- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Maryland Additional Info for Part-Year Residents

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

I was a part year resident of Maryland last year, establishing residency partway through September coming from a state without Federal Income Tax.

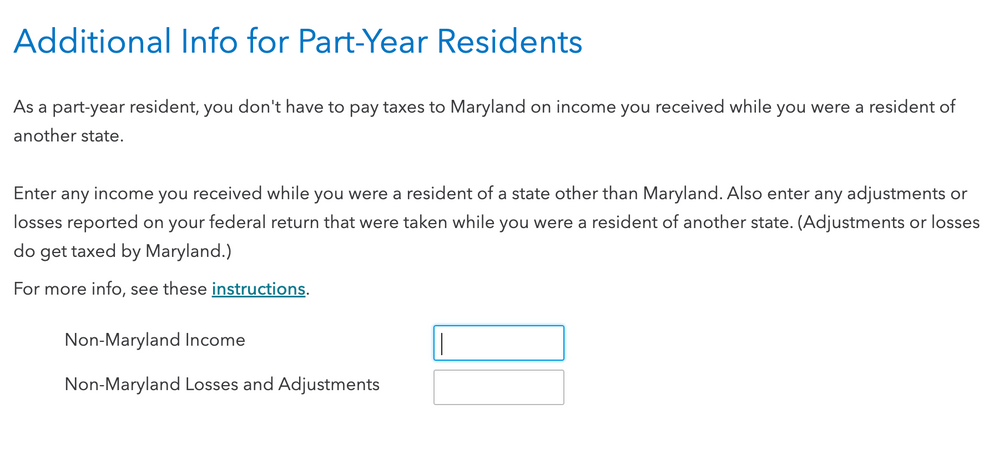

There is a screen with "Additional Info for Part-Year Residents" with 2 fields: "Non-Maryland Income" and "Non-Maryland Losses and Adjustments" - screenshot below. I have two questions:

1.) How can I simply calculate "Non-Maryland Income" ? My W2 has State Wages in Box 16 for Maryland, but not the other state (since no income tax). Do I deduct MD State Wages from Box 1, Box 3, or calculate it some other method? How do I go about including income from other sources such as 1099-INT?

2.) What would be included in Non-Maryland Losses and Adjustments?

Note in the screenshot below, the link to "these instructions" simply directs to https://www.marylandtaxes.gov/ and based on my own reading of the Maryland tax booklet, part time residents have to fill out form 502 - which presumably is what TT is doing on the back-end. Of course if I'm paying TT, I don't want to have to delve into these forms myself - I want a simple answer.

I have not found a satisfactory answer to these questions from the Community boards, and when I spoke on two different occasions with TurboTax support, the support specialists were simply not confident in their answers. I'd like to avoid completing Maryland Form 502 on my own as doing so would negate the entire benefit of having to pay TurboTax to file my taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

As you originally guessed your non-Maryland income is the amount on box 16 - your Maryland income - subtracted from box 1 - your total taxable income.

If you have income from other sources besides your W2 then allocate them by month.

The program isn't calculating it automatically because you only have the one part-year state return. You should be good once you do the calculation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

Based on what you have stated you will need to file a Maryland State Return. Since it is available to you through Turbo Tax that would be the easiest way to do this.

Click here for helpful information about filing your state return when multiple states are involved. It explains the apportionment percentage.

Also, you can click here to contact Turbo Tax for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

Yes, obviously I need to file a Maryland State tax return, that is why I posted this question.

I already called two people from TurboTax's support line. Both were unfamiliar and unable to help me with this question. They seemed to simply be guessing at the answers and could not give me accurate information. If anyone at TurboTax does actually know what they are talking about, please reply to this thread.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

When you enter your W-2 in your Federal Return (with state wage info) TurboTax calculates your Maryland Income for you on the Maryland return. You don't need to enter anything for 'Non-Maryland Income' unless you had other income not reported on a W-2 that was included on your Federal return.

If you had Capital Gains/Loss (or Business Gains/Loss) on your Federal return, divide that amount by 12, then multiply by 9.5 to calculate 'Non-Maryland Losses/Adjustments' for the time you didn't live in Maryland.

Click this link for more details on Allocating Part-Year Resident Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

Hi MarilynG1 - thanks for your response.

