- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Yes, since you have now set up a new home, reside in Canada as your primary residence, and have no intention of returning to New Jersey, Canada would be considered your place of domicile.

Visits to New Jersey to visit your parents are temporary and does not indicate your intention to return to New Jersey.

You will need to be careful though. If your 1099 was issued because your income was earned from New Jersey sources, you could still have a filing requirement as a nonresident.

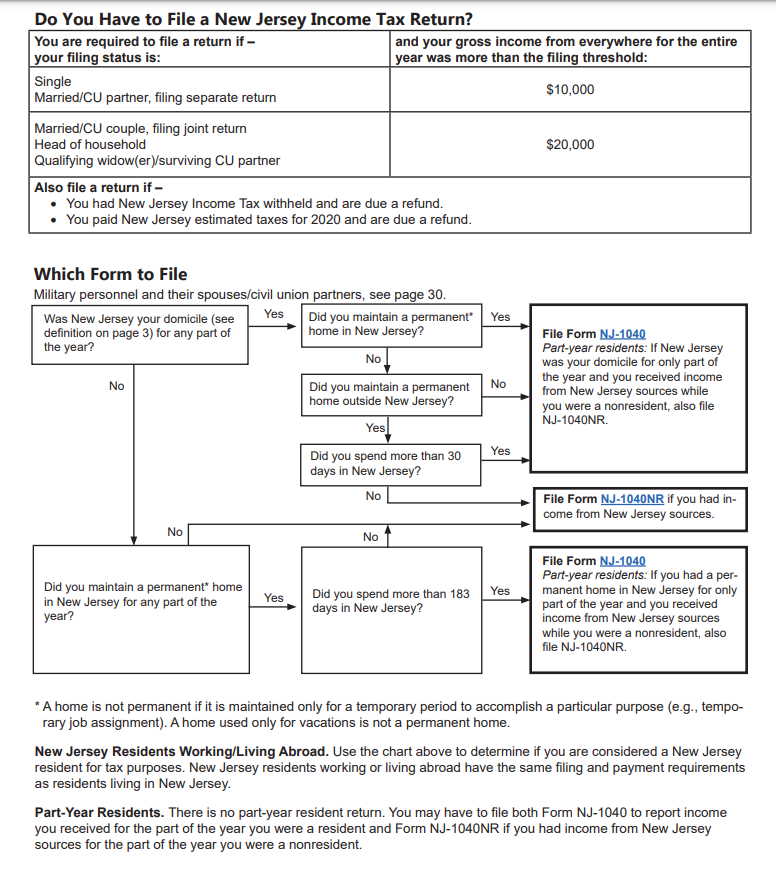

You need to file a nonresident New Jersey tax return if you received income from New Jersey sources throughout the year and if you meet the filing threshold requirements as shown below.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 21, 2021

7:40 AM

732 Views