- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Live in NJ, Work remotely in NJ most of the time, Assigned to Company's NYC branch

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in NJ, Work remotely in NJ most of the time, Assigned to Company's NYC branch

I live in NJ but I'm assigned to my company's NY branch. My company almost only withholds NY state tax.

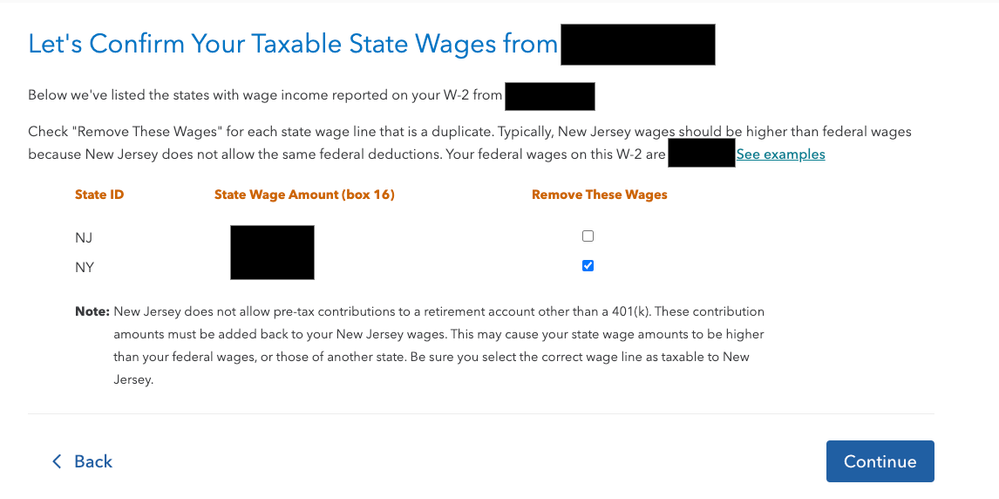

Most of the time I work remote in NJ but come in to the office 1-2 a week. When I'm on the below page, should I be removing NY or NJ state wages? What's the reasoning?

Also, should I allocate 100% of my W2 wages from the company to NY or should it be ~25% because I'm remote in NJ ~75% of the time?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in NJ, Work remotely in NJ most of the time, Assigned to Company's NYC branch

1. I think you are on the NJ screen. It depends on what the boxes show versus reality that determines the right answer. If your w2 shows 100% of your NJ wages and 25% NY wages, then you need to exclude NY wages. If NJ wages are 75% and NY 25%, then together they make up your NJ income.

2. Remote work and taxation is evolving each year. Nonresidents are taxed on NY source income, which is primarily real property, like a rental house, a business, selling hats to tourists, services to NY clients and more. Being an employee in the state is also NY income. There is an extensive list at Nonresidents: New York source income.

Only the portion that is from NY source income should be included on the NY tax return. So the days you work from home, are not NY source income. A few years ago, they were.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in NJ, Work remotely in NJ most of the time, Assigned to Company's NYC branch

Yes, it is the NJ screen. What do you mean by "If your w2 shows 100% of your NJ wages and 25% NY wages, then you need to exclude NY wages"? I'm still a bit confused which state I should be excluding.

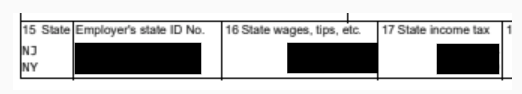

My W2 shows the income as being earned in NY and tax is withheld in NY (except no city tax is withheld) even though I live in NJ. However, there is also a second line duplicating my income and showing it as NJ. Below is the example...I redacted the actual numbers but approximate values would be Box 16 showing $405K for NJ and $400K for NY row and box 17 shows $100 for NJ and $35K for NY. Based on this, which state should I be excluding?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in NJ, Work remotely in NJ most of the time, Assigned to Company's NYC branch

I have similar question but i completely work from home. Will that make exception not to pay NY Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in NJ, Work remotely in NJ most of the time, Assigned to Company's NYC branch

@vedas81 --

If you're a full year non-resident of New York, and you never physically work within New York, not even for a single day, then your work income is not subject to New York income tax. It is of course 100% taxable by your state of residence.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TaxedUpToHere

Returning Member

juliorevka

Level 2

btk_1

Level 1

mstirone

New Member

taxpayer1776

Level 2

Want a Full Service expert to do your taxes?