- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Yes, it is the NJ screen. What do you mean by "If your w2 shows 100% of your NJ wages and 25% NY wages, then you need to exclude NY wages"? I'm still a bit confused which state I should be excluding.

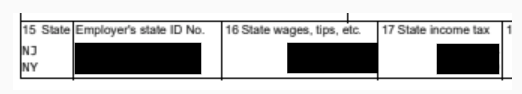

My W2 shows the income as being earned in NY and tax is withheld in NY (except no city tax is withheld) even though I live in NJ. However, there is also a second line duplicating my income and showing it as NJ. Below is the example...I redacted the actual numbers but approximate values would be Box 16 showing $405K for NJ and $400K for NY row and box 17 shows $100 for NJ and $35K for NY. Based on this, which state should I be excluding?

April 13, 2024

10:59 AM