- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland Additional Info for Part-Year Residents

I was a part year resident of Maryland last year, establishing residency partway through September coming from a state without Federal Income Tax.

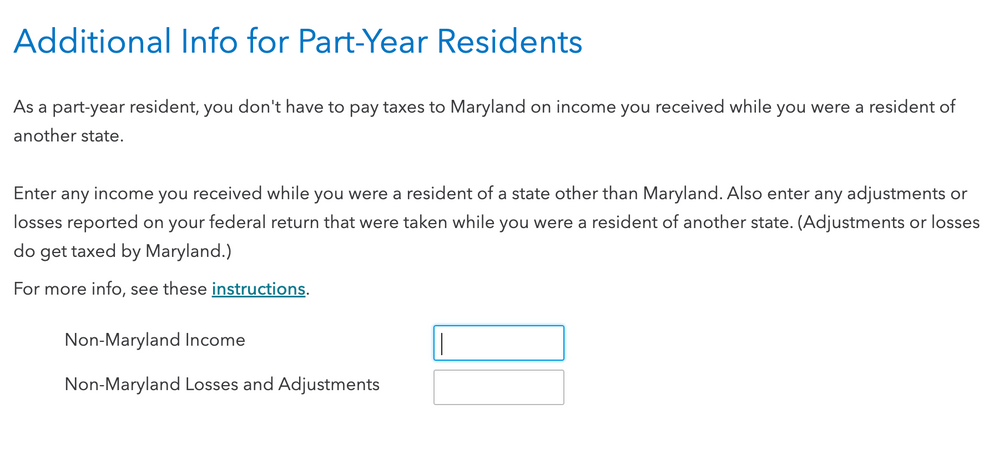

There is a screen with "Additional Info for Part-Year Residents" with 2 fields: "Non-Maryland Income" and "Non-Maryland Losses and Adjustments" - screenshot below. I have two questions:

1.) How can I simply calculate "Non-Maryland Income" ? My W2 has State Wages in Box 16 for Maryland, but not the other state (since no income tax). Do I deduct MD State Wages from Box 1, Box 3, or calculate it some other method? How do I go about including income from other sources such as 1099-INT?

2.) What would be included in Non-Maryland Losses and Adjustments?

Note in the screenshot below, the link to "these instructions" simply directs to https://www.marylandtaxes.gov/ and based on my own reading of the Maryland tax booklet, part time residents have to fill out form 502 - which presumably is what TT is doing on the back-end. Of course if I'm paying TT, I don't want to have to delve into these forms myself - I want a simple answer.

I have not found a satisfactory answer to these questions from the Community boards, and when I spoke on two different occasions with TurboTax support, the support specialists were simply not confident in their answers. I'd like to avoid completing Maryland Form 502 on my own as doing so would negate the entire benefit of having to pay TurboTax to file my taxes.