- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Live overseas but get 1099 at parents address in NJ

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live overseas but get 1099 at parents address in NJ

Hi All,

If I live overseas, in Ontario, Canada, but get 1099 income and have a 1099-MISC that is sent to my parents New Jersey address each year, do I need to file NJ taxes? How does this work?

All work is performed remotely, and none of it is performed in NJ, however the 1099 is being sent to a NJ address. Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live overseas but get 1099 at parents address in NJ

Clarification - I was a previous NJ resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live overseas but get 1099 at parents address in NJ

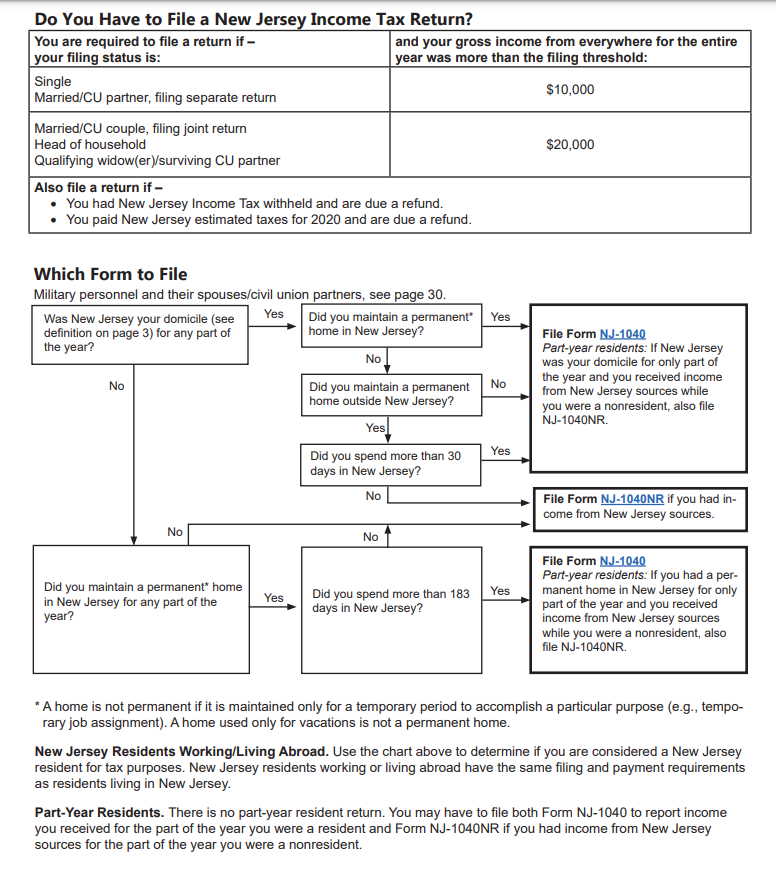

If you are not a New Jersey resident, you do not have to file the New Jersey tax return to report the income if you did not do the work in New Jersey. The address on the form is not conclusive of the income source.

However, you are probably still a New Jersey resident, unless you took steps to change your domicile. In this case, you will want to file a New Jersey resident return, and report all income regardless of where it was earned.

Domicile. A domicile is the place you consider your permanent home – the place where you intend to return after a period of absence (e.g., vacation, business assignment, educational leave). You have only one domicile, although you may have more than one place to live. Your domicile does not change until you move to a new location with the intent to establish your permanent home there and to abandon your New Jersey domicile. Moving to a new location, even for a long time, does not change your domicile if you intend to return to New Jersey. Your home, whether inside or outside New Jersey, is not permanent if you maintain it only for a temporary period to accomplish a particular purpose (e.g., temporary job assignment).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live overseas but get 1099 at parents address in NJ

Thank you for that answer! The move to Canada is intended to be permanent, my kids go to school in Canada and I do not plan on coming back to New Jersey to live; however I do visit the state a lot due to parents living there. Hope that clarifies. Is my domicile Canada if I'm living here in Canada with my wife/kids? We all previously used to live in New Jersey.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live overseas but get 1099 at parents address in NJ

Yes, since you have now set up a new home, reside in Canada as your primary residence, and have no intention of returning to New Jersey, Canada would be considered your place of domicile.

Visits to New Jersey to visit your parents are temporary and does not indicate your intention to return to New Jersey.

You will need to be careful though. If your 1099 was issued because your income was earned from New Jersey sources, you could still have a filing requirement as a nonresident.

You need to file a nonresident New Jersey tax return if you received income from New Jersey sources throughout the year and if you meet the filing threshold requirements as shown below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mysert

Level 1

Roxas-JK

New Member

sadielorenz

New Member

Jo DeVie

New Member

Sampuru

Returning Member