- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

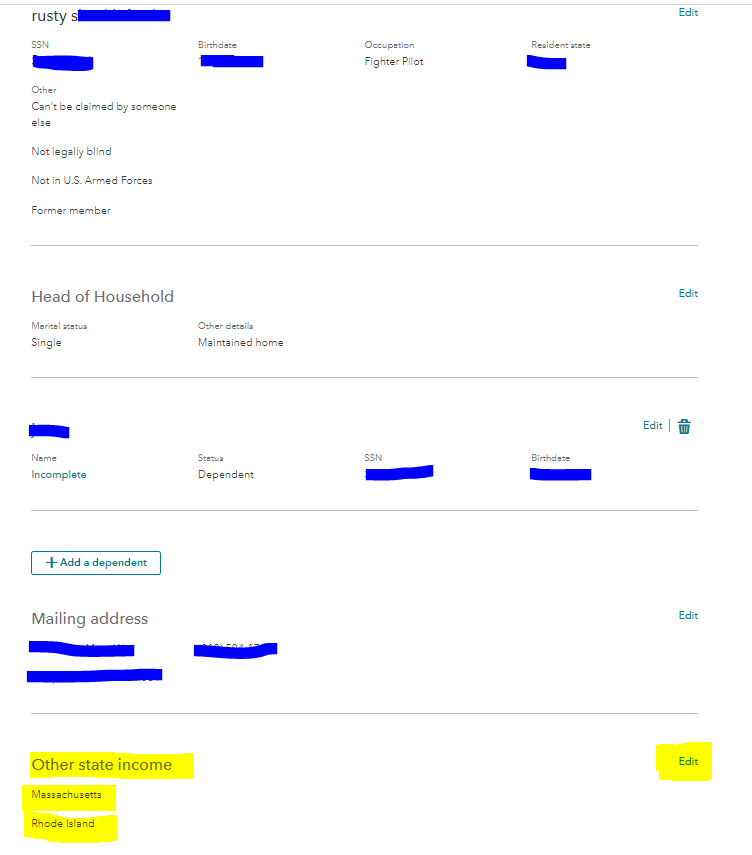

Online or Desktop? It is at the bottom of the Personal Information section (My Info in TurboTax Online). Your son's state of residence is Hawaii. Rhode Island (if he worked and earned money there) and Massachusetts should be in the Other State Income field are nonresident states. Do not say he lived in another state if he was just there (in RI) for education purposes.

The Other State Income questions come AFTER all of the residency questions - but for his purposes, he only has one resident state - Hawaii. Use the nonresident return instructions and prepare the nonresident return(s) before the resident returns. @deanadk

Scroll all the way down to the bottom of the Personal Information Section.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

May 11, 2021

2:23 PM