 - September 30, 2024? On this page in the "Complete Schedule R/NR" section (see screenshot), I tried entering $0 for all rows in the "Massachusetts Income While Nonresident" column, but I was later told that the Schedule R/NR isn't necessary since I'm reporting $0 nonresident income, and my only option to proceed is to remove the Schedule R/NR. After removing the Schedule R/NR and getting to the Summary page, my total income indicated as being taxable by MA was way too high.

Also, there's a page in my MA tax return, titled, "Pay Tax to Another State?", which asks if I paid tax to MA and another state. Should I answer yes to this since I will have paid tax to CO for July-September too once I submit a CO Part-Year State Tax Return, or should I answer no since I wasn't double-taxed at the time (when my earnings were taxed MA taxes, but should have been taxed CO taxes)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved from MA to CO in July, but employer didn't update state of residence (and state taxes) until October

You would only file two state returns: a Part-Year return for MA and a Part-Year return for CO. You never actually earned income in MA while you were a non-resident; that was only an allocation error on the part of your employer.

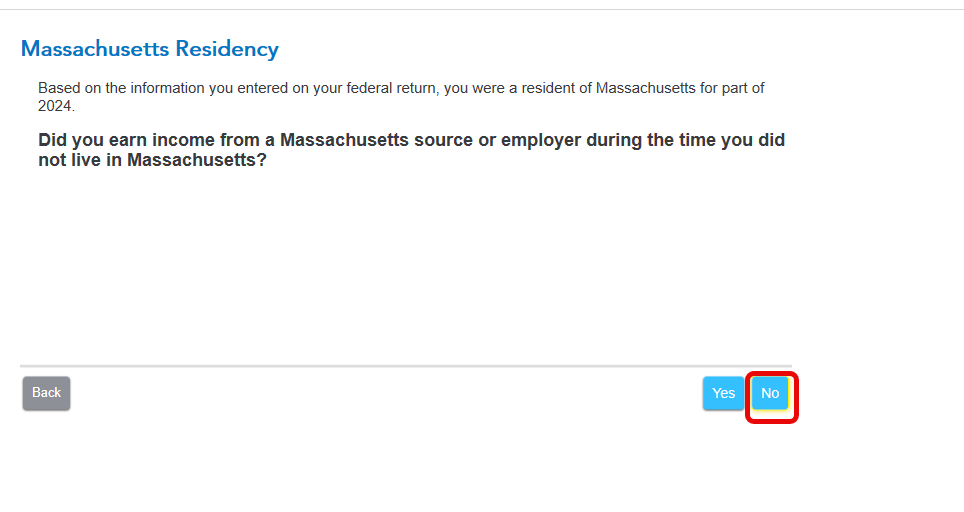

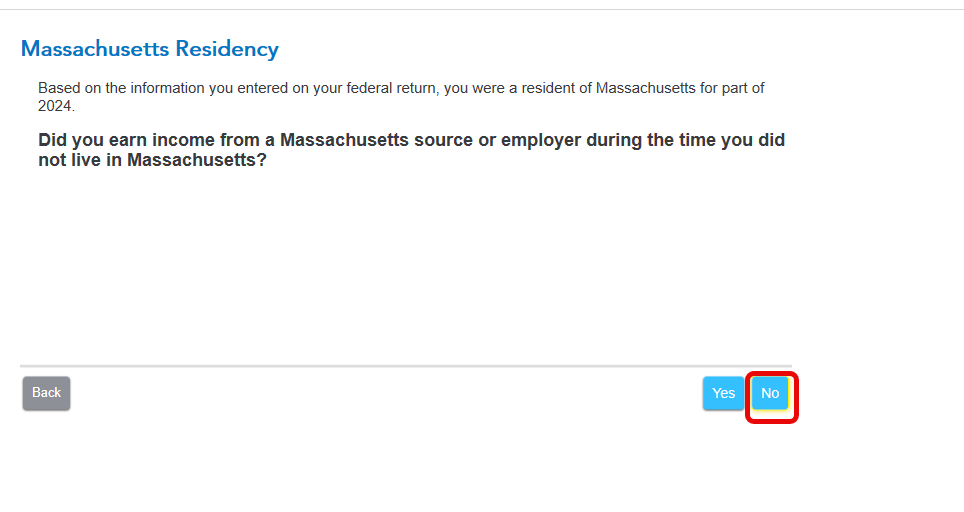

First prepare your MA return, and in the interview you will see a screen Massachusetts Residency and the question: Did you earn income from a Massachusetts source or employer during the time you did not live in Massachusetts? Answer No.

Continue through the interview, and you will arrive at How Massachusetts Handles Income for Part-Year Residents. For each income type, you will be given a chance to enter the amount earned while living in MA. You'll see the total wages earned in all states, and continue to Non-Massachusetts Portion of Income, where you can enter the correct amount of income earned once you moved to CO.

You should answer No to the question in the MA return about paying tax to another state, because as you surmised, you weren't double-taxed on this income, and you won't be when you file both returns.

Next, prepare your Colorado return. You'll proceed through the interview, and reach a page Colorado Portion of Wages. On that screen, adjust the amount from when you lived in CO to the correct amount.

When you've finished both returns, you will probably get a refund from MA and owe tax to CO, which represents that there was too much withholding for MA and not enough for CO.

These are the screenshots for MA:

And this is what it looks like for CO:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved from MA to CO in July, but employer didn't update state of residence (and state taxes) until October

You would only file two state returns: a Part-Year return for MA and a Part-Year return for CO. You never actually earned income in MA while you were a non-resident; that was only an allocation error on the part of your employer.

First prepare your MA return, and in the interview you will see a screen Massachusetts Residency and the question: Did you earn income from a Massachusetts source or employer during the time you did not live in Massachusetts? Answer No.

Continue through the interview, and you will arrive at How Massachusetts Handles Income for Part-Year Residents. For each income type, you will be given a chance to enter the amount earned while living in MA. You'll see the total wages earned in all states, and continue to Non-Massachusetts Portion of Income, where you can enter the correct amount of income earned once you moved to CO.

You should answer No to the question in the MA return about paying tax to another state, because as you surmised, you weren't double-taxed on this income, and you won't be when you file both returns.

Next, prepare your Colorado return. You'll proceed through the interview, and reach a page Colorado Portion of Wages. On that screen, adjust the amount from when you lived in CO to the correct amount.

When you've finished both returns, you will probably get a refund from MA and owe tax to CO, which represents that there was too much withholding for MA and not enough for CO.

These are the screenshots for MA:

And this is what it looks like for CO:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Moved from MA to CO in July, but employer didn't update state of residence (and state taxes) until October

Thanks very much, @IsabellaG! I really appreciate your detailed answer and instructions.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

audreyrosemary11

Level 2

audreyrosemary11

Level 2

audreyrosemary11

Level 2

Bobgolf49r

New Member

lastmintax

New Member