- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Living in CT, worked in MA for one month. Tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living in CT, worked in MA for one month. Tax return?

Living in CT full time. Worked in MA only for three weeks in December.

In my W2, state tax was paid for CT.

Do I still need to file MA state tax?

I just did Federal & CT state tax using Turbo Tax Deluxe but I am not sure if I need to purchase MA state tax or not.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living in CT, worked in MA for one month. Tax return?

Yes, file the nonresident MA return. I will leave the instructions below. When you prepare the state returns, prepare the MA nonresident return first.

Once you've determined that you need to file a nonresident state return, the first thing you want to do is make sure you've filled out the Personal Info section correctly:

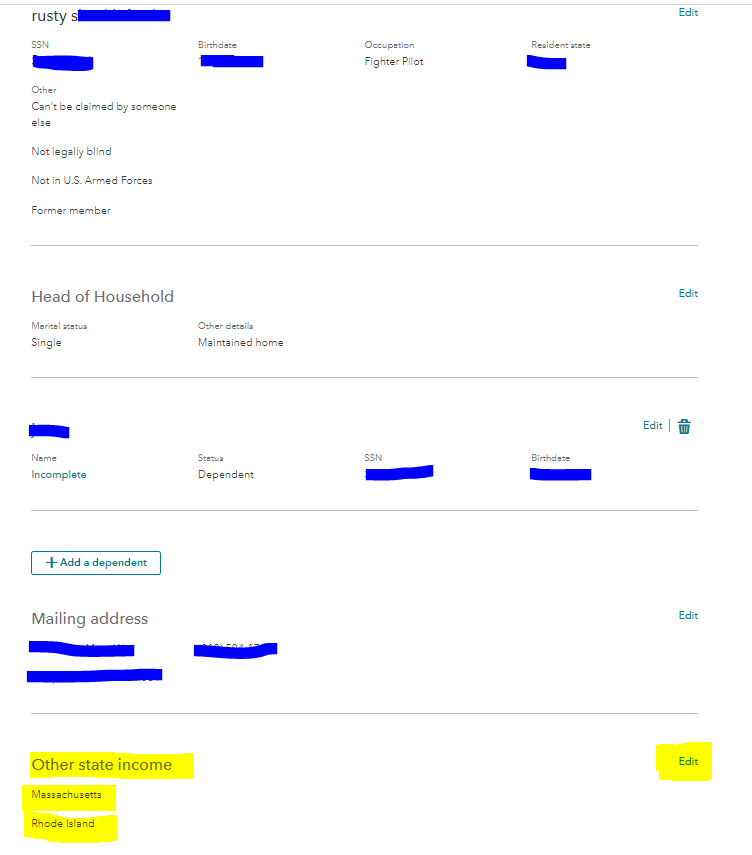

- With your return open, select My Info in the left-hand menu.

- Then, on the Personal info summary screen, scroll down to Other State Income, and select Edit.

- At the Did you make money in any other states? question, answer Yes, and make sure your nonresident state(s) are selected from the drop-down.

- Select Continue to return to your Personal info summary.

After you finish your federal return, you'll automatically move to the State tab, where you'll see your nonresident state(s) listed in addition to your resident state.

Tip: To ensure accurate calculations, always complete the non-resident return first if filing in multiple states because your resident state might give you a credit for any taxes paid in that situation.

Also:

- Select the long-form (if the option is available) even if TurboTax defaults to the short form.

- Only report the income attributable to the nonresident state.

- If preparing a nonresident return solely to recover erroneous tax withholdings, enter 0 on the screen that asks for the amount of income earned in that state. This will eliminate your tax liability for that state, resulting in a full refund.

- If you live in a reciprocal state, consider submitting an exemption form to your employer so you don't have to file a nonresident return next year.

Related Information:

- Why would I have to file a nonresident state return?

- What is a state reciprocal agreement?

- Which states have reciprocal agreements?

- Do I need to file a nonresident return for an out-of-state employer?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living in CT, worked in MA for one month. Tax return?

If you're a part-year resident with an annual Massachusetts gross income of more than $8,000, you must file a Massachusetts tax return. If you earned less than that while living/working in Mass. you do not need to file a Massachusetts state tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living in CT, worked in MA for one month. Tax return?

Thank you. Follow-up question - I have not lived in MA (lived in CT entire year) but my gross income during December is more than $8,000.

