- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

You would only file two state returns: a Part-Year return for MA and a Part-Year return for CO. You never actually earned income in MA while you were a non-resident; that was only an allocation error on the part of your employer.

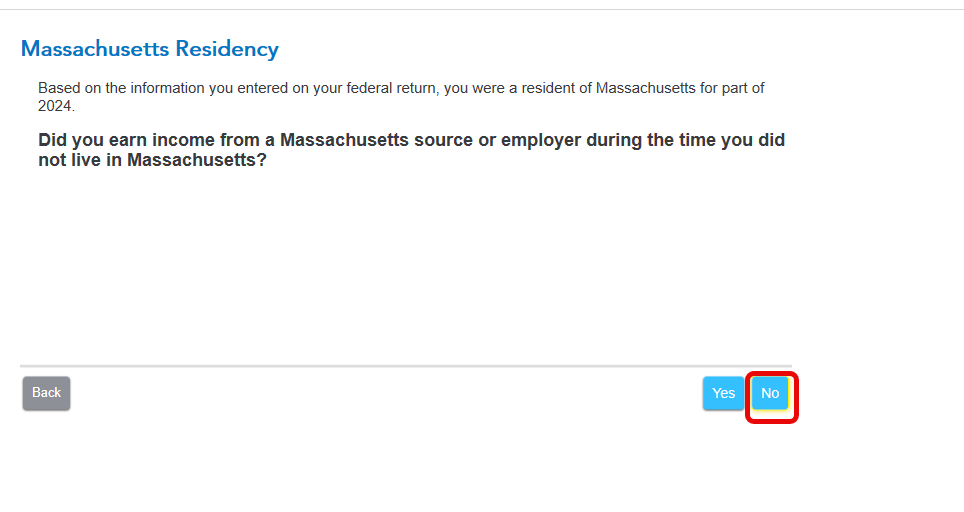

First prepare your MA return, and in the interview you will see a screen Massachusetts Residency and the question: Did you earn income from a Massachusetts source or employer during the time you did not live in Massachusetts? Answer No.

Continue through the interview, and you will arrive at How Massachusetts Handles Income for Part-Year Residents. For each income type, you will be given a chance to enter the amount earned while living in MA. You'll see the total wages earned in all states, and continue to Non-Massachusetts Portion of Income, where you can enter the correct amount of income earned once you moved to CO.

You should answer No to the question in the MA return about paying tax to another state, because as you surmised, you weren't double-taxed on this income, and you won't be when you file both returns.

Next, prepare your Colorado return. You'll proceed through the interview, and reach a page Colorado Portion of Wages. On that screen, adjust the amount from when you lived in CO to the correct amount.

When you've finished both returns, you will probably get a refund from MA and owe tax to CO, which represents that there was too much withholding for MA and not enough for CO.

These are the screenshots for MA:

And this is what it looks like for CO:

**Mark the post that answers your question by clicking on "Mark as Best Answer"