1. Yes state and local taxes are part of itemized deductions. If you take the standard deduction, they won't help you. The program will take local payments from your w2 or any items you input and move them to Sch A itemized deductions for state and local taxes. The federal has a cap of $10,000 for state and local taxes so yours may not be showing.

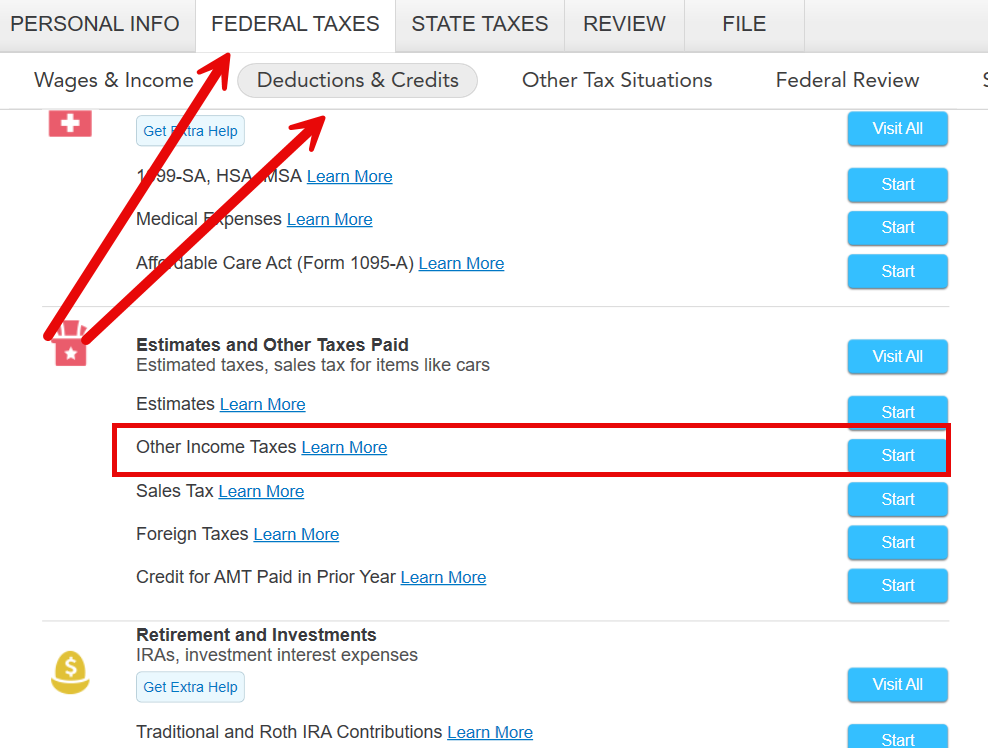

2. Yes, that is the general section. If you made local tax payments not on a form (like w2), you can input them as Other Income Taxes - a subsection of Estimates and Other Taxes Paid. On the next screen, select the appropriate option.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"