In this case, do I still need to file non-resident MA state tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living in CT, worked in MA for one month. Tax return?

Yes, file the nonresident MA return. I will leave the instructions below. When you prepare the state returns, prepare the MA nonresident return first.

Once you've determined that you need to file a nonresident state return, the first thing you want to do is make sure you've filled out the Personal Info section correctly:

- With your return open, select My Info in the left-hand menu.

- Then, on the Personal info summary screen, scroll down to Other State Income, and select Edit.

- At the Did you make money in any other states? question, answer Yes, and make sure your nonresident state(s) are selected from the drop-down.

- Select Continue to return to your Personal info summary.

After you finish your federal return, you'll automatically move to the State tab, where you'll see your nonresident state(s) listed in addition to your resident state.

Tip: To ensure accurate calculations, always complete the non-resident return first if filing in multiple states because your resident state might give you a credit for any taxes paid in that situation.

Also:

- Select the long-form (if the option is available) even if TurboTax defaults to the short form.

- Only report the income attributable to the nonresident state.

- If preparing a nonresident return solely to recover erroneous tax withholdings, enter 0 on the screen that asks for the amount of income earned in that state. This will eliminate your tax liability for that state, resulting in a full refund.

- If you live in a reciprocal state, consider submitting an exemption form to your employer so you don't have to file a nonresident return next year.

Related Information:

- Why would I have to file a nonresident state return?

- What is a state reciprocal agreement?

- Which states have reciprocal agreements?

- Do I need to file a nonresident return for an out-of-state employer?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living in CT, worked in MA for one month. Tax return?

One more clarification question - thank you all for your help!

I googled a little bit and found contradictory results.

I worked remotely full time - in my home office in CT. My employer is located in MA.

Still non-resident tax to MA?

Have never been to the company's office.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living in CT, worked in MA for one month. Tax return?

No. If you never have been to Massachusetts, are permanently working remotely from Connecticut, and there is no Massachusetts income tax deducted from your earnings, then you do not have to file a nonresident return.

Massachusetts source income is considered compensation for services performed in Massachusetts. You are performing services from Connecticut.

However, per the State of Massachusetts, there are special rules for wages or other compensation paid to employees who are working remotely (working from home or a location other than their usual work location) due to the COVID-19 Pandemic. For tax years 2020 and 2021, compensation paid to a nonresident for services that would normally be performed in Massachusetts are treated as Massachusetts source income subject to tax if they are performed in another state due to a Pandemic Related Circumstance and should be reported as taxable income on Form 1-NR/PY.

If you need further explanation, please see Massachusetts gross income for nonresidents.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living in CT, worked in MA for one month. Tax return?

I am using TurboTax Deluxe for 2020. I can't find anything under the Personal Info screen that asks for "Other State Income" or "Did you make money in any other states?" My son is a resident of Hawaii, is a college student in Rhode Island. He had an internship in Massachussetts where he earned a little over $8900. TurboTax asks if he is a resident of Hawaii, which I marked yes. The next question asks if he lived in another state. When I clicked on the "Learn More" link it said college students should consider which state he earned more money, but doesn't clarify what the answer should be. Should I say yes, he lived in another state? Should I follow the same instructions you gave the poster from CT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living in CT, worked in MA for one month. Tax return?

Online or Desktop? It is at the bottom of the Personal Information section (My Info in TurboTax Online). Your son's state of residence is Hawaii. Rhode Island (if he worked and earned money there) and Massachusetts should be in the Other State Income field are nonresident states. Do not say he lived in another state if he was just there (in RI) for education purposes.

The Other State Income questions come AFTER all of the residency questions - but for his purposes, he only has one resident state - Hawaii. Use the nonresident return instructions and prepare the nonresident return(s) before the resident returns. @deanadk

Scroll all the way down to the bottom of the Personal Information Section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Living in CT, worked in MA for one month. Tax return?

Thank you for getting back to me so quickly! I eventually found the info you were talking about. I was surprised he had to pay so much in taxes for both Hawaii and Massachusetts even though his income was so low. Hawaii did give credit for what he paid in Massachusetts. His income was only $8900, TT said he owed Massachusetts almost $100 and Hawaii $200 after the credit. I thought that was quite high.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jbrooksnw

New Member

jcrouser

New Member

dennison-jenna

New Member

warrenjen

New Member

lynnot

New Member