I'm not sure TurboTax automatically calculates my non-Maryland income - if I leave this field blank, TurboTax says I owe tens of thousands in unpaid taxes, as though my entire income for the year was taxable for Maryland (it is not).

So while I also would have assumed TurboTax automatically calculates this for me, I am fairly sure I do need to put a number in here. The question is, how do I calculate that number, without wading into Maryland state tax form 502 myself (again, the point of TurboTax is that I don't have to file these forms myself...)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

And to confirm, I had looked at the Allocating Part-Year Resident Income article - that doesn't really answer my question, unfortunately, because it is unclear if this field requires my income BEFORE deductions like 401(k), HSA, etc., or after, or is some other specialized calculation altogether.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

As you originally guessed your non-Maryland income is the amount on box 16 - your Maryland income - subtracted from box 1 - your total taxable income.

If you have income from other sources besides your W2 then allocate them by month.

The program isn't calculating it automatically because you only have the one part-year state return. You should be good once you do the calculation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

Thanks Robert - this is very helpful - can you also advise on how to approach the "Non-Maryland Losses and Adjustments" section? Is there a specific number from my Federal return that I should pro-rate there? I did not have business losses and adjustments, but I did have capital gains/losses from selling stock over the last year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

Losses are the same as gains - either look at the date of each trade and use the amounts for the trades that occurred while you were a Maryland resident or take the net loss and divide it by 12 and then multiply it by the number of months you were a resident.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

Similarly, it is not clear how to calculate the NON-Maryland income. In my W2 (Box 16) both my MD income and DC income (which is from 2/13/22 through the rest of the year). Do I simply use the Income shown for DC in this box?

How about the TT box which is asking for Non-Maryland Losses and Adjustments? Does TT have any instructions? The hyperlink to the Maryland site is for the main page and I cannot find the required information. What losses and adjustments are TT requesting? TT does a great job in general, but this is very poorly done here. I hope we get detailed instructions about this box.

Last but not least, I am planning on filing return for MD and DC, why is TT asking for this information when I am dealing with the first state entries (MD)? Seems like it needs to wait and automatically enter this information after both states entries are complete.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

In answer to your first question, yes, you would apportionate the amount of earned income received from both states, the amount showing on the W2 from MD and the amount showing on the W2 from DC if that was your only earned income. Because you may have additional earned income besides the wages, you would need a precise allocation for all those earned income items. see HERE for information on how that's done.

As far as your second question is concerned, there are various adjustments to income that you may or may not have had on your federal return , that must be added back for Maryland purposes. These are called Non-Maryland income and Adjustments. see HERE pg. 7 number 11

And finally, for your last question see HERE for preparing nonresident returns in Turbotax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

Hey Abraham - curious if TurboTax plans on adding the capability to automate these calculations? It seems like performing them manually depletes the utility of having TurboTax do taxes in the first place and doesn't give confidence in the accuracy of the final filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

Thank you for your response.

Regarding my 1st quest, I need to make sure I am clear. As I stated before my W2 clearly includes both DC income and MD income. You went on telling me that I have to apportionate the amount of earned income.... This got me confused because the earned income for each state is already figured out and included in my W2 as I noted above. Again, all I am asking on this is whether I should include the Non-Maryland earned income here as shown in my W2 form without any adjustments?

My second question related to the Non-Maryland income and Adjustments box in TT. If the 1st box took care of the earned income (i.e., 1st question), then it looks like any adjustments to earned income from other incomes and losses need to be apportioned here. The link you sent me does not clarify this for me. Please confirm.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

The income assigned to DC on your W-2 would be the non-Maryland earned income if all your earned income was from W-2 wages. If you have adjustments to your earned income, you just need to determine for each item of adjustment if you lived outside of Maryland when the item of adjustment occured, and assign that to the non-Maryland column in TurboTax.

{Edited 2/16/23 at 6:19 PM PST}

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

I agree with @nicknack1 and @DaveTash, having to go through this process negates the entire point of having purchased TT. When will TT actually automate this? I had a similar issue with being a part-time resident of DC and MD while having worked in WV the entire year and running into this problem of how to properly allocate. Also, the answer you provided needs to be made clearer instead of simply posting links.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

VJR-M

Level 1

jsefler

New Member

NeedHelpInWI

Level 1

ebohn99

New Member

krinsky

New